|

The Week Ahead: Highlights

US Preview

Weak Jobs Readings Last Week Put New Focus on Employment

Report for January

By Theresa Sheehan, Econoday Economist

The two-day federal government shutdown forced some delays

in the data release schedule. One was that the monthly employment report was

moved from Friday, February 6 to Wednesday, February 11. As a result, markets

and analysts continue to await the January numbers on payrolls and the

unemployment rate.

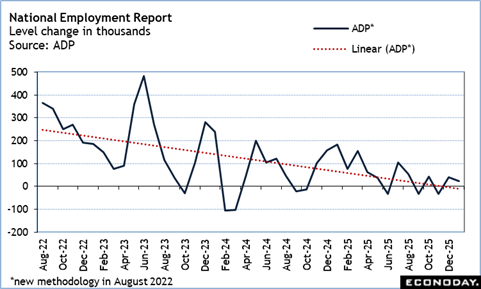

What has changed from last week is that data released in the

February 2 week may have reshaped some expectations for the upcoming release.

The ADP national employment report showed a meager 22,000 in private payrolls

in January that was mostly from gains in education and healthcare offsetting

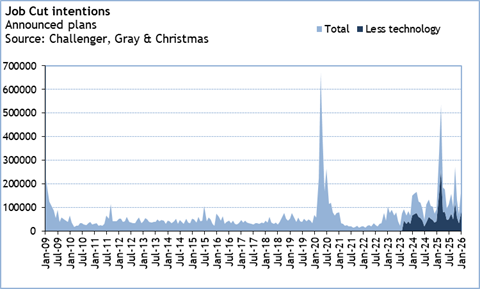

declines in several other industries. The Challenger report reflected a sharp

204.2 percent month-over-month increase to 108,135 job cut announcements in

January.

This was the biggest increase for a January since 239,451 in

January 2009, just when unemployment began to climb in the Great Recession

(December 2007-June 2009). Taken together, there is no hint of a pickup in

hiring in January and a hint that unemployment may be starting to rise.

However, this does not change the broad outlook for the January employment

report.

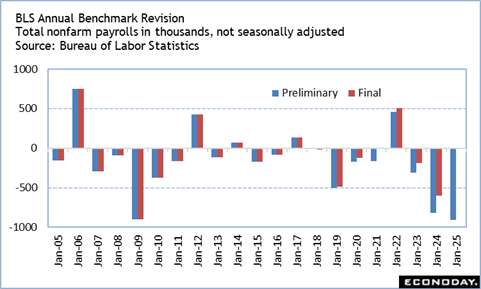

The BLS released the annual revisions to the household

survey in January with the December data. This month will be the annual

revisions to the establishment survey for which massive downward revisions are

expected for a third year in a row. The preliminary March 2025 benchmark

revision was for down 911,000, almost twice the downward revision of 598,000 in

the final 2024 data (preliminary minus 181,000) and about four times the size

of the downward revision of 187,000 in the final March 2023 numbers (preliminary

minus 187,0000). Note that in recent years it is quite common for the final

benchmark revision to be revised from the preliminary estimate, and that is

frequently smaller than the original estimate.

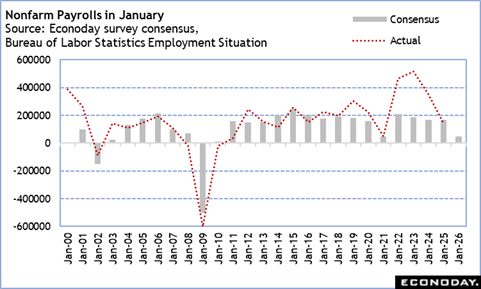

The annual revisions make forecasting the January payroll

change difficult. At this writing, the Econoday consensus is roughly for up

67,000. Forecasters are hesitant to change their estimates based on the ADP

report given it does not line up with the BLS private payrolls numbers all that

well except in the direction of the payroll change. However, the so-called

"whisper number" may be less optimistic and a weak headline might not be quite

unexpected.

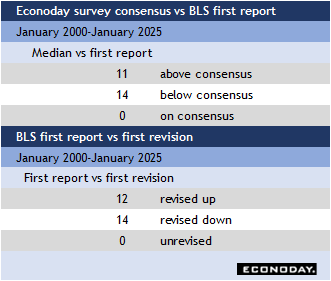

Historically, the median forecast is slightly more likely to

come in below consensus than above it, but that is also because there is a high

degree of uncertainty in putting a number on the change in payrolls. January is

typically a month to add jobs as businesses have done their end-of-year

planning for staffing, college graduates join the workforce, and school systems

resume operations after the winter break.

Seasonal adjustment of January payrolls can also be

difficult because of weather conditions if these arrive early in the month.

This year that shouldn't be a problem since the severe cold weather blanketing

much of the country did not arrive until after the January 17 end of the survey

reference period. This is also a 5-week survey period, so hiring early in

January should be fully captured.

Asia-Pacific Preview

China, India Inflation Reports in Focus

By Brian Jackson, Econoday Economist

Inflation data for Indian and China will be the highlight of

the Asia-Pacific data calendar. The Reserve Bank of India left policy rates on

hold last week, noting that the outlook for inflation "continues to be

benign and near the inflation target." Food prices likely keep downward

pressure on inflation in January. Price pressures in China have also been

muted.

Household spending data for Australia and trade data for

Taiwan are also scheduled for release. Officials at the Reserve Bank of

Australia noted that household spending had contributed to unexpected strength

in private demand when announcing their decision to hike policy rates this

week, while Taiwanese exports have been boosted by strong demand for high-tech

products.

The Week Ahead: Econoday Consensus Forecasts

Monday

Australia Household Spending for December (Mon 1100

AET; Sun 0000 GMT; Sun 1900 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.3%

The consensus sees spending up only 0.1 percent for December

after a big 1.0 percent increase in November.

Tuesday

France ILO Unemployment Rate for Fourth Quarter (Tue 0730

CET; Tue 0630 GMT; Tue 0130 EST)

Consensus Forecast, Rate: 7.5%

Consensus Range, Rate: 7.5% to 7.7%

No change expected in the jobless rate at 7.5 percent, not a

pretty picture.

Denmark CPI for January (Tue 0800 CET; Tue 0700 GMT; Tue

0200 EST)

Consensus Forecast, Y/Y: 1.8%

Consensus Range, Y/Y: 1.7% to 1.8%

The consensus sees CPI up 1.8 percent on year in January after

1.9 percent in December.

Norway CPI for January (Tue 0800 CET; Tue 0700 GMT; Tue

0200 EST)

Consensus Forecast, Y/Y: 3.1%

Consensus Range, Y/Y: 3.1% to 3.2%

The consensus sees CPI up 3.1 percent on year in January after

3.2 percent in December.

United States NFIB Small Business Optimism Index for January

(Tue 0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 99.8

Consensus Range, Index: 99.5 to 100.8

Sentiment expected to improve again to 99.8 for January from

99.5 in December and 99.0 in November.

US Retail Sales for December (Tue 0830 EST; Tue 1330

GMT)

Consensus Forecast, Retail Sales - M/M: 0.4%

Consensus Range, Retail Sales - M/M: 0.2% to 0.6%

Consensus Forecast, Ex-Vehicles - M/M: 0.4%

Consensus Range, Ex-Vehicles - M/M: 0.3% to 0.5%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.3%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.3% to

0.3%

Pretty decent rise of 0.4 percent expected.

US Employment Cost Index for Fourth Quarter (Tue 0830

EST; Tue 1330 GMT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.8% to 0.9%

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.4% to 3.5%

Employment costs are seen up 0.8 percent again in Q4 after rising

0.8 percent in Q3.

US Imports and Export Prices for December (Tue 0830

EST; Tue 1330 GMT)

Consensus Forecast, Import Prices - M/M: 0.1%

Consensus Range, Import Prices - M/M: 0.1% to 0.2%

Consensus Forecast, Export Prices - M/M: 0.1%

Consensus Range, Export Prices - M/M: 0.0% to 0.1%

The consensus sees import prices and export prices both up

0.1 percent on the month.

US Business Inventories for November (Tue 1000 EST;

Tue 1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

A 0.2 percent increase is the call.

Wednesday

China CPI for January (Wed 0930 CST; Wed 0130 GMT; Tue

2030 EST)

Consensus Forecast, Y/Y: 0.4%

Consensus Range, Y/Y: 0.3% to 0.9%

CPI expected up 0.4 percent on year, down from 0.8 percent

in December, as price increases remain very constrained.

China PPI for January (Wed 0930 CST; Wed 0130 GMT; Tue

2030 EST)

Consensus Forecast, Y/Y: -1.5%

Consensus Range, Y/Y: -1.7% to -1.3%

The consensus looks for an easing in the rate of deflation

at minus 1.5 percent for January versus minus 1.9 percent in December.

Norway GDP for Fourth Quarter (Wed 0800 CET; Wed 0700

GMT; Wed 0200 EST)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: 0.4% to 0.5%

Growth expected at 0.5 percent on quarter in Q4.

Italy Industrial Production for December (Wed 1000

CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 2.4%

Output seen up 1.2 percent on year in December after rising

1.4 percent in November.

US Employment Situation for January (Wed 0830 EST; Wed

1330 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 67,000

Consensus Range, Nonfarm Payrolls - M/M: 40,000 to 105,000

Consensus Forecast, Unemployment Rate: 4.4%

Consensus Range, Unemployment Rate: 4.3% to 4.5%

Consensus Forecast, Private Payrolls - M/M: 80,000

Consensus Range, Private Payrolls - M/M: 30,000 to

100,000

Consensus Forecast, Manufacturing Payrolls - M/M: -7,000

Consensus Range, Manufacturing Payrolls - M/M: -10,000

to -5,000

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2%

to 0.4%

Consensus Forecast, Average Hourly Earnings - Y/Y: 3.6%

Consensus Range, Average Hourly Earnings - Y/Y: 3.6%

to 3.8%

Consensus Forecast, Average Workweek: 34.3 hrs

Consensus Range, Average Workweek: 34.2 hrs to 34.3

hrs

Payrolls seen up a moderate 67K and the jobless rate flat at

4.4 percent.

Thursday

Japan PPI for January

(Thu 0830 JST; Wed 2330 GMT; Wed 1830 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.1% to 0.3%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.0% to 2.4%

Japan's producer inflation is expected to rise on the year

for a 59th consecutive month in January, but at the slowest pace and extending

its deceleration for a second straight month. The underlying upward price trend

remains intact, supported by firm food and nonferrous metals prices, although

momentum has eased as domestic gasoline prices fall and rice prices hover

around recent highs.

Producer inflation, measured by the corporate goods price

index, is seen rising 2.3 percent on the year in January, down from a 2.4

percent increase in the previous month, when growth slowed to the weakest pace

since April 2024. On a month-on-month basis, the CGPI is projected to rise 0.2

percent, marking a fifth straight monthly increase after a 0.1 percent gain in

December.

UK Monthly GDP for December (Thu 0700 GMT; Thu 0200

EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.1%

The consensus sees growth at 0.1 percent on the month for

December versus 0.3 percent in November.

United Kingdom GDP for Fourth Quarter (Thu 0700 GMT;

Thu 0200 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 1.2%

Growth seen at 0.2 percent on quarter in Q4 and 1.2 percent

on year.

Eurozone GDP for Fourth Quarter (Thu 0700 GMT; Thu

0200 EST)

Consensus Forecast, Q/Q: 0.3%

Consensus Range, Q/Q: 0.3% to 0.3%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.3% to 1.3%

Growth seen at 0.3 percent on quarter in Q4 and 1.3 percent

on year.

US Jobless Claims for Week 2/6 (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Initial Claims - Level: 215 K

Consensus Range, Initial Claims - Level: 210 K to 225

K

After surging unexpectedly by 22K to 231K a week ago, the

consensus looks for claims back down at 215K this week.

US Existing Home Sales for January (Thu 1000 EST; Thu

1500 GMT)

Consensus Forecast, Initial Claims - Sales Rate: 4.20

M

Consensus Range, Initial Claims - Sales Rate: 4.13M

to 4.25M

Forecasters see sales flagging at a 4.20 million unit rate

in January, down from 4.35 million in December.

United States CPI for January (Fri 0830 EST; Fri 1330

GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: 0.1% to 0.3%

Consensus Forecast, CPI - Y/Y: 2.5%

Consensus Range, CPI - Y/Y: 2.3% to 2.8%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to

0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 2.5%

Consensus Range, Ex-Food & Energy - Y/Y: 2.5% to 2.5%

The consensus looks for stable inflation readings with CPI

up 0.3 percent for total and core on the month and up 2.5 percent from a year

ago for both total and core.

|