|

Global Economics

will be taking the next week off. Next article will be dated January 2, 2026

Pre-Holiday US Data Release

Crunch Coming Dec. 23

By Theresa Sheehan, Econoday Economist

The data release schedule in the December 22 week is

curtailed by the presence of the Christmas holidays. In the US, Christmas Eve

on Wednesday is not an official holiday, nor is Boxing Day on Friday. Christmas

is a holiday on Thursday. As a result, many people will extend their time off

by taking vacation on Wednesday and Friday. Some will further extend that into

the next week through the New Year observance. There is an early market close

for stocks and bonds on December 24 and a full market close on December 25. On

December 31, there is an early bond market close, but not for stock markets.

January 1 is a full market close for both stocks and bonds. Tuesday morning

sees a rush to get a number of reports out before the holiday period. Most of

these have little market moving potential as they are part of the catch up in

data reporting after the government shutdown.

Among the crush of Tuesday morning releases is the GDP

estimate for the July-September quarter. The BEA is calling it an "initial"

estimate since it combines the normal "advance" and "second estimates". Given

it covers the third quarter 2025, the data in the report is relatively old with

the fourth quarter already approaching its end. Nonetheless, this will be the

first official measure of growth in the third quarter and will help frame

economic activity going into the fourth quarter. The government shutdown

occurred mostly in October and is expected to cut perhaps two-tenths from

growth in the October-December period, according to Fed Chair Jerome Powell. He

anticipated that will be recovered in the first quarter 2026.

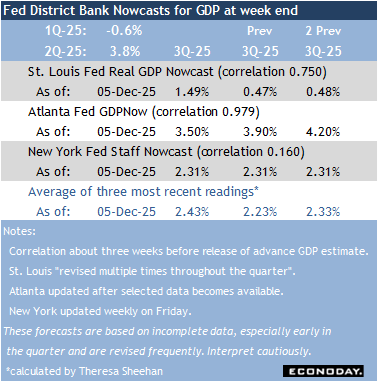

The GDP Nowcasts from three Fed district banks point to

growth centering around 2.5 percent. The Atlanta Fed GDPNow - the most reliable

of the three - forecasts growth of around 3.5 percent. It seems probable that

consumer spending continues to buoy expansion despite the impacts of tariffs or

because of them as consumers front-load purchases in anticipation of higher

prices. Whether this momentum carries into the fourth quarter remains to be

seen.

Singapore, Taiwan Industrial

Production Reports in Focus

By Brian Jackson, Econoday Economist

The Asia-Pacific data calendar is very light. Singapore will

report industrial production and inflation data, Hong Kong will report

inflation data, and Taiwan will report industrial production data.

United Kingdom GDP for Third Quarter (Mon 0700 GMT; Mon

0200 EST)

Consensus Forecast, Q/Q: 0.1%

Consensus Range, Q/Q: 0.1% to 0.1%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.3% to 1.3%

In the final revision for Q3 GDP, forecasters see no

revision from the previously reported 0.1 percent Q/Q and 1.3 percent Y/Y.

Singapore CPI for November (Tue 1300 CST; Tue 0500

GMT; Tue 0000 EST)

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.1% to 1.4%

The consensus sees CPI up 1.3 percent on year in November compared

with 1.2 percent in October.

Canada Monthly GDP for October (Tue 0830 EST; Tue

1330 GMT)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -0.4% to 0.0%

The consensus agrees with the Stats Canada estimate calling

for a decrease of 0.3 percent in October after an increase of 0.2 percent in

September.

US Durable Goods Orders for October (Tue 0830 EST; Tue

1330 GMT)

Consensus Forecast, New Order - M/M: -1.5%

Consensus Range, New Order - M/M: -4.5% to 0.6%

Consensus Forecast, Ex-Transportation - M/M: 0.1%

Consensus Range, Ex-Transportation - M/M: -1.0% to

0.4%

Another month of plunging aircraft orders expected to

depress the headline number but leave ex-transportation nearly flat at plus 0.1

percent.

US GDP for Third Quarter (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Q/Q - Annual Rate: 3.2%

Consensus Range, Q/Q - Annual Rate: 2.5% to 3.8%

Consensus Forecast, Personal Consumption Expenditures -

Annual Rate: 2.7%

Consensus Range, Personal Consumption Expenditures -

Annual Rate: 2.7% to 3.1%

Growth expected at a robust 3.2 percent in Q3 with a lift

from net exports. PCE seen at a decent 2.7 percent.

US Industrial Production for November (Tue 0915 EST;

Tue 1415 GMT)

Consensus Forecast, Industrial Production - M/M: 0.1%

Consensus Range, Industrial Production - M/M: -0.4%

to 0.3%

Consensus Forecast, Capacity Utilization Rate: 75.9%

Consensus Range, Capacity Utilization Rate: 75.7% to 76.1%

Output expected barely changed and capacity utilization flat

too in line with anemic ISM purchasing managers manufacturing indexes.

US Consumer Confidence for December (Tue 1000 EST; Tue

1500 GMT)

Consensus Forecast, Index: 91.9

Consensus Range, Index: 89.0 to 94.5

Confidence indicator expected better but still depressed at

91.9 for December after falling 6.8 points to 88.7 in November from 95.5 in

October. Consumers remain worried by pocketbook issues.

US Jobless Claims Week 12/20 (Wed 0830 GMT; Wed 1330

EST)

Consensus Forecast, Initial Claims - Level: 225K

Consensus Range, Initial Claims - Level: 217K to 235K

Claims expected at 225K, not much changed from 224K last

week, which is down 13 from the week before that. It's a noisy indicator week

to week but the trend has been remarkably stable given all the sturm and drang

over the job market.

Japan Tokyo CPI for December (Thu 0830 JST; Wed 2330

GMT; Wed 1830 EST)

Consensus Forecast, CPI - Y/Y: 2.4%

Consensus Range, CPI - Y/Y: 2.1% to 2.5%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.5%

Consensus Range, Ex-Fresh Food - Y/Y: 2.5% to 2.7%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

2.9%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.7%

to 2.9%

The Tokyo consumer price index, a leading indicator of

nationwide inflation trends, is expected to decline on the year for the first

time in four months in December, reflecting lower prices at supermarkets

through the earlier part of the month.

The core measure (excluding fresh food) is forecast to post

a rise of 2.5 percent on the year in December, slowing from 2.8 percent in

November. The total CPI is seen gaining 2.4%, down from a 2.7 percent rise in

the previous month, while the core-core index (excluding fresh food and energy)

is expected to edge up to 2.9 percent from 2.8 percent in November. All three

readings have remained below 3 percent since June after easing from earlier

peaks.

Japan Unemployment Rate for November (Thu 0830 JST; Wed

2330 GMT; Wed 1830 EST)

Consensus Forecast, Rate: 2.6%

Consensus Range, Rate: 2.5% to 2.6%

Broad-based labor shortages are expected to push Japanese

payrolls higher for a 40th consecutive year-on-year increase in November, while

the seasonally adjusted unemployment rate is seen edging lower. This aligns

with the Bank of Japan's Tankan corporate sentiment survey for the December

quarter, which pointed to strong labor tightness across sectors, with shortages

particularly acute among smaller firms.

The seasonally adjusted unemployment rate is expected to be

stable at 2.6 percent in November from a month earlier. In October, employment

rose by 520,000 on the year to 68.65 million, led by gains in the medical and

welfare industries, while declines were recorded in farming, manufacturing, and

the wholesale and retail sectors.

The number of unemployed increased by 130,000, bringing the

total to 1.83 million in October. By reason for job seeking compared with a

year earlier, layoffs due to employer circumstances increased by 40,000,

voluntary departures rose by 50,000, and new job seekers increased by 40,000

during the month.

Japan Industrial Production for November (Thu 0850

JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, M/M: -1.3%

Consensus Range, M/M: -2.5% to 0.5%

Consensus Forecast, Y/Y: -1.0%

Consensus Range, Y/Y: -2.0% to 1.0%

Japan's industrial output is expected to return to a

downward path in November, falling 1.3 percent from the previous month after

rising unexpectedly in October, driven by a recovery in auto production as well

as gains in industries such as electrical machinery and information and

communications equipment.

Output in November is seen falling as cuts are anticipated

in sectors including transport equipment, information and communications

machinery, and chemicals. Persisting U.S. tariff policies are also seen

weighing on production in the auto and metals sectors. The Ministry of Economy,

Trade and Industry has projected that output will slip 2.6 percent in November

before declining a further 2.0 percent in December. The ministry maintained its

long-held assessment that industrial output is "taking one step forward and one

step back."

On the year, November output is expected to dip 1.0 percent

after rising 1.6 percent (revised from up 1.5 percent) in the prior month.

Japan Retail Sales for November (Thu 0850 JST; Wed

2350 GMT; Wed 1850 EST)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.2% to 0.5%

Consensus Forecast, Y/Y: 0.7%

Consensus Range, Y/Y: -0.5% to 0.9%

Japanese retail sales are seen rising 0.7 percent on the

year in November, marking a third consecutive month of gains after increasing

1.7 percent the previous month, supported by firm demand for drugs and

cosmetics and a rebound in auto sales.

The uptrend in retail sales is expected to continue, though

but growth is expected to be slower as signs of weaker sales at major

department stores, softer motor vehicle sales, and a drop in new passenger car

registrations weigh on overall performance.

On the month, retail sales are projected to rise 0.5 percent

rise on a seasonally adjusted basis, following a 1.6 percent gain in October

and flat growth in September.

|