|

The Week Ahead: Highlights

US Preview

Markets Eye ADP Payrolls, Challenger Layoffs in Absence

of Employment Report

By Theresa Sheehan, Econoday Economist

Major data reports remain delayed into the November 3 week.

Even if the government opens in the next few days, it will take time for the

statistical agencies to collect, prepare, and publish reports delayed by the

shutdown. Whether the agencies decide to play catch-up on an accelerated

revised schedule, or if they opt to just include the missing numbers in an

upcoming release depends on how much longer the shutdown stretches out.

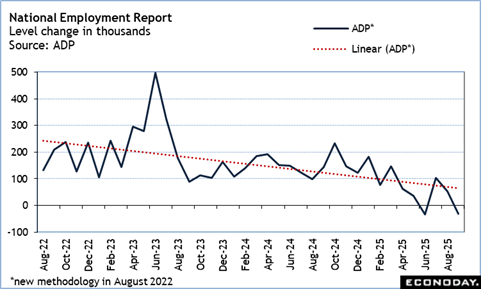

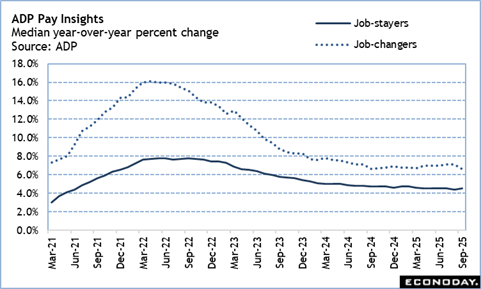

The October monthly employment numbers were scheduled for

Friday at 8:30 ET. This will be the second month in a row without this

all-important economic report. Once again markets will be focused on the ADP

national employment report at 8:15 ET on Wednesday to get a sense of hiring

conditions and the pay insights to see if upward pressure on compensation is

continuing to cool.

Note that ADP is now publishing preliminary payroll numbers

weekly on Tuesday at 8:15 ET until the week of the final monthly report which

remains on Wednesdays at 8:15 ET.

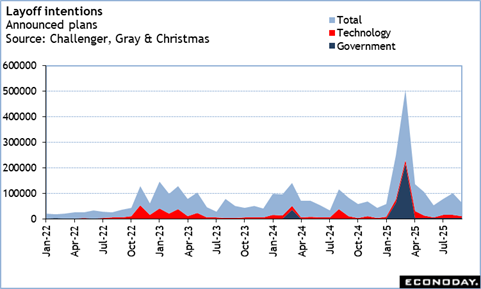

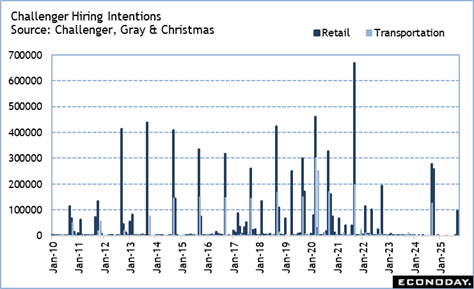

The Challenger report for October at 7:30 ET on Thursday

could provide an indication if layoff activity is picking up or if it remains

broadly modest as the US economy continues to expand. The Amazon announcement

of job cuts for 30,000 workers will be in a narrow sector. It is if layoffs are

happening across many industries that would be cause for concern. The

Challenger numbers of hiring plans may look gloomy again as retailers and/or

transportation services are planning comparatively little seasonal hiring in

2025. In part, it is lack of labor supply for these types of jobs. However,

consumer spending in this coming holiday season is anticipated to be restrained

in a time of high economic uncertainty.

Europe Preview

Will Week Ahead European Data Show Shifting Tradewinds?

By Marco Babic, Econoday Economist

With the US reaching trade deals with China and South Korea

last week, it's timely that trade data for Europe is starting to come out. To

be sure, the deals struck last week won't be reflected in the data, but given

the absence of US official data due to the US government shutdown, it will be

of peak interest.

Germany and France report their September trade results for

September on Friday. Canada also reports its trade figures on Tuesday, and

while not part of the EU, it will be an important piece of information to see

if there are the beginnings of a restructuring of trade flows. Certainly, to

the extent of its trade with both the US and the EU.

Judging from the last week's trade negotiations between the

US and China, it's difficult to conclude that the US got anything more than a

reprieve from China rather than a substantial deal. This is particularly true

of China's export controls on rare earth elements and magnets, offering only a

one-year delay.

The US Supreme Court is expected to rule on the legality of

many of the tariffs sometime in November, and the US Senate voted on scrapping

tariffs with Brazil. For some months, the feeling has been that countries have

been negotiating, or attempting to, with the administration while awaiting the

US ruling which will review a ruling by a lower court that many of the tariffs

are illegal.

Resignation or Acceptance?

A ruling either way could be a seismic event for the global

economy with a collective sigh to be expected. A ruling against the tariffs

would be a sigh of relief, while the court deciding to uphold them would be a

sigh of resignation. Europe, since its unpopular trade deal with the US has

largely been gritting its teeth and slogging through.

Even without trade data from the US, the current policy

continues to affect global trade. China will report its trade results for

October which could offer deeper insights into trade realignments.

Looking to container shipping volumes, the RWI - Leibniz

Institute for Economic Research index fell to 136.7 in September from 137.3 in

August. While container activity increased in Chinese ports to a reading of

153.3 from 151.7 in August, it was a different story in Europe. The North-Range

Index for northern European ports and Germany fell to 115.3 in September from

117.0 the previous month.

Like a supertanker, trade flows take time to turn. Even so,

the US trade policy has triggered a rapid global reassessment of trade and

November will possibly tell if there is a sigh of relief or resignation.

Asia-Pacific Preview

Reserve Bank of Australia Expected on Hold; Regional PMI

Reports Due

By Brian Jackson, Econoday Economist

The Reserve Bank of Australia's policy meeting will be the

main focus in the Asia-Pacific region. Both quarterly and monthly CPI data

for Australia published earlier this week showed an increase in headline

inflation, largely reflecting the impact of electricity rebates expiring.

Underlying measures of inflation, however, also picked up and it now looks very

likely that officials will keep rates on hold and at the following meeting in

December. Australia will also report trade and household spending data next

week.

The week will also see the release of October PMI surveys

for the region. With the exception of solid growth in India, these surveys are

showing that global trade tensions continue to weigh on activity in the region.

With official PMI survey data for China already published last week showing

weakness in October, other surveys will likely show subdued conditions

elsewhere.

China, Taiwan, and South Korea report inflation data in the

week ahead, with the latter likely to shape expectations for the Bank of

Korea's policy meeting late November after it left rates on hold last week. New

Zealand will also report quarterly labour market data.

The Week Ahead: Econoday Consensus Forecasts

Monday

Australia Household Spending for September (Wed 1000

EST; Wed 1500 GMT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.2% to 1.1%

Credit card data suggest a decent 0.4 percent increase on

the month with a risk of a stronger report.

China PMI Manufacturing for October (Mon 0945 CST; Mon

0145 GMT; Sun 2045 EST)

Consensus Forecast, Index: 50.7

Consensus Range, Index: 50.6 to 50.9

Slightly weaker growth expected with the PMI at 50.7 for

October, off from 51.2 in September.

France PMI Manufacturing Final for October (Wed 0950

CET; Wed 0850 GMT; Wed 0350 EST)

Consensus Forecast, Index: 48.3

Consensus Range, Index: 48.3 to 48.3

The consensus sees no revision from the flash at 48.3 for

the final as France continues to lag its peers in the Eurozone.

Germany PMI Manufacturing Final for October (Wed 0955

CET; Wed 0755 GMT; Wed 0355 EST)

Consensus Forecast, Index: 49.6

Consensus Range, Index: 49.3 to 49.6

Forecasters see no change from the flash at 49.6, a rather

uninspiring result.

Eurozone PMI Manufacturing Final for October (Wed 1000

CET; Wed 0800 GMT; Wed 0400 EST)

Consensus Forecast, Index: 50.0

Consensus Range, Index: 50.0 to 50.0

The call is no change from the flash at 50.0 in the PMI

manufacturing final, showing no growth in business.

United Kingdom PMI Manufacturing Final for October (Wed

0930 BST; Wed 0930 GMT; Wed 0430 EST)

Consensus Forecast, Index: 49.6

Consensus Range, Index: 49.6 to 49.6

The consensus sees no change from the flash at 49.6 for the

final.

United States PMI Manufacturing Final for October (Wed

0945 EST; Wed 1445 GMT)

Consensus Forecast, Index: 52.2

Consensus Range, Index: 52.2 to 52.2

The call is no change from the flash at 52.2 in the PMI

manufacturing final, which suggests surprising ongoing resilience, a stronger

reading than the more widely-used ISM manufacturing data.

United States ISM Manufacturing Index for October (Wed

0945 EST; Wed 1445 GMT)

Consensus Forecast, Index: 49.5

Consensus Range, Index: 48.1 to 50.1

The consensus sees another month of marginal contraction at

49.5, pretty steady from 49.1 in September.

United States Construction Spending for September (Wed

1000 EST; Wed 1500 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.1% to 0.2%

Forecasters a decline of 0.1 percent on the month, in

keeping with continuing sluggishness in the sector.

Tuesday

South Korea CPI for October (Tue 0800 KST; Mon 2300

GMT; Mon 1900 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 2.1% to 2.3%

CPI expected up 0.2 percent on the month in October versus

an increase of 0.5 percent in September. On year, expectations call for an

increase of 2.2 percent versus 2.1 percent in September.

Australia RBA Announcement (Tue 1430 AET; Tue 0330 GMT;

Tue 2230 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 3.60%

Consensus Range, Level: 3.60% to 3.60%

After an upside surprise on inflation, the RBA stays on hold

through year end. Markets look for rate cuts in the first half of 2026 as

inflation recedes.

India PMI Manufacturing Final for October (Tue 1030

IST; Tue 0500 GMT; Tue 0000 EST)

Consensus Forecast, Level: 58.4

Consensus Range, Level: 58.4 to 58.4

The consensus sees no change from the flash at 58.4 for the

final, showing robust expansion.

United States Motor Vehicle Sales for October (Tue

0800 AM ET; Tue 1300 GMT)

Consensus Forecast, Mlns of Units, SAAR: 15.5 M

Consensus Range, 15.5 M to 16.3 M

Sales seen at a trend-like 15.5 million unit rate.

United States International Trade in Goods and Services

for September (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, Balance: - $64.1 B

Consensus Range, Balance: -$85.0 to -$57.0 B

The trade gap is expected at a relatively narrow $64.1

billion.

United States Factory Orders for September (Tue 1000

EST; Tue 1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -1.0% to 1.4%

Orders expected up 0.2 percent on the month.

United States JOLTS for September (Tue 1000 EST; Tue 1500

GMT)

Consensus Forecast, Job Openings: 7.30 M

Consensus Range, Job Openings: 7.18 M to 7.40 M

Job openings expected unchanged at 7.30 million rate versus

7.227 million in August

Wednesday

New Zealand Labour Market Conditions for Third Quarter (Wed

1045 NZDT; Tue 2145 GMT; Tue 1645 EST)

Consensus Forecast, Unemployment Rate: 5.3%

Consensus Range, Unemployment Rate: 5.2% to 5.3%

The jobless rate is expected to tick up to 5.3 percent from

5.2 percent as labor force growth outpaces job gains.

China PMI Composite for October (Wed 0945 CST; Wed 0145

GMT; Tue 2045 EST)

Consensus Forecast, Services Index: 52.7

Consensus Range, Services Index: 52.3 to 53.7

Services PMI expected pretty steady at 52.7 versus 52.9 in

September

Germany Manufacturing Orders for September (Wed 0800 CET;

Wed 0700 GMT; Wed 0200 EST)

Consensus Forecast, M/M: 0.8%

Consensus Range, M/M: -1.6% to 1.5%

Consensus Forecast, Y/Y: -4.1%

Consensus Range, Y/Y: -4.2% to -3.9%

Orders seen rebounding by 0.8 percent on the month to

reverse the decline of 0.8 percent in August. On year, the consensus sees a 4.1

percent decrease.

France Industrial Production for September (Wed 0845 CET;

Wed 0745 GMT; Wed 0245 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.5%

The consensus sees orders recovering by 0.2 percent after a

decline of 0.7 percent in August.

France PMI Composite Final for October (Wed 0950 CET;

Wed 0850 GMT; Wed 0350 EST)

Consensus Forecast, Composite Index: 46.8

Consensus Range, Composite Index: 46.8 to 46.8

Consensus Forecast, Services Index: 47.1

Consensus Range, Services Index: 47.1 to 47.1

No revision expected for composite at 46.8 or services at

47.1 from the flash.

Germany PMI Composite Final for October (Wed 0955 CET;

Wed 0855 GMT; Wed 0355 EST)

Consensus Forecast, Composite Index: 53.8

Consensus Range, Composite Index: 53.8 to 53.8

Consensus Forecast, Services Index: 54.5

Consensus Range, Services Index: 54.0 to 54.5

The consensus sees no change from the flash for composite at

53.8 or services at 54.5.

Eurozone PMI Composite Final for October (Wed 1000

CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, Composite Index: 52.2

Consensus Range, Composite Index: 52.2 to 52.2

Consensus Forecast, Services Index: 52.6

Consensus Range, Services Index: 52.6 to 52.6

Forecasters expect the composite final unchanged at 52.2 and services final unrevised at 52.6.

United Kingdom PMI Composite Final for October (Wed

0930 BST; Wed 0930 GMT; Wed 0430 EST)

Consensus Forecast, Composite Index: 51.1

Consensus Range, Composite Index: 51.1 to 51.1

Consensus Forecast, Services Index: 51.1

Consensus Range, Services Index: 51.1 to 51.1

No change in flash seen in the final at 51.1 for both

composite and services.

United States ADP Employment Report for October (Wed 0815

EST; Wed 1315 GMT)

Consensus Forecast, Private Payrolls - M/M: 28K

Consensus Range, Private Payrolls - M/M: -20K to 50K

Private payrolls expected up a modest 28K after their

decline of 32K in September.

United States PMI Composite Final for October (C 0945

EST; Wed 1345 GMT)

Consensus Forecast, Composite Index: 54.8

Consensus Range, Composite Index: 54.8 to 54.8

Consensus Forecast, Services Index: 55.2

Consensus Range, Services Index: 55.2 to 55.2

No revision expected from the flash at 54.8 for composite

and 55.2 for services.

United States ISM Services Index for October (Wed

0945 EST; Wed 1345 GMT)

Consensus Forecast, Services Index: 51.0

Consensus Range, Services Index: 50.0 to 52.0

Forecasters see a slight uptick to 51.0 in October from 50.0

in September.

Brazil Selic Rate Announcement (Wed 1630 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 15%

Consensus Range, Level: 15% to 15%

No change is the call from the Brazil Copom.

Thursday

Australia International Trade in Goods for September (Thu

1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: A$3.9 B

Consensus Range, Balance: A$3.0 B to A$4.5 B

After a drop to A$1.b billion in August on declining gold

exports and rising imports of consumer goods, the consensus sees the surplus

back up to its trend level in September.

India PMI Composite Final for October (Thu 1030 IST; Thu

0500 GMT; Thu 0000 EST)

Consensus Forecast, Composite Index: 59.9

Consensus Range, Composite Index: 59.9 to 59.9

Consensus Forecast, Services Index: 58.8

Consensus Range, Services Index: 58.8 to 58.8

Forecasters expect no change from the flash at 59.9 for

composite and 58.8 for services in the final.

Germany Industrial Production for September (Thu 0800

CEST; Thu 0700 GMT; Thu 0200 EDT)

Consensus Forecast, M/M: 3.1%

Consensus Range, M/M: 1.8% to 3.5%

Consensus Forecast, Y/Y: -1.1%

Consensus Range, Y/Y: -2.0% to 0.6%

The consensus looks for output to rebound by 3.1 percent on

the month in September after falling by 4.3 percent in August. On year, the

call is minus 1.1 percent versus minus 4.2 percent in August.

Taiwan CPI for October (Thu 1600 CST; Thu 0800 GMT; Thu

0400 EST)

Consensus Forecast, Y/Y: 1.4%

Consensus Range, Y/Y: 1.4% to 1.5%

Forecasters see CPI up 1.4 percent on year after 1.25

percent in September.

Eurozone Retail Sales for September (Thu 1100 CEST;

Thu 1000 GMT; Thu 0500 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.2% to 0.3%

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: 0.6% to 1.5%

Sales expected up 0.2 percent on the month and 1.1 percent

on year.

United Kingdom BoE Announcement & Minutes (Thu

1200 BST; Thu 1100 GMT; Thu 0700 EST)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 4.0%

Consensus Range, Level: 4.0% to 4.0%

The consensus sees no change from the BOE but the vote

should be split with some doves even calling for a 50 bp cut.

United States Jobless Claims for Week 11/06 (Thu 0830

EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 232 K

Consensus Range, Initial Claims - Level: 224K to 259K

The consensus sees claims at 232K.

United States Productivity and Costs for Third Quarter (Thu

0830 EST; Thu 1330 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate:

2.7%

Consensus Range, Nonfarm Productivity - Annual Rate: 1.0%

to 4.0%

Consensus Forecast, Unit Labor Costs - Annual Rate: 0.9%

Consensus Range, Unit Labor Costs - Annual Rate: 0.8%

to 2.0%

Productivity expected up 2.7 percent with ULC up 0.9

percent.

United States Wholesale Inventories (Preliminary) for

September (Thu 1000 EST; Thu 1500 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.3% to 0.1%

Inventories expected down 0.1 percent.

Friday

Japan Household Spending for

September (Fri 0830 JST; Fri 2330 GMT; Fri 1930 EST)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -2.0% to 0.4%

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 0.6% to 4.3%

Japan's real household spending is forecast to rise 2.6% in September,

marking the fifth consecutive month of year-on-year growth, following a 2.3%

increase in August. The gain in August was driven by higher spending on

automobiles and robust leisure-related activities. On the month, sales are seen

down 0.5 percent.

The upward trend in both categories is expected to continue

in September, with car purchases likely to increase as the recent decline in

new passenger car registrations shows signs of easing.

Spending on auto-related items is also projected to rise

from a year earlier, reflecting a continued rebound from the production and shipment

suspensions within the Toyota group amid last year's

safety scandal.

China Merchandise Trade for October (ANYTIME)

Consensus Forecast, Balance of Trade: $97.0 B

Consensus Range, Balance of Trade: $95.3 B to $101.0

B

Consensus Forecast, Imports - Y/Y: 3.2%

Consensus Range, Imports - Y/Y: 2.5% to 7.0%

Consensus Forecast, Exports - Y/Y: 4.0%

Consensus Range, Exports - Y/Y: 1.6% to 7.3%

The trade surplus is expected wider at $97.0 billion in

October versus $90.5 billion in September.

United States Employment for October (Fri 0830 EST; Fri

1330 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 32K

Consensus Range, Nonfarm Payrolls - M/M: -90K to 55K

Consensus Forecast, Unemployment Rate: 4.4%

Consensus Range, Unemployment Rate: 4.3% to

4.7%

Consensus Forecast, Average hourly earnings - M/M:

0.3%

Consensus Range, Average hourly earnings - M/M: 0.3%

to 0.3%

Consensus Forecast, Workweek - 34.3 hours

Consensus Range, Workweek hours: 34.2 to 34.3

Payrolls seen up 32K with the jobless rate up to 4.4 percent

as federal job losses start to bite.

Canada Labour Force Survey for October (Fri 0830 EST;

Fri 1330 GMT)

Consensus Forecast, Employment - M/M: 8K

Consensus Range, Employment - M/M: -20K to 15K

Consensus Forecast, Unemployment Rate: 7.2%

Consensus Range, Unemployment Rate: 7.1% to 7.2%

Another tiny 8K increase in payrolls is the call with the

jobless rate up at 7.2 percent from 7.1 percent in September.

United States Consumer Sentiment for November (Fri 1000

EST; Fri 1500 GMT)

Consensus Forecast, Index: 53.2

Consensus Range, Index: 51.0 to 55.0

Sentiment expected down again to 53.2 in the first report

for November from 53.6 in October as consumers remain worried about their jobs

and inflation.

United States Consumer Credit for October (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, Consumer Credit - M/M: $10.5 B

Consensus Range, Consumer Credit - M/M: $10.0 B to

$11.0 B

A trend-like increase of $10.5 billion is expected.

|