|

The Week Ahead: Highlights

US Preview

CPI Is All You Get

By Theresa Sheehan, Econoday Economist

The October 20 week faces a fairly empty schedule as the

federal government closure goes into its third week. Only one of the delayed

reports will be released. The September CPI numbers are rescheduled to Friday,

October 24 at 8:30 ET. The workers associated with preparing the data have been

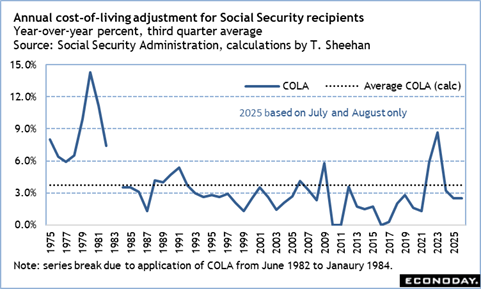

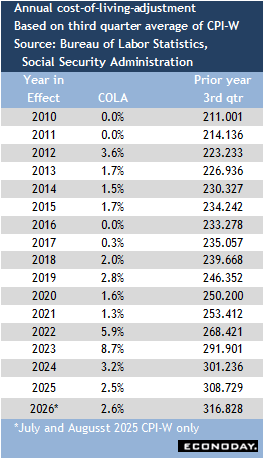

called back in for this report only. Congress needs the September CPI data to

calculate the annual cost-of-living-adjustment (COLA) for social security

benefits which is applied in January. The COLA is the year-over-year percent

change in the average of the CPI-W for July-September. For July and August

only, the year-over-year change is up 2.6 percent. If pass-through of tariff

costs is starting to occur in consumer prices, it could be a bit higher than

that.

The communications blackout period around the October 28-29

FOMC meeting goes into effect at midnight on Saturday, October 18 and runs

through midnight on Thursday, October 30. There will be no public comments from

Fed officials about monetary policy. Fed Chair Jerome Powell spoke on October

14 and offered no guidance on the outcome of the meeting other than saying that

it is not on a "predetermined path."

Asia-Pacific Preview

China Data in Focus

By Brian Jackson, Econoday Economist

Chinese GDP and monthly activity data will the main focus in

the week ahead, providing additional information about the impact on the

domestic economy of global trade tensions and ongoing weakness in the property

sector. China's leaders will also convene next week for high-level discussions

about the next five-year plan, with an offical communique scheduled for

publication at the end of this meeting. This may provide some additional

details of plans to boost domestic consumption but will likely stress the need

for policy stability.

The Bank of Korea's policy meeting will also take place.

After cutting rates earlier in the year, officials have left rates on hold at

their last two meetings but also noted that they have a "rate cut stance".

Although officials remain concerned about property market pressures, contained

inflation and concerns about the growth outlook may be enough to deliver

further policy easing next week, although the Econoday consensus sees no action.

New Zealand inflation and trade data next week will shape

expectations for next month's Reserve Bank of New Zealand policy meeting.

Singapore inflation and industrial production data are also scheduled for

release, with a flash PMI survey for India set to give an early indication of

conditions in October.

The Week Ahead: Econoday Consensus Forecasts

Monday

New Zealand CPI for Third Quarter (Mon 1045 NZST; Sun

2145 GMT; Sun 1745 EDT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.5% to 1.1%

Consensus Forecast, Y/Y: 3.0%

Consensus Range, Y/Y: 2.9% to 3.1%

The consensus looks for CPI up 0.9 percent on the quarter

and up 3.0 percent on year in Q3 after increases of 0.5 percent on quarter and

2.7 percent on year in Q2. Food prices and energy costs lifted in inflation in

Q3 while housing costs have been moderating.

China Fixed Asset Investment for September (Mon 1000

CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: 0.2%

Consensus Range, Year to Date on Y/Y Basis: 0.1% to 0.3%

Forecasters see FAI growth even lower at a vanishingly low

0.2 percent in September year on year versus a 0.5 percent in August.

China GDP for Third Quarter (Mon 1000 CST; Sun 0200

GMT; Sun 2200 EDT)

Consensus Forecast, Q/Q: 0.8%

Consensus Range, Q/Q: 0.7% to 0.9%

Consensus Forecast, Y/Y: 4.7%

Consensus Range, Y/Y: 4.5% to 4.9%

Growth seen at 0.8 percent on the quarter and 4.7 percent on

year for Q3 versus 1.1 percent and 5.2 percent in Q2. Lots of interest in this

number as most indicators slowed in the summer after a stronger start to the

year.

China Industrial Production for September (Mon 1000

CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 5.0%

Consensus Range, Y/Y: 4.7% to 5.5%

Growth in industrial production is seen declining to 5.0

percent on year in September versus 5.2 percent in August.

China Retail Sales for September (Mon 1000 CST; Mon

0200 GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 3.0%

Consensus Range, Y/Y: 2.9% to 3.2%

The consensus sees sales growth from a year ago down to 3.0

percent in September versus 3.4 percent in August.

Germany PPI for September (Mon 0800 CEST; Mon 0600

GMT; Mon 0200 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.3% to 0.3%

Consensus Forecast, Y/Y: -1.5%

Consensus Range, Y/Y: -1.9% to -1.4%

Wholesale prices are seen up 0.2 percent on the month and

down 1.5 percent on year in September after slipping by 0.5 percent on the

month and declining 2.2 percent on year in August.

United States Leading Indicators for September (Mon 1000

EDT; Mon 1600 GMT)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -0.4% to -0.3%

The index is seen down by another 0.3 percent in September

after declining by a sharp 0.5 percent in August.

Tuesday

China Loan Prime Rate for October (Tue 0900 CST; Mon 0100

GMT; Mon 2100 EDT)

Consensus Forecast, 1-Year Rate - Change: 0 bp

Consensus Range, 1-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 1-Year Rate - Level: 3.0%

Consensus Range, 1-Year Rate - Level: 3.0% to 3.0%

Consensus Forecast, 5-Year Rate - Change: 0 bp

Consensus Range, 5-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 5-Year Rate - Level: 3.5%

Consensus Range, 5-Year Rate - Level: 3.5% to 3.5%

The consensus looks for no change this time on both 1-year

and 5-year LPR.

Canada CPI for September (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, CPI - M/M: -0.1%

Consensus Range, CPI - M/M: -0.2% to 0.1%

Consensus Forecast, CPI - Y/Y: 2.2%

Consensus Range, CPI - Y/Y: 2.1% to 2.4%

Consensus Forecast, Core - M/M: 0.1%

Consensus Range, Core - M/M: 0.0% to 0.1%

Consensus Forecast, Core - Y/Y: 2.7%

Consensus Range, Core - Y/Y: 2.6% to 2.7%

Forecasters see CPI down 0.1 percent on the month and up 2.2

percent on year in September versus a decrease of 0.1 percent on the month and

an increase of 1.9 percent in August.

Wednesday

Japan Merchandise Trade for September (Wed 0850 JST;

Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, Balance: ¥-65.10 B

Consensus Range, Balance: ¥-261.40 B to ¥-89.40 B

Consensus Forecast, Imports - Y/Y: 1.7%

Consensus Range, Imports - Y/Y: -1.7% to 5.0%

Consensus Forecast, Exports - Y/Y: 4.6%

Consensus Range, Exports - Y/Y: 2.7% to 5.7%

Japanese export values are forecast to post their first

year-on-year rise in five months in September, up 4.6%, after being nearly flat

(-0.1%) in August and slipping 2.6% in July, thanks to the recent economic

recovery in Europe and solid demand from Asia, led by Taiwan, Hong Kong and

Vietnam. The rebound in exports is expected to be led by ships, computer chips

and raw materials while those of automobiles and iron/steel continued falling.

The late emergence of a silver lining in external demand for

the third quarter is still clouded by sluggish demand from the key U.S. market

as the protectionist trade policy under the Trump administration targeting the

auto and metals industries continues to bite and the Chinese economic recovery

remains wobbly.

Trump tariffs forced Japanese carmakers to slash the prices

for U.S. customers, basically covering high import costs and thus protecting

their market share in the world's biggest economy. That worked initially but

the August trade data showed the volumes of Japanese exports to the world fell

for first time in five months, causing jitters.

Import values are expected to rebound a slight 1.7% for the

first rise in three months and the fourth this year after slumping 5.2% in

August and 7.4% in July. The increase is driven by aircraft from the United

States and computers (with the latest Windows 11 operating system) and

smartphones from Asia, as seen in the previous month, which is partly offset by

continued declines in prices for crude oil, coal and liquefied natural gas.

Combining those factors, the trade balance is forecast to

post a small deficit of ¥65.10 billion following a revised ¥242.78 billion

deficit in August and a ¥306.09 billion deficit in September 2024.

United Kingdom CPI for September (Wed 0700 BST; Wed 0600

GMT; Tue 0200 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.2%

Consensus Forecast, Y/Y: 4.0%

Consensus Range, Y/Y: 3.9% to 4.1%

UK annual inflation seen at a shocking 4.0 percent in

September after an already nasty 3.8 percent in August. Month on month, the

consensus looks for an increase of 0.2 percent after rising 0.3 percent in

August.

Thursday

South Korea Bank of Korea Announcement (Thu 1000 KST;

Thu 0100 GMT; Wed 2100 EDT)

Consensus Forecast, Change: 0 bps

Consensus Range, Change: -25 bps to 0 bps

Consensus Forecast, Level: 2.50%

Consensus Range, Level: 2.25% to 2.50%

The consensus looks for no action, though a minority sees a

25 bp cut.

Singapore CPI for September (Thu 1300 SGT; Thu 0500

GMT; Thu 0100 EDT)

Consensus Forecast, Y/Y: 0.6%

Consensus Range, Y/Y: 0.5% to 0.6%

The consensus sees CPI up 0.6 percent on year in September

after an increase of 0.5 percent in August.

France Business Climate Indicator for October (Thu 0845

CEST; Thu 0645 GMT; Thu 0245 EDT)

Consensus Forecast, Index: 96

Consensus Range, Index: 94 to 96

The index is expected flat at 96 in October from 96 in

September.

Canada Retail Sales for August (Thu 0830 EDT; Thu 1230

GMT)

Consensus Forecast, M/M: 1.0%

Consensus Range, M/M: 1.0% to 1.1%

Forecasters agree with the Stats Canada preliminary estimate

calling for a rebound of 1.0 percent for September after August's decline of

0.8 percent.

United States Jobless Claims for Week 10/23 (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 232K

Consensus Range, Initial Claims - Level: 223K to 254K

Claims seen at 232K, pretty flat from where they've been

lately.

United States Existing Home Sales for September (Thu 1000

EDT; Thu 1400 GMT)

Consensus Forecast, Annual Rate: 4.06 M

Consensus Range, Annual Rate: 3.95 M to 4.12 M

The consensus sees sales up marginally at a 4.06 million

rate in September versus 4.0 million in August.

Eurozone EC Consumer Confidence Flash for October (Thu

1600 CEST; Thu 1400 GMT; Thu 1000 EDT)

Consensus Forecast, Index: -15.0

Consensus Range, Index: -15.6 to -14.5

Confidence seen at minus 15.0 in the October flash.

Friday

Japan CPI for September (Fri 0830 JST; Thu 2330 GMT; Thu

1930 EDT)

Consensus Forecast, Y/Y: 2.9%

Consensus Range, Y/Y: 2.6% to 3.0%

Consensus Forecast, Ex-Fresh Food - Y/Y: 3.0%

Consensus Range, Ex-Fresh Food - Y/Y: 2.6% to 3.0%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

3.1%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 3.0%

to 3.3%

Consumer inflation in Japan is expected to show a technical

uptick to around 3 percent in two key measures in September after three months

of easing, led by a year-on-year increase in overall energy costs which is

triggered by a sharp slowdown in subsidized electricity price gains in

September 2024.

The core reading (excluding fresh food) is forecast to post

a 3.0 percent rise on year in September after its annual rate decelerated to

2.7 percent in August from 3.1 percent in July from 3.3 percent in June and the

recent peak of 3.7 percent in May which had reflected the impact of summertime

utility subsidies. The year-on-year rise in the total CPI is seen at 2.9

percent, up from 2.7 percent the previous month. The underlying inflation

measured by the core-core CPI (excluding fresh food and energy) is estimated at

3.1 percent after having slowed to 3.3 percent in August from 3.4 percent in

July.

Singapore Industrial Production for September (Fri 1300

SGT; Fri 0500 GMT; Fri 0100 EDT)

Consensus Forecast, M/M: 8.4%

Consensus Range, M/M: 5.2% to 8.6%

The consensus sees output recovering by 8.4 percent on the

month in September after a big 9.7 percent drop in August.

United Kingdom Retail Sales for September (Fri 0700 BST;

Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -1.0% to 0.3%

Consensus Forecast, Y/Y: 0.7%

Consensus Range, Y/Y: -0.2% to 1.3%

Sales expected down 0.2 percent on the month in September

after rising 0.5 percent in August. On year, the consensus sees sales up by a

sluggish 0.7 percent again after rising 0.7 percent in August on year.

France PMI Composite Flash for October (Fri 0915 CEST;

Fri 0715 GMT; Fri 0315 EDT)

Consensus Forecast, Manufacturing Index: 48.0

Consensus Range, Manufacturing Index: 48.0 to 48.2

Consensus Forecast, Services Index: 48.5

Consensus Range, Services Index: 48.1 to 49.0

The manufacturing index is seen at 48.0 versus 48.2 and

services unchanged at 48.5 versus 48.5.

Germany PMI Composite Flash for October (Fri 0930

CEST; Fri 0730 GMT; Fri 0330 EDT)

Consensus Forecast, Composite Index: 51.0

Consensus Range, Composite Index: 50.5 to 51.5

Consensus Forecast, Manufacturing Index: 49.0

Consensus Range, Manufacturing Index: 49.0 to 49.7

Consensus Forecast, Services Index: 51.0

Consensus Range, Services Index: 51.0 to 51.5

The composite index is expected at 51.0 versus 52.0 in

September final. Manufacturing is seen at 49.0 versus 49.5 and services at 51.0

versus 51.5.

Eurozone PMI Composite Flash for October (Fri 1000

CEST; Fri 0800 GMT; Fri 0400 EDT)

Consensus Forecast, Composite Index: 51.0

Consensus Range, Composite Index: 50.5 to 51.0

Consensus Forecast, Manufacturing Index: 49.9

Consensus Range, Manufacturing Index: 49.1 to 50.0

Consensus Forecast, Services Index: 51.3

Consensus Range, Services Index: 50.7 to 51.5

The composite index is expected at 51.0 versus 51.2 in

September final. Manufacturing is seen at 49.9 versus 49.8 and services at 51.3

versus 51.3.

United Kingdom PMI Composite Flash for October (Fri

0930 BST; Fri 0830 GMT; Fri 0430 EDT)

Consensus Forecast, Composite Index: 50.7

Consensus Range, Composite Index: 50.5 to 51.1

Consensus Forecast, Manufacturing Index: 46.7

Consensus Range, Manufacturing Index: 45.8 to 47.0

Consensus Forecast, Services Index: 51.1

Consensus Range, Services Index: 50.2 to 52.0

The composite index is expected at 50.7 versus 50.1 in

September final. Manufacturing is seen at 46.7 versus 46.2 and services at 51.1

versus 50.8.

United States CPI for September (Fri 0830 EDT; Fri 1230

GMT)

Consensus Forecast, CPI - M/M: 0.4%

Consensus Range, CPI - M/M: 0.3% to 0.5%

Consensus Forecast, CPI - Y/Y: 3.1%

Consensus Range, CPI - Y/Y: 3.0% to 3.1%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.3% to

0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.1%

Consensus Range, Ex-Food & Energy - Y/Y: 3.0% to 3.2%

The delayed CPI is expected to show an increase of 0.4

percent for September on the month and a 3.1 percent rise on year. The core is

expected up 0.3 percent and up 3.1 percent on year. Tariffs lifted food and

goods prices while services is not really slowing down. It's also problematic

that gasoline prices and commodities were generally higher in September. Not a

pretty picture for the Fed at the same time employment seems to be suffering.

United States PMI Composite Flash for October (Fri 0945

EDT; Fri 1345 GMT)

Consensus Forecast, Manufacturing Index: 52.1

Consensus Range, Manufacturing Index: 51.0 to 52.5

Consensus Forecast, Services Index: 54.0

Consensus Range, Services Index: 53.2 to 54.3

The manufacturing PMI is expected at 52.1 for the October

flash versus 52.0 in September final. Services is seen at 54.0 versus 54.2 in

the September final

United States New Home Sales for September (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Annual Rate: 710K

Consensus Range, Annual Rate: 650K to 725K

Sales expected to fall back to 710K in September after a

surging to a surprisingly strong 800K in August.

United States Consumer Sentiment for October (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 55.0

Consensus Range, Index: 53.9 to 55.5

Consensus Forecast, Year-ahead Inflation Expectations: 4.6%

Consensus Range, Year-ahead Inflation Expectations: 4.6%

to 4.6%

The index is expected unrevised at 55.0 in the October final

from 55.0 in the October flash and 55.1 in September. One-year inflation

expectations also expected unchanged at 4.6 percent from the flash.

|