|

The Week Ahead: Highlights

US Preview

US Consumer Sentiment Report is Lone Major Indicator with

Government Shutdown

By Theresa Sheehan, Econoday Economist

With the US federal government shut down since October 1,

data reports from the official statistical agencies will not be published in

the week ahead, barring a miracle agreement between the warring parties. Even

if the shutdown ends soon, it will take at least a few days to prepare and

publish the reports.

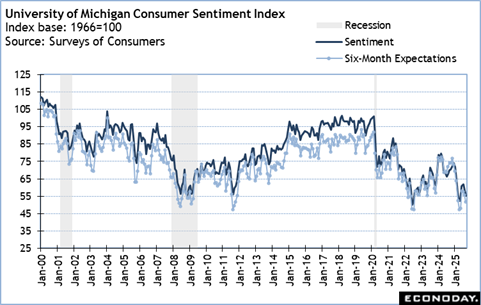

The October 6 week already has a light report schedule. Now

the only major report that is likely to be released is the preliminary

University of Michigan consumer sentiment index for October at 10:00 ET on

Friday. The index managed to climb up from the near-record lows of 52.2 in

April and May - 50.0 in June 2022 - to 61.8 in July but has fallen in the past

two months. The index is likely to decline further from the 55.1 reading in

September. Consumer sentiment continues to decline for both current conditions

and the six-month outlook. Consumers remain worried about price inflation for

non-discretionary household items and about their job security.

The Federal Reserve is set to release the minutes of the

September 16-17 FOMC meeting at 14:00 ET on Wednesday. However, the contents of

the minutes are rendered moot. Whatever the FOMC thought about the economy

three weeks ago has been superseded by subsequent events like the announcement

of yet more punitive tariffs with major trading partners and the government

shutdown. Without good data, making monetary policy decisions will become even

more difficult when the FOMC next meets on October 28-29.

Asia-Pacific Preview

Watching for RBNZ Rate Cut

By Brian Jackson, Econoday Economist

The policy meeting of the Reserve Bank of New Zealand is the

main focus of the Asia-Pacific data calendar in the week ahead. Officials

continued their policy-easing cycle late August with another 25 basis point

rate cut and indicated then that they will likely lower the cash rate further

in coming months. Since then, there has been no further inflation data

published but GDP data showed weak growth in the three months to June,

suggesting further policy easing is likely at this meeting.

Recent policy decisions by the Reserve Bank of Australia

will likely affect the consumer and business confidence survey scheduled for

release. The RBA cut rates last month but left them on hold this week. The last

of this month's round of PMI survey's will also be published early next week,

followed by inflation and trade data from Taiwan.

The Week Ahead: Econoday Consensus Forecasts

Monday

Eurozone Retail Sales for August (Mon 1100 CEST; Mon

0900 GMT; Mon 0500 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: -0.1% to 0.5%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.3% to 1.7%

Sales are expected up only 0.1 percent on the month in

August after dropping 0.5 percent in July. On year, the consensus sees sales up

1.3 percent versus 2.2 percent in August.

Tuesday

Japan Household Spending for August (Tue 0830 JST; Mon

2330 GMT; Mon 1930 EDT)

Consensus Forecast, M/M: -0.3%

Consensus Range, M/M: -1.4% to 0.5%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 0.2% to 1.7%

Japan's real household spending is forecast to post a modest

1.0% increase on the year in August slowing from recent gains of 1.4% in July,

1.3% in June and 4.7% in May as the killer heat wave promoted many people to

stay home or office during the day to avoid extreme heat and humidity. That is

believed to have somewhat offset the uplifting impact of solid demand for

beverages, summer clothing and air conditioners. The recent recovery in vehicle

purchases has also run its course after last year's Toyota group output

suspension over safety check scandals.

Easing but still elevated processed food inflation in the

aftermath of severe domestic rice supply shortages has also kept many

households cautious, spending less on non-essential items including gift money

in line with simplified weddings and funerals during the pandemic.

On the month, real average expenditures by households with

two or more people are expected to post a seasonally adjusted 0.3% drop after

rising 1.7% in July and plunging 5.2% in June.

Germany Manufacturing Orders for August (Tue 0800 CEST;

Tue 0600 GMT; Tue 0200 EDT)

Consensus Forecast, M/M: 1.3%

Consensus Range, M/M: 0.5% to 2.5%

Consensus Forecast, Y/Y: 3.0%

Consensus Range, Y/Y: 3.0% to 3.9%

Orders are seen rebounding by 1.3 percent on the month in

August after a big 2.9 percent drop on the month in July. On year, the

consensus sees sales up 3.0 percent after dropping 3.5 percent on year in July.

Canada Merchandise Trade for August (Tue 0830 EDT; Tue

1230 GMT)

Consensus Forecast, Balance: -C$5.4 B

Consensus Range, Balance: -C$6.0 B to -C$3.5 B

The consensus looks for a deficit at C$5.4 billion in

August, up from C$4.9 billion in July.

United States International Trade in Goods and Services

for August (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Balance: -$61.0 B

Consensus Range, Balance: -$80.0 B to -$59.4 B

The trade gap is expected to fall to $61.0 billion in August

from $73.8 billion in July.

United States Consumer Credit for August (Tue 1500

EDT; Tue 1900 GMT)

Consensus Forecast, Balance: $13.5 B

Consensus Range, Balance: $12.0 B to $15.0 B

Credit is seen rising a trend-like $13.5 billion after

increasing $16.0 billion in July.

Wednesday

New Zealand RBNZ Announcement (Wed 1400 NZST; Wed 0200

GMT; Tue 2200 EDT)

Consensus Forecast, Change: -25 Bps

Consensus Range, Change: -50 Bps to -25 Bps

Consensus Forecast, Level: 2.75%

Consensus Range, Level: 2.50% to 2.75%

The Econoday consensus anticipates a 25 bp rate cut to 2.75

percent this week, as the economy remains weak and RBNZ guidance pointed to more

rate reduction this year. Markets are pricing a good chance of a 50 bp cut on

the view that there is no good reason for the RBNZ not to act aggressively headed

into the year end holiday season.

Germany Industrial Production for August (Wed 0800

CEST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast, M/M: -1.0%

Consensus Range, M/M: -2.0% to 1.0%

Consensus Forecast, Y/Y: 0.0%

Consensus Range, Y/Y: -0.4% to 1.1%

Output is expected to fall back by 1.0 percent on the month

in August after rising 1.3 percent in July. On year, output is seen flat after

a 1.5 percent increase in July.

Thursday

Germany Merchandise Trade for August (Thu 0800 CEST; Thu

0600 GMT; Thu 0200 EDT)

Consensus Forecast, Balance: E15.2 B

Consensus Range, Balance: E14.0 B to E15.5 B

The trade surplus is expected at E15.2 billion versus E1.7

billion in July.

Brazil CPI for September (Thu 0900 BRT; Thu 1200 GMT;

Thu 0800 EDT)

Consensus Forecast, Y/Y: 5.20%

Consensus Range, Y/Y: 5.20% to 5.24%

The consensus sees CPI up 5.20 percent on year in September

versus 5.13 percent in August.

United States Jobless Claims for Week 10/9 (Thu 0830 EDT;

Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 235K

Consensus Range, Initial Claims - Level: 223K to 236K

Claims expected relatively flat at 235K.

United States Wholesale Inventories (Preliminary) for

August (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.2% to 0.1%

The consensus sees no revision from the flash at minus 0.2

percent.

Friday

Japan PPI for September (Fri

0850 JST; Fri 2350 GMT; Fri 1950 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: -0.3% to 0.5%

Consensus Forecast, Y/Y: 2.5%

Consensus Range, Y/Y: 2.4% to 2.8%

Producer inflation in Japan is forecast to post a 2.5% rise

on the year in September after rising 2.7% in August and stabilizing under 3%

in recent months thanks to summer fuel subsidies and easing domestic rice

supply shortages.

The year-on-year increase in the corporate goods price index

decelerated to a 15-month low of 2.5% in July (the slowest since 1.2% in April

2024) from 2.7% in June after having hit a recent peak of 4.3% in each of

February and March this year (the highest since 4.5% in June 2023).

On the upside risk, however, the previous import cost-cost

cutting effects of a firmer yen on the year has lost its shine as the yen's

weakness seen in the first seven months of 2024 that peaked at Y158.06 to the

dollar (Tokyo hours spot monthly average rate) in July last year vs. Y146.71 in

July this year. In August, the dollar yen rate averaged at Y147.67, with the

yen slightly weaker than the August 2024 rate of Y146.23.

On the month, the CGPI is forecast to post its first rise in

two months, up 0.2%, after dipping 0.2% in August and rising 0.3% in July. The

decrease in August was led by lower costs for utilities (electricity and

natural gas) and farm produce (pork, chicken eggs and beef), items that had

driven the July increase.

Canada Labour Force Survey for September (Fri 0830

EDT; Fri 1230 GMT)

Consensus Forecast, Employment - M/M: 10K

Consensus Range, Employment - M/M: -10K to 25K

Consensus Forecast, Unemployment Rate: 7.1%

Consensus Range, Unemployment Rate: 7.0% to 7.2%

After two months of huge job losses totaling more than 100K,

the Canadian economy is expected to show modest job growth of 10K leaving

unemployment flat at a high 7.1 percent.

United States Consumer Sentiment for October (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 54.0

Consensus Range, Index: 53.0 to 60.1

The first reading for October is expected to show another

decline to 54.0 from 55.1 in September and 58.2 in August as consumers fret

over rising prices and weakening employment prospects.

|