|

Is a 50-point hike really a possibility at the coming FOMC? Based on the results of the latest employment report, the answer is: You Bet! At 311,000, nonfarm payroll growth in February was, for the fifth month in a row, at the top of Econoday’s consensus range. February, in fact, was the tenth straight month and twelfth of the last thirteen that payroll growth has exceeded Econoday’s consensus. Before turning to the details of the report and what it means for monetary policy, let’s first look at the latest week’s policy decisions which, in contrast to Federal Reserve jawboning, were decidedly less than hawkish.

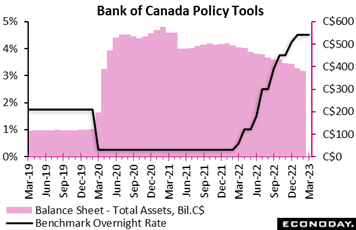

The Bank of Canada on Wednesday left its policy interest rate at 4.50 percent, as widely expected ending a run of 8-straight hikes. Yet the bank maintained that its policy bias is still toward tightening: "Governing Council will continue to assess economic developments and the impact of past interest rate increases, and is prepared to increase the policy rate further if needed to return inflation to the 2 percent target." The Bank of Canada on Wednesday left its policy interest rate at 4.50 percent, as widely expected ending a run of 8-straight hikes. Yet the bank maintained that its policy bias is still toward tightening: "Governing Council will continue to assess economic developments and the impact of past interest rate increases, and is prepared to increase the policy rate further if needed to return inflation to the 2 percent target."

The BoC said it is not lowering its guard against upside risks to inflation given that consumer spending is resilient and the labour market "very tight", an assessment confirmed later in the week by the February labour force survey that showed a solid rise in employment and an accelerating 5.4 percent wage rate. March’s no action follows a 25-point hike in January that in turn followed 50-point moves in December and October, 75 points in September, 100 points in July and a couple of earlier rate moves bringing the total to 425 points.

While the cumulative effects of this tightening are slowing growth in Canada and elsewhere and commodity prices have evolved roughly in line with the bank's expectations, "the strength of China's recovery and the impact of Russia's war in Ukraine remain key sources of upside risk," the bank said in reference to inflation.

Looking ahead, however, the message included a dovish note: "With weak economic growth for the next couple of quarters, pressures in product and labour markets are expected to ease. This should moderate wage growth and also increase competitive pressures, making it more difficult for businesses to pass on higher costs to consumers."

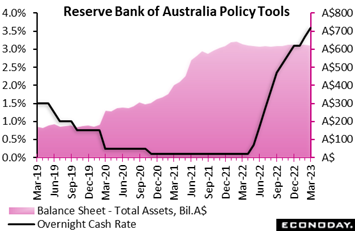

The Reserve Bank of Australia on Tuesday increased its main policy rate by 25 basis points from 3.35 percent to 3.60 percent, in line with the consensus forecast. Since it began to normalise policy settings last May the RBA has raised policy rates at ten consecutive meetings, with the cumulative increase at 350 points. Headline inflation slowed from 7.8 percent in December to 7.4 percent in January but remains well above the RBA's target range of 2.0 percent to 3.0 percent and is expected to remain above target until mid-2025. The Reserve Bank of Australia on Tuesday increased its main policy rate by 25 basis points from 3.35 percent to 3.60 percent, in line with the consensus forecast. Since it began to normalise policy settings last May the RBA has raised policy rates at ten consecutive meetings, with the cumulative increase at 350 points. Headline inflation slowed from 7.8 percent in December to 7.4 percent in January but remains well above the RBA's target range of 2.0 percent to 3.0 percent and is expected to remain above target until mid-2025.

Officials have been forecasting that headline inflation peaked late last year and the statement accompanying the latest decision notes that monthly data appear to confirm this. They expect inflation to moderate further in coming months in response to weaker domestic demand, but also note that wage growth has picked up and that the labour market remains tight. Officials note that there is uncertainty about the global outlook and the timing and extent of an expected slowdown in household spending, but expect the Australian economy to grow below its trend rate in the next two years.

Officials have reaffirmed their determination to return inflation to the target range and have again promised they "will do what is necessary to achieve that". They warn, however, that this determination to subdue inflationary pressures will present downside risks to the growth outlook, reiterating that the "path to achieving a soft landing remains a narrow one". The statement also notes that officials continue to expect they will increase policy rates further in coming months.

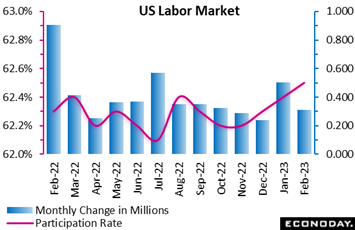

Policy rates in the US are definitely going up, made certain by a 311,000 February rise in nonfarm payrolls that was well above Econoday’s consensus for 223,000. Job gains averaged 408,000 in the first two months of the year compared to 264,000 in the fourth quarter 2022. The unemployment rate did rise unexpectedly to a still very low 3.6 percent, but the participation rate, which was expected to remain unchanged, ticked higher to 62.5 percent. Policy rates in the US are definitely going up, made certain by a 311,000 February rise in nonfarm payrolls that was well above Econoday’s consensus for 223,000. Job gains averaged 408,000 in the first two months of the year compared to 264,000 in the fourth quarter 2022. The unemployment rate did rise unexpectedly to a still very low 3.6 percent, but the participation rate, which was expected to remain unchanged, ticked higher to 62.5 percent.

Service providers' payrolls rose 245,000 in February with solid increases in retail trade (50,100), professional and business services (45,000), healthcare (44,200), and particularly in leisure and hospitality (105,000). There was a 25,000 decline in the information sector which included a 4,000 decrease in computing infrastructure providers and a 2,400 dip in computer systems design and related services. Goods producers' payrolls rose 20,000 due to a 24,000 rise in construction. If homebuilding has slowed, workers are finding employment in other aspects of the sector. Manufacturing payrolls fell 4,000 and mining and logging was unchanged.

Average hourly earnings eased 0.2 percent month-over-month and accelerated 2 tenths of the year to 4.6 percent year-over-year. The pace of average hourly earnings is trending lower, but somewhat unevenly for the annual rate.

The U-6 unemployment rate, like the overall rate, rose up 2 tenths to 6.8 percent in February. The labor force increased by 419,000 with a 177,000 rise in the newly employed and a 242,000 increase in the unemployed. Since new entrants to the labor force declined 16,000 to 515,000, most of the labor force increase was in job losers which rose 223,000 to 2.752 million.

US labor remains in short supply although the rise in the unemployment rate suggests the imbalance in supply and demand may be easing slightly. The slowing in monthly wages is positive for monetary policy although the annual change remains well above the Fed's 2 percent inflation target. If the February employment report isn't as strong as January's, it is still sufficient to ensure that the FOMC has no reason not to raise rates on the maximum employment side of the dual mandate.

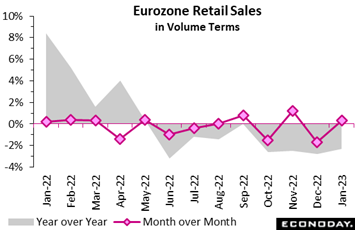

Eurozone data have been surprising to the downside, a trend tracked by Econoday’s Consensus Divergence Index (detailed in the The bottom line). The zone’s retail sector disappointed at the start of the year. A modest 0.3 percent monthly increase in volume sales was well short of the consensus and did little to reverse December's 1.7 percent decline. Year-over-year, sales contracted 2.3 percent, up from minus 2.8 percent but still sub-zero for a fourth consecutive month. Eurozone data have been surprising to the downside, a trend tracked by Econoday’s Consensus Divergence Index (detailed in the The bottom line). The zone’s retail sector disappointed at the start of the year. A modest 0.3 percent monthly increase in volume sales was well short of the consensus and did little to reverse December's 1.7 percent decline. Year-over-year, sales contracted 2.3 percent, up from minus 2.8 percent but still sub-zero for a fourth consecutive month.

January's monthly advance reflected a 1.8 percent increase in purchases of food, drink and tobacco, their first gain since last September, and a 0.8 percent rise in non-food (ex-auto fuel) sales. Auto fuel saw a 1.5 percent decline.

Regionally, France (0.1 percent) eked out a minimal monthly rise but Germany (minus 0.3 percent) posted its third drop in the last four months. Elsewhere, the picture was similarly mixed with a sharp 4.9 percent jump in the Netherlands contrasting with a 9.8 percent collapse in Austria.

The January data leave overall Eurozone sales 0.5 percent below their average level in the fourth quarter. February and/or March will need to be a good deal stronger if the retail sector is not to extend its run of negative contributions to quarterly real GDP growth.

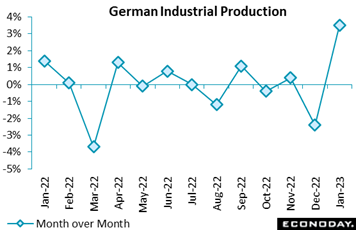

Germany’s industrial production has also been disappointing, but not in January which saw a 3.5 percent monthly rise that was fully 2 percentage points above the consensus and more than reversed December's 2.4 percent drop. Annual growth was still negative at minus 1.2 percent but up from minus 3.6 percent last time. Even so, production was still some 4.8 percent below its pre-pandemic level in February 2020. Germany’s industrial production has also been disappointing, but not in January which saw a 3.5 percent monthly rise that was fully 2 percentage points above the consensus and more than reversed December's 2.4 percent drop. Annual growth was still negative at minus 1.2 percent but up from minus 3.6 percent last time. Even so, production was still some 4.8 percent below its pre-pandemic level in February 2020.

Manufacturing fared slightly less strongly but still saw a 1.9 percent monthly gain. This was on the back of a 6.9 percent jump in intermediates which more than offset declines in capital goods (0.6 percent) and consumer goods (1.8 percent). Especially robust were electronic equipment (7.1 percent) and chemicals and chemical products (9.8 percent). Elsewhere, energy was up 0.4 percent and construction jumped 12.6 percent after a weather-impacted 7.5 percent slump in December.

January's rebound puts total industrial production 1.9 percent above its average level in the first quarter. Moreover, with manufacturing orders (data posted separately) posting back-to-back gains in December and January (up 1.0 and 3.4 percent), the near-term outlook would seem a good deal less gloomy than for some time. That said, domestic demand is still soft and compared with a year ago, orders are still down 11.0 percent is much more negative than production.

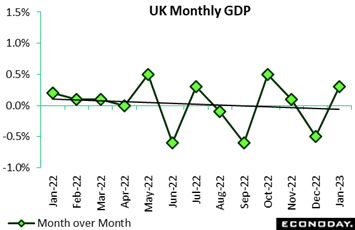

However gloomy the outlook may be for the UK, the country’s data have been beating forecasts. The economy, in fact, was a good deal stronger than expected in January. Real GDP expanded by 0.3 percent on the month, only reversing a portion of December's unrevised 0.5 percent contraction but beating the market consensus by 2 tenths. The advance left the quarterly change flat at 0.0 percent but nudged up annual growth from minus 0.1 percent to also 0.0 percent. Even so, total output was still 0.2 percent below its pre-Covid level in February 2020. However gloomy the outlook may be for the UK, the country’s data have been beating forecasts. The economy, in fact, was a good deal stronger than expected in January. Real GDP expanded by 0.3 percent on the month, only reversing a portion of December's unrevised 0.5 percent contraction but beating the market consensus by 2 tenths. The advance left the quarterly change flat at 0.0 percent but nudged up annual growth from minus 0.1 percent to also 0.0 percent. Even so, total output was still 0.2 percent below its pre-Covid level in February 2020.

January's monthly gain was led by services which grew 0.5 percent after a 0.8 percent slump at year-end. Sizeable contributions came from education, transport and storage, human health activities, and arts, entertainment and recreation activities, all of which rebounded having fallen in December. Output in consumer facing services rose 0.3 percent. By contrast, industrial production dropped 0.3 percent and so unwound December's advance. Elsewhere, construction declined 1.7 percent after a flat performance in December.

January's update further reduces the likelihood of the UK economy falling into recession in the first half of 2023 although that is still a clear possibility. It also increases the chances of another hike in Bank Rate later this month.

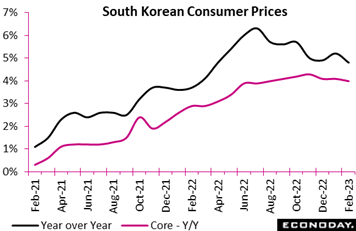

South Korea's headline consumer price index rose 4.8 percent on the year in February, down from 5.2 percent in January and its lowest level since March 2022. Nevertheless, headline inflation has now been above the Bank of Korea's 2.0 percent target for nearly two years. The index rose 0.3 percent on the month after advancing 0.8 percent previously. South Korea's headline consumer price index rose 4.8 percent on the year in February, down from 5.2 percent in January and its lowest level since March 2022. Nevertheless, headline inflation has now been above the Bank of Korea's 2.0 percent target for nearly two years. The index rose 0.3 percent on the month after advancing 0.8 percent previously.

Underlying inflation eased slightly in February. Core CPI, excluding food and energy, rose 0.3 percent on the month after a previous increase of 0.6 percent with the year-over-year increase moderating from 4.1 percent to 4.0 percent.

The small decline in headline inflation in January was largely driven by transport costs, up 0.4 percent on the year after a previous increase of 3.0 percent, and utilities prices, up 7.7 percent after a previous increase of 8.0 percent. The year-over-year change in prices was relatively steady for other major categories, including food, clothing and footwear, and communication.

At the BoK's most recent policy meeting, held last month, officials left the main policy rate unchanged at 3.50 percent. Officials expect inflation to moderate over 2023 and advised that they will need to "judge" whether further rate increases are "warranted" based on "the pace of inflation slowdown and developments in the uncertainties". The moderation in price pressures shown in February's data will likely boost the chances that rates will be left unchanged at the BoK's next policy meeting in mid-April.

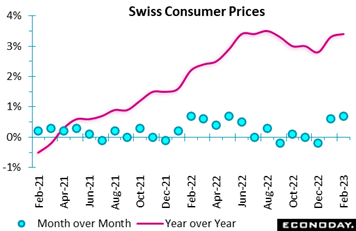

In constrast to Korea, consumer prices in Switzerland, though modest by international standards, accelerated for a second consecutive month. A 0.7 percent monthly increase was nearly double the consensus and large enough to lift the annual rate from 3.3 percent to 3.4 percent, its highest reading since last August. In constrast to Korea, consumer prices in Switzerland, though modest by international standards, accelerated for a second consecutive month. A 0.7 percent monthly increase was nearly double the consensus and large enough to lift the annual rate from 3.3 percent to 3.4 percent, its highest reading since last August.

Domestic prices were up 0.6 percent on the month, raising their yearly rate from 2.6 percent to 2.9 percent. The increase here was compounded by import prices which jumped fully 1.1 percent, although negative base effects meant that their annual rate still fell from 5.2 percent to 4.9 percent.

Within the CPI basket, significant contributions to the overall monthly rise came from food and non-alcoholic drink and clothing and footwear where prices advanced 1.1 percent and 3.7 percent respectively. Restaurants and hotels (1.6 percent) household goods and services (1.0 percent) and recreation and culture (1.3 percent) similarly posted solid gains. Petroleum products were only flat and there were no declines. As a result, core prices (excluding unprocessed food and energy) climbed fully 0.8 percent versus January, lifting the annual core rate by 0.2 percentage points to 2.4 percent, a new record high.

The broad-based acceleration in inflation in February probably all but guarantees another round of tightening from the Swiss National Bank later this month.

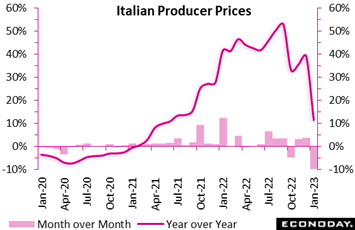

The week’s most striking price indications came from Italian producer prices. A 9.9 percent monthly drop slashed the annual PPI rate from 39.2 percent to 11.6 percent, its lowest post since June 2021. The week’s most striking price indications came from Italian producer prices. A 9.9 percent monthly drop slashed the annual PPI rate from 39.2 percent to 11.6 percent, its lowest post since June 2021.

Inevitably, the overall monthly decline was dominated by energy where prices dropped fully 21.6 percent. Excluding this category, the PPI actually rose 0.5 percent although negative base effects still ensured a fall in the yearly core rate from 11.2 percent to 9.8 percent. Within this, consumer goods were up a monthly 0.6 percent, capital goods 0.3 percent and intermediates 0.4 percent.

Accordingly, the January data flatter to deceive. Underlying PPI inflation has probably peaked but prices are still rising at a fast enough rate to suggest that getting CPI inflation back below 2 percent is a long way off.

February’s employment report gave a boost to Econoday’s Consensus Divergence Index which bounced back into modestly positive ground at 7, just above the zero line to indicate that the country’s data, as they have through most of the year, are exceeding expectations. Likewise boosted by another strong labour force survey, Canada’s ECDI improved in the week to minus 6 and when excluding prices (ECDI-P), the reading moves into positive ground at 4.

Outside of inflation, most of the Eurozone’s economic indicators released since the February ECB meeting have surprised on the downside. That said, the latest reading on the ECDI (minus 21) would be even more negative but for the unexpected buoyancy of prices - at minus 40, the ECDI-P stands only just above its all-time low. And it will be the inflation surprises that determine the central bank’s policy decision in the coming week so another 50-point tightening still looks a done deal.

In the UK, the economic data continue to run significantly hotter than expected. At now 40 and 41 respectively, both the ECDI and ECDI-P are well in positive surprise territory and so support speculation about another hike in Bank Rate later this month.

In Switzerland, the gap between the ECDI (18) and ECDI (minus 5) continues to show upside surprises concentrated in the inflation data and so similarly leaves the SNB on course to raise its policy rate again next week.

In Japan both the ECDI (minus 10) and ECDI-P (minus 6) remain close enough to zero to signal no significant surprises in the recent data. However, in China, economic activity in general continues to outpace market expectations and, but for the unexpected weakness in the latest inflation reports, the ECDI (36) and would be much higher – the ECDI stands at a maximum 100.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

The European Central Bank at its last meeting said it would raise rates by 50 basis points at this month’s meeting – and that’s the consensus for Thursday’s announcement. For Tuesday’s CPI from the US, some moderation, but not very much, is the expectation in results that wouldn’t ease chances for a very hawkish Federal Reserve meeting in the subsequent week.

Further improvement is the expectation for key Chinese data, estimated to be posted on Wednesday. Industrial production is expected to double to a 2.6 percent rise with retail sales expected to jump into positive territory at a gain of 3.5 percent. Both reports will be for the combined period of January and February.

Other key will include the UK labour market report on Tuesday, Eurozone industrial production on Wednesday, and manufacturing sales and housing starts from Canada on Tuesday and Wednesday. Asian data will include New Zealand GDP and Japanese merchandise trade, both on Thursday.

Turning back to the Fed, one last key report that policy makers will get to consider will be retail sales on Wednesday which, after surging in January, are expected to flatten in February. And dead flat is the consensus for US consumer sentiment on Friday.

UK Labour Market Report (Tue 0700 GMT; Tue 0300 EDT)

Consensus Forecast, ILO Unemployment Rate for three months to January: 3.8%

The ILO unemployment rate for the three months to January is expected to edge higher to 3.8 versus 3.7 percent in the prior three reports.

US CPI for February (Tue 1230 GMT; Tue 0830 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 6.0%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 5.5%

Core prices in February are expected to hold steady at an elevated 0.4 percent monthly gain with overall prices also expected to rise 0.4 percent after January’s 0.5 percent rise. Annual rates, which in January were 6.4 percent overall and 5.6 percent for the core, are expected at 6.0 and 5.5 percent.

Canadian Manufacturing Sales for January (Tue 1230 GMT; Tue 08:30 EDT)

Consensus Forecast, Month over Month: 3.9%

Manufacturing sales are expected to rise 3.9 percent in January after falling 1.5 percent in December.

Chinese Fixed Asset Investment for January/February (Wed 0200 GMT; Wed 1000 CST; Tue 2200 EDT)

Consensus Forecast, Year-to-Date on Y/Y Basis: 4.5%

Fixed asset investment in the combined months of January and February is expected to rise 4.5 percent. This would compare with 5.1 percent growth in December.

Chinese Industrial Production for January/February (Wed 0200 GMT; Wed 1000 CST; Tue 2200 EDT)

Consensus Forecast, Year over Year: 2.6%

Year-over-year growth in industrial production is expected to accelerate to 2.6 percent in the combined months of January and February versus growth of 1.3 percent in December.

Chinese Retail Sales for January/February (Wed 0200 GMT; Wed 1000 CST; Tue 2200 EDT)

Consensus Forecast, Year over Year: 3.5%

After falling 1.8 percent in December, year-over-year sales in the January and February combined period are expected to rise 3.5 percent.

Eurozone Industrial Production for January (Wed 1000 GMT; Wed 1100 CET; Wed 0600 EDT)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 0.3%

Production in January is expected to rise 0.5 percent after falling 1.1 percent in December. Consensus for the year-over-year rate is 0.3 percent.

Canadian Housing Starts for February (Wed 1215 GMT; Wed 0815 EDT)

Consensus Forecast, Annual Rate: 220,000

Housing starts are expected to rise slightly to a 220,000 annualized rate in February versus 215,000 in January.

US PPI-FD for February (Wed 1230 GMT; Wed 0830 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 5.4%

US PPI-FD, Less Food & Energy

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 5.2%

After rising a sharper-than-expected 0.7 percent in January, producer prices in February are expected to slow to a monthly 0.3 percent. The annual rate in February is seen at 5.4 percent versus January’s 6.0 percent. February’s ex-food ex-energy rate is seen at 0.4 percent on the month and 5.2 percent on the year versus January’s 0.5 and 5.4 percent, both of which were also sharper than expected.

US Retail Sales for February (Wed 1230 GMT; Wed 0830 EDT)

Consensus Forecast, Month over Month: -0.3%

Consensus Forecast, Ex-Vehicles - M/M: 0.2%

February sales are expected to fall 0.3 percent versus January’s outsized 3.0 percent surge which, in context, did follow 1.1 percent declines in both the key holiday months of November and December.

New Zealand Fourth-Quarter GDP (Wed 2145 GMT; Thu 1045 NZDT; Wed 1745 EDT)

Consensus Forecast, Quarter over Quarter: -0.2%

Consensus Forecast, Year over Year: 3.4%

Consensus for fourth-quarter GDP is quarter-to-quarter contraction of 0.2 percent versus 2.0 percent growth in the third quarter.

Japanese Merchandise Trade for February (Wed 2350 GMT; Thu 0850 JST; Wed 1950 EDT)

Consensus Forecast: -¥1,074 billion

Consensus Forecast, Imports Y/Y: 11.7%

Consensus Forecast, Exports Y/Y: 7.7%

A deficit of ¥1,074 is the consensus for February’s trade balance versus a deficit of ¥3,499 billion in January, a month that saw a slowdown in exports which are expected to rebound in the coming report.

Japanese Machinery Orders for January (Wed 2350 GMT; Thu 0850 JST; Wed 1950 EDT)

Consensus Forecast, Month over Month: 1.5%

Consensus Forecast, Year over Year: -3.4%

Machinery orders are expected to rise 1.5 percent in January to trim year-over-year contraction to minus 3.4 percent. This would follow a 1.6 percent monthly rise and yearly contraction of 6.6 percent in December, a month when the Cabinet Office said machinery orders were “pausing”.

Australian Labour Force Survey for February (Thu 0030 GMT; Thu 1130 AEDT; Wed 2030 EDT)

Consensus Forecast, Employment: 50,000

Consensus Forecast, Unemployment Rate: 3.6%

At a consensus rise of 50,000, employment is expected to rebound from a 11,700 decline in January. The unemployment rate is expected to fall 1 tenth to 3.6 percent.

US Housing Starts for February (Thu 1230 GMT; Thu 0830 EDT)

Consensus Forecast, Annual Rate: 1.315 million

US Building Permits

Consensus Forecast: 1.340 million

Housing starts in January fell much sharper than expected, to a 1.309 million annualized rate from December’s 1.371 million. February is expected to come in flat at 1.315 million. Permits, at 1.339 million in January, are also seen flat at 1.340 million.

European Central Bank Announcement (Thu 1315 GMT; Thu 1415 CET; Thu 0915 EDT)

Consensus Forecast, Change: 50 basis points

Consensus Forecast, Refi Rate: 3.50%

The ECB outright stated in its February announcement that it “intends to raise interest rates by another 50 basis points” at its March meeting. Given no subsequent retraction, this then is the expectation, 50 basis points across its three rates.

US Industrial Production for February (Fri 1315 GMT; Fri 0915 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Manufacturing Output - M/M: -0.2%

Consensus Forecast, Capacity Utilization Rate: 78.5%

Industrial production is expected to rise 0.4 percent in February after January’s no change. Manufacturing output is seen down 0.2 percent after rebounding 1.0 percent in January following declines of 1.8 and 0.8 percent in the two prior months. The utilization rate is seen up 2 tenths to 78.5 percent.

US Consumer Sentiment Index, Preliminary March (Fri 1400 GMT; Fri 1000 EDT)

Consensus Forecast: 67.0

Consumer sentiment is expected to hold steady at a depressed 67.0 in the first reading for March.

|