|

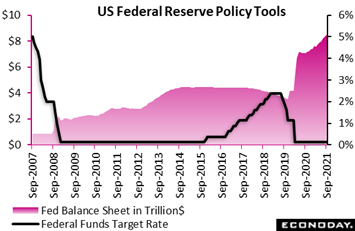

Econoday's consensus divergence indexes continue their convergence toward the zero line, indicating that economic results across the major economies are coming in as expected. But the mix inside the index is skewed: weaker-than-expected results for supply and demand that are masking higher-than-expected rates of inflation, inflation that the Federal Reserve is all but certain will begin to fizzle. Backed by this conviction, the Fed is likewise certain that it is now at the very precipice, the very edge of announcing a taper, of pulling back from the bond market. How soon is soon? Very soon as the room closes in on the Fed.

Tapering is coming as long as upward price pressures do in fact prove transitory and the labor market continues to improve. Jerome Powell said he's confident bottlenecks will recede and that inflation will fade, and he expressed nearly as much confidence in the labor market telling reporters at the FOMC press conference that measures of improvement were "all but met'. And "soon" is the operative word for the policy shift, which makes the next FOMC announcement on November 3 the likely start for tapering provided, according to Powell, that the September employment report proves "decent." What "decent" means, of course, isn't spelled out: decent relative to nonfarm expectations in the 500,000 to 750,000 range? or decent relative to August's puny 235,000 result that badly missed low estimates. Looking at the actual FOMC statement for guidance turns up the open-ended phrase "continued to strengthen" when describing the jobs market. The September employment report is one to look forward to, and take note that it's not on the first Friday of the month this time around but will be on the second Friday, on October 8 at the usual 8:30 am slot. Tapering is coming as long as upward price pressures do in fact prove transitory and the labor market continues to improve. Jerome Powell said he's confident bottlenecks will recede and that inflation will fade, and he expressed nearly as much confidence in the labor market telling reporters at the FOMC press conference that measures of improvement were "all but met'. And "soon" is the operative word for the policy shift, which makes the next FOMC announcement on November 3 the likely start for tapering provided, according to Powell, that the September employment report proves "decent." What "decent" means, of course, isn't spelled out: decent relative to nonfarm expectations in the 500,000 to 750,000 range? or decent relative to August's puny 235,000 result that badly missed low estimates. Looking at the actual FOMC statement for guidance turns up the open-ended phrase "continued to strengthen" when describing the jobs market. The September employment report is one to look forward to, and take note that it's not on the first Friday of the month this time around but will be on the second Friday, on October 8 at the usual 8:30 am slot.

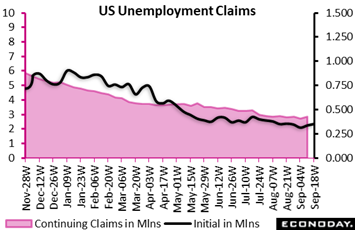

Getting a "decent" September employment report however it's defined is no certainty in any case, especially based on the week's initial indications. Employment was stagnant in September's PMI services flash where 14 straight months of improvement came to an end. And initial jobless claims in the September 18 week, which is the reference period for the September employment report, came in at 351,000 which is dead flat compared to the 349,000 level in the reference period for October's report. The latest claims result, more than 40,000 above Econoday's consensus, was in fact a big disappointment, reflecting ongoing problems along the supply chain that have slowed vehicle production as well as the winding down of summer vacations when leisure and travel tapers off. And the winding down of emergency benefits is what the unemployed are now facing. New claims for pandemic unemployment assistance (PUA) fell nearly 8,000 to just over 15,000 in the September 18 week and will soon reach zero. Continuing PUA claims further confirm that claimants are running out of benefits, down nearly 600,000 to 4.896 million in data for the September 4 week. The level for the pandemic emergency unemployment compensation (PEUC) program was down more than 160,000 to 3.645 million. Both the PUA and PEUC are expected to see large incremental declines in the coming weeks. Look for the unemployed to move to seasonal retail and wholesale jobs as the holidays approach or take temporary work in the transportation sector that will tide them over until supply-chain issues improve. Getting a "decent" September employment report however it's defined is no certainty in any case, especially based on the week's initial indications. Employment was stagnant in September's PMI services flash where 14 straight months of improvement came to an end. And initial jobless claims in the September 18 week, which is the reference period for the September employment report, came in at 351,000 which is dead flat compared to the 349,000 level in the reference period for October's report. The latest claims result, more than 40,000 above Econoday's consensus, was in fact a big disappointment, reflecting ongoing problems along the supply chain that have slowed vehicle production as well as the winding down of summer vacations when leisure and travel tapers off. And the winding down of emergency benefits is what the unemployed are now facing. New claims for pandemic unemployment assistance (PUA) fell nearly 8,000 to just over 15,000 in the September 18 week and will soon reach zero. Continuing PUA claims further confirm that claimants are running out of benefits, down nearly 600,000 to 4.896 million in data for the September 4 week. The level for the pandemic emergency unemployment compensation (PEUC) program was down more than 160,000 to 3.645 million. Both the PUA and PEUC are expected to see large incremental declines in the coming weeks. Look for the unemployed to move to seasonal retail and wholesale jobs as the holidays approach or take temporary work in the transportation sector that will tide them over until supply-chain issues improve.

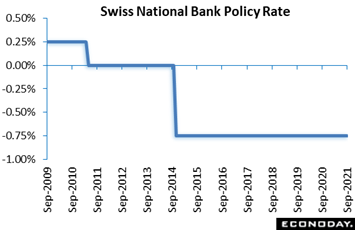

Policy led the week's news including no-change decisions from the Bank of England and also the Swiss National Bank where the policy rate, as it has for the last seven years, was once again pegged at minus 0.75 percent. The SNB continued to describe the Swiss franc as "highly valued" and predictably reiterated its willingness to intervene as and when necessary to prevent any unwanted appreciation. Reflecting a slower-than-expected upswing in the country's trade and hospitality industries, the SNB now expects GDP to grow 3.0 percent this year, down from the previous 3.5 percent call though total output is still seen reclaiming its pre-pandemic level later in 2021. Production capacity is expected to remain underutilized for some time yet. And though the near-term inflation forecast has been revised up slightly, levels of 0.7 percent in 2022 and 0.6 percent in 2023 remain very subdued. In sum, with inflation too weak and the franc uncomfortably strong, SNB policy looks to remain on hold for some time to come. Recent FX interventions suggest that EUR/CHF1.07 is now the pain threshold for the central bank and, if needed, further aggressive sales of the local currency are to be expected in the event of any major break below this level. Policy led the week's news including no-change decisions from the Bank of England and also the Swiss National Bank where the policy rate, as it has for the last seven years, was once again pegged at minus 0.75 percent. The SNB continued to describe the Swiss franc as "highly valued" and predictably reiterated its willingness to intervene as and when necessary to prevent any unwanted appreciation. Reflecting a slower-than-expected upswing in the country's trade and hospitality industries, the SNB now expects GDP to grow 3.0 percent this year, down from the previous 3.5 percent call though total output is still seen reclaiming its pre-pandemic level later in 2021. Production capacity is expected to remain underutilized for some time yet. And though the near-term inflation forecast has been revised up slightly, levels of 0.7 percent in 2022 and 0.6 percent in 2023 remain very subdued. In sum, with inflation too weak and the franc uncomfortably strong, SNB policy looks to remain on hold for some time to come. Recent FX interventions suggest that EUR/CHF1.07 is now the pain threshold for the central bank and, if needed, further aggressive sales of the local currency are to be expected in the event of any major break below this level.

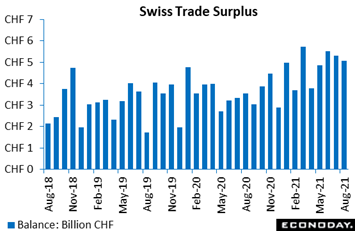

Clouding the SNB's "highly valued" contention for the franc is the ongoing buoyancy of Swiss exports. The merchandise trade balance came in at a CHF5.06 billion surplus in August following an even larger CHF5.30 surplus in July. August's surplus was up from CHF3.54 billion in the same month in 2020 and reflected a 20.3 percent yearly jump in exports against a 14.3 percent rise for imports. On a monthly basis, exports rose 2.1 percent to likewise eclipse a 1.2 percent advance on the import side. Exports now stand 12.0 percent above their pre-pandemic level in February 2020, in strong favorable contrast to imports which are down 1.0 percent. Net merchandise exports are on course to make a small positive contribution to third-quarter GDP growth. Clouding the SNB's "highly valued" contention for the franc is the ongoing buoyancy of Swiss exports. The merchandise trade balance came in at a CHF5.06 billion surplus in August following an even larger CHF5.30 surplus in July. August's surplus was up from CHF3.54 billion in the same month in 2020 and reflected a 20.3 percent yearly jump in exports against a 14.3 percent rise for imports. On a monthly basis, exports rose 2.1 percent to likewise eclipse a 1.2 percent advance on the import side. Exports now stand 12.0 percent above their pre-pandemic level in February 2020, in strong favorable contrast to imports which are down 1.0 percent. Net merchandise exports are on course to make a small positive contribution to third-quarter GDP growth.

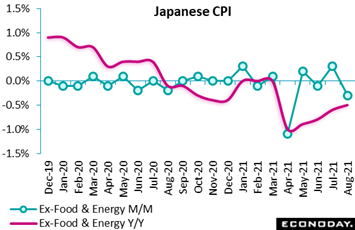

The Bank of Japan also met in the week and, like the others, held policy steady, vowing to stick to its zero-to-negative rate policy "as long as necessary" to achieve its 2 percent inflation target. Japan's underlying inflation rate (excluding fresh food and energy) remained below zero for the fifth straight month, at minus 0.5 percent which, however, was 1 tenth better than July to extend an improving trend. Not improving, however, was the monthly rate which fell 0.3 percent. This narrow measure is not receiving support from the recent pickup in energy markets. The total CPI dipped 0.4 percent in August, showing the 11th consecutive year-over-year slip after falling 0.3 percent in July. Fresh food prices (lettuce, etc.) were down 8.8 percent on the year after falling 4.2 percent the previous month. Japanese policymakers are trying to downplay what they see as the temporary downside effects of large-scale communications discounts and downward CPI revisions tied to a routine statistical update that takes place every five years. Last month, the government said in the monthly economic report that consumer prices had turned firmer when one-off factors were excluded, such as sharply lower mobile communication fees introduced in April. The government, in fact, changed its assessment on consumer prices to "firm" from "flat," effectively upgrading the view for the first time in 17 months. The Bank of Japan also met in the week and, like the others, held policy steady, vowing to stick to its zero-to-negative rate policy "as long as necessary" to achieve its 2 percent inflation target. Japan's underlying inflation rate (excluding fresh food and energy) remained below zero for the fifth straight month, at minus 0.5 percent which, however, was 1 tenth better than July to extend an improving trend. Not improving, however, was the monthly rate which fell 0.3 percent. This narrow measure is not receiving support from the recent pickup in energy markets. The total CPI dipped 0.4 percent in August, showing the 11th consecutive year-over-year slip after falling 0.3 percent in July. Fresh food prices (lettuce, etc.) were down 8.8 percent on the year after falling 4.2 percent the previous month. Japanese policymakers are trying to downplay what they see as the temporary downside effects of large-scale communications discounts and downward CPI revisions tied to a routine statistical update that takes place every five years. Last month, the government said in the monthly economic report that consumer prices had turned firmer when one-off factors were excluded, such as sharply lower mobile communication fees introduced in April. The government, in fact, changed its assessment on consumer prices to "firm" from "flat," effectively upgrading the view for the first time in 17 months.

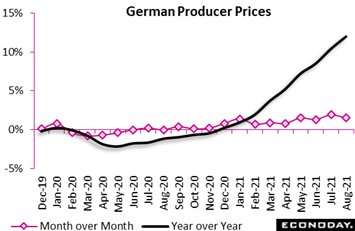

It's hard to get much of an inflation scare from consumer prices in Japan, but it's easy to get a scare looking at producer prices in Germany where a monthly 1.5 percent rise in August was almost double expectations and the fourth month in a row over one percent. August's advance lifted the annual rate from 10.4 percent to 12.0 percent, its highest reading since December 1974. In line with the pattern seen over much of the year so far, energy (up 3.3 percent) continued to record the steepest monthly gain but intermediates (up 1.4 percent) were also again very elevated. There were fresh rises as well for consumer durables and non-durables as well as capital goods. Simply put: pipeline inflation pressures in German manufacturing remain as intense as ever. In fact, the yearly core rate, at 8.3 percent like the total rate, has now increased a remarkable 11.8 percentage points since the end of 2020 as global supply chain issues continue to bite. It's inflation results like these that have been skewing Econoday's consensus divergence indexes higher. It's hard to get much of an inflation scare from consumer prices in Japan, but it's easy to get a scare looking at producer prices in Germany where a monthly 1.5 percent rise in August was almost double expectations and the fourth month in a row over one percent. August's advance lifted the annual rate from 10.4 percent to 12.0 percent, its highest reading since December 1974. In line with the pattern seen over much of the year so far, energy (up 3.3 percent) continued to record the steepest monthly gain but intermediates (up 1.4 percent) were also again very elevated. There were fresh rises as well for consumer durables and non-durables as well as capital goods. Simply put: pipeline inflation pressures in German manufacturing remain as intense as ever. In fact, the yearly core rate, at 8.3 percent like the total rate, has now increased a remarkable 11.8 percentage points since the end of 2020 as global supply chain issues continue to bite. It's inflation results like these that have been skewing Econoday's consensus divergence indexes higher.

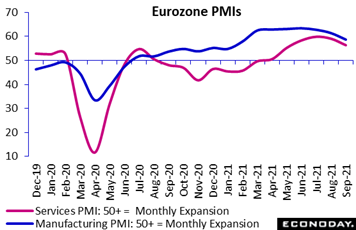

Pulling down the divergence readings in the latest week were September's run of flash PMIs where moderation was more moderate than expected. Both the manufacturing and services PMIs slowed in the US as they did in the Eurozone, dropping nearly 3 points to 58.7 for manufacturing and an 8-month low, and nearly 3 points to 56.3 for services. Aggregate demand in the Eurozone's samples posted the smallest increase since April with reduced growth rates reported in both the domestic and overseas markets. Production remained severely hampered by disruptions to global supply chains, in turn pushing backlogs sharply higher. Supplier delivery times in manufacturing lengthened again and were well beyond anything seen prior to the pandemic. Robust employment growth remained a strong positive in contrast to business confidence which, reflecting Covid worries, declined for a third successive month and to its weakest level since January. Inputs costs are near record highs as is acceleration in selling prices. Regionally in terms of composite output, growth in both France (55.1 after 55.9) and Germany (55.3 after 60.0) cooled, the latter significantly. Elsewhere, the slowdown was less acute but growth was still the slowest since April. In sum, September's preliminary findings point to a clear loss of economic momentum and may prompt some downward forecast revisions for third-quarter Eurozone growth. If central banks do begin to wind down stimulus, overheating in the real economy won't be the cause. Pulling down the divergence readings in the latest week were September's run of flash PMIs where moderation was more moderate than expected. Both the manufacturing and services PMIs slowed in the US as they did in the Eurozone, dropping nearly 3 points to 58.7 for manufacturing and an 8-month low, and nearly 3 points to 56.3 for services. Aggregate demand in the Eurozone's samples posted the smallest increase since April with reduced growth rates reported in both the domestic and overseas markets. Production remained severely hampered by disruptions to global supply chains, in turn pushing backlogs sharply higher. Supplier delivery times in manufacturing lengthened again and were well beyond anything seen prior to the pandemic. Robust employment growth remained a strong positive in contrast to business confidence which, reflecting Covid worries, declined for a third successive month and to its weakest level since January. Inputs costs are near record highs as is acceleration in selling prices. Regionally in terms of composite output, growth in both France (55.1 after 55.9) and Germany (55.3 after 60.0) cooled, the latter significantly. Elsewhere, the slowdown was less acute but growth was still the slowest since April. In sum, September's preliminary findings point to a clear loss of economic momentum and may prompt some downward forecast revisions for third-quarter Eurozone growth. If central banks do begin to wind down stimulus, overheating in the real economy won't be the cause.

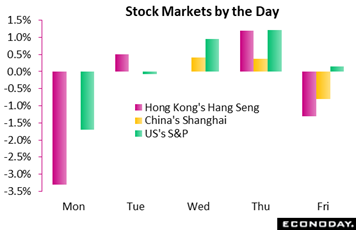

Markets ended on Friday where they started on Monday: feeling vulnerable and uncertain over China's Evergrande. The Hang Seng dropped 3.3 percent on Monday with property and bank stocks hit hardest after the heavily indebted property developer signaled to its creditors that it would not be able to make pending payments. Reports were mixed through the week how the Chinese government would react and whether the company has or hasn't reached any agreements. Less mixed was the policy message from the Federal Reserve which on Wednesday pretty much assured everybody, as long as the September employment report is "decent", that it will begin tapering in November. The Hang Seng was down 2.9 percent on the week, the Shanghai composite unchanged, and the S&P up 0.5 percent. Markets ended on Friday where they started on Monday: feeling vulnerable and uncertain over China's Evergrande. The Hang Seng dropped 3.3 percent on Monday with property and bank stocks hit hardest after the heavily indebted property developer signaled to its creditors that it would not be able to make pending payments. Reports were mixed through the week how the Chinese government would react and whether the company has or hasn't reached any agreements. Less mixed was the policy message from the Federal Reserve which on Wednesday pretty much assured everybody, as long as the September employment report is "decent", that it will begin tapering in November. The Hang Seng was down 2.9 percent on the week, the Shanghai composite unchanged, and the S&P up 0.5 percent.

Econoday's consensus divergence index, however skewed by high inflation results, are clumping toward the zero line to indicate that results, on net, are hitting expectations. The results underscore the ongoing economics theme: marking up forecasts on inflation and trimming forecasts for growth. Looking at country data, US forecasters have been hitting the mark so far this month with the US score at 3. Switzerland's score is also at 3. Italy's divergence index is at 14, indicating a mild degree of outperformance but again biased up by high prices. France's index is right at zero with German data and Eurozone data only slightly in negative surprise territory, both at minus 7. The UK is the outlier, but at a comparatively light reading of minus 18 to indicate that economic activity here is lagging expectations, but again only modestly.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Mixed to favorable German data is expected for the coming week with softness expected for GfK consumer confidence on Tuesday, only a little heat for consumer prices on Thursday, steady strength in employment also on Thursday, and lastly a bounce is expected for retail sales on Friday. For the Eurozone, steady heat is expected for September's inflation data on Friday, preceded by easing economic sentiment on Wednesday and expected slowing in M3 money growth on Monday. US durable goods are expected to show modest improvement on Monday with even more modest improvement (nearly none at all) for US consumer confidence on Tuesday. PCE price indicators on Friday, where mixed is the expectation, will be the highlight of the US calendar followed by an ISM manufacturing report that is expected to remain around the very solid 60 line. Japanese data are expected to come in flat, both industrial production on Thursday and the quarterly Tankan report on Friday. Chinese data will be headlined by the Caixan manufacturing PMI which is not expected to emerge back above breakeven 50. Continued weakness is expected for both Swiss leading indicators on Thursday and monthly GDP from Canada on Friday.

Eurozone M3 Money Supply (Mon 08:00 GMT; Mon 10:00 CEST; Tue 04:00 EDT)

Consensus Forecast, Year-over-Year: 7.8%

Broad money growth, where annual figures have been slowing and masking stable monthly rates, is expected to rise to an annual rate of 7.8 percent in August from 7.6 percent in July.

US Durable Goods Orders for August (Mon 12:30 GMT; Mon 08:30 EDT)

Consensus Forecast: Month over Month: 0.6%

Consensus Forecast: Ex-Transportation - M/M: 0.4%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.2%

Durable goods orders flattened out in July reflecting weakness in transportation. A headline rebound of 0.6 percent is expected for August, a moderate-to-solid 0.4 percent gain excluding transportation, but a soft 0.2 percent rise for core capital goods.

Germany: GfK Consumer Climate for October (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast: -2.0

GfK's index for the October outlook is expected to fall 8 tenths to minus 2.0 which, for a second straight month, was on the weak side of expectations and still well below normal levels.

US International Trade in Goods (Advance) for August (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Balance: -$87.0 billion

The US goods deficit (Census basis) is expected to widen to $87.0 billion in August after narrowing by a sharp $5.2 billion in July to $86.8 billion (revised from $86.4 billion).

US Consumer Confidence Index for September (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 114.8

Econoday's consensus for the September consumer confidence index is a rise to 114.8 versus what was a much lower-than-expected 113.8 in August.

Eurozone: EC Economic Sentiment for September (Wed 09:00 GMT; Wed 11:00 CEST; Wed 05:00 EDT)

Consensus Forecast: 116.8

September's consensus for economic sentiment is expected to ease to 116.8 from 117.5 in August, which was solid but a bit lower than expected.

Japanese Industrial Production for August (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Month over Month: -0.5%

Industrial production is expected to rise 0.5 percent on the month in August following a 1.5 percent decline in July.

China: Caixin Manufacturing PMI for September (Thu 01:45 GMT; Thu 09:45 CST; Wed 21:45 EDT)

Consensus Forecast: 49.5

September's Caixan manufacturing PMI is expected to firm slightly but only to 49.5 versus sub-50 contraction of 49.2 in August that was a point below the consensus.

KOF Swiss Leading Indicator for September (Thu 07:00 GMT; Thu 09:00 CEST; Thu 03:00 EDT)

Consensus Forecast: 111.4

After August's 17.4 point plunge to 113.5, which was one of steepest falls on record and the third decline in row, KOF's leading indicator for September is expected to fall further to 111.4.

German Unemployment Rate for September (Thu 07:55 GMT; Thu 09:55 CEST; Thu 03:55 EDT)

Consensus Forecast: 5.5%

Germany's unemployment rate, which has been moving steadily lower, is expected to hold steady in September at 5.5 percent.

Eurozone Unemployment Rate for August (Thu 09:00 GMT; Thu 11:00 CEST; Thu 05:00 EDT)

Consensus Forecast: 7.5%

Trending down all year, the Eurozone' s unemployment rate is expected to decline 1 tenth to 7.5 percent in August.

German CPI, Preliminary for September (Thu 12:00 GMT; Thu 14:00 CEST; Thu 08:00 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 4.0%

Consumer inflation has been highly elevated, at 3.9 percent in August with 4.0 percent the expectation for September. The monthly rate, following no change in August, is seen increasing a moderate 0.2 percent.

Japanese Tankan for Third Quarter (Thu 23:50 GMT; Fri 08:50 JST; Thu 19:50 EDT)

Consensus Forecast, Large Manufacturers: 13

Forecasters see the index for large manufacturers slipping a point to 13.

German Retail Sales for August (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 1.5%

After swinging steeply higher in June (up 4.2 percent) and then steeply lower in July (down 5.1 percent), retail sales in August are expected to rebound a monthly 1.5 percent.

Eurozone HICP Flash for September (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast, Year over Year: 3.3%

Underlying Core

Consensus Forecast, Year over Year: 1.8%

The flash annual rate is seen rising 3 tenths in September to 3.3 percent; the underlying core rate is expected to rise 2 tenths to 1.8 percent.

US Personal Income for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 0.3%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.6%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 3.6%

Personal income, which surged an unexpected 1.1 percent in July, is expected to slow to a gain of 0.3 percent in August. Monthly inflation rates are expected to slow with annual rates seen steady at elevated levels.

Canadian GDP for July (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: -0.3%

GDP for July is expected to fall 0.3 percent on the month versus a 0.7 percent rise in June, a result that was much stronger than expected.

US: ISM Manufacturing Index for September (Fri 14:00 GMT; Fri 10:00 EDT)

Consensus Forecast: 59.8

Led by new orders, ISM manufacturing has been tracking at the very strong 60 line with 59.8 the expectation for September.

|