|

Just about the only data that are beating expectations nowadays are inflation reports, not good news for those who believe in the transitory hypothesis. As the Federal Reserve ponders what to do about tapering, the latest employment report isn't likely to put the central bank in much of a rush to taper, especially with the level of US unemployed at 8.4 million, far more than the February 2020 pre-pandemic level of 5.7 million. US employment was the second of the week's one-two punch, the first delivered by China which is where we'll start.

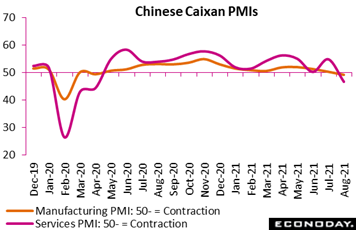

PMIs from China have been skirting the 50-line the past several months with the bulk of them in August dipping below the breakeven barrier. Covid outbreaks in parts of China in recent weeks have disrupted activity in many industries, pulling down Caixan's manufacturing PMI from 50.3 in July to 49.2 in August, its lowest level in 18 months and indicating contraction for the sector for the first time since April last year. And for the first time since February last year, new orders fell for a second consecutive month while new export orders fell for the first time since February this year. Respondents reported a fall in payrolls, while the survey's measure of business confidence was steady but subdued. Price pressures picked up in the month, both input costs and selling prices. PMIs from China have been skirting the 50-line the past several months with the bulk of them in August dipping below the breakeven barrier. Covid outbreaks in parts of China in recent weeks have disrupted activity in many industries, pulling down Caixan's manufacturing PMI from 50.3 in July to 49.2 in August, its lowest level in 18 months and indicating contraction for the sector for the first time since April last year. And for the first time since February last year, new orders fell for a second consecutive month while new export orders fell for the first time since February this year. Respondents reported a fall in payrolls, while the survey's measure of business confidence was steady but subdued. Price pressures picked up in the month, both input costs and selling prices.

Caixan's services PMI fell more dramatically, from 54.9 in July to 47.2 in August, for its lowest level in 17 months. Disappointments included contraction in output and new orders, another month of stagnation for new export orders, and the second reduction in payrolls in the last three months. Business sentiment also fell in August as profit margins tightened, with respondents reporting a small increase in input costs but an outright reduction in selling prices. These results, which were broadly mirrored by official CFLP data also released during week, follow a run of disappointments and pulled Econoday's consensus divergence index for the country into deeply negative territory at minus 71, a level indicating that forecasters are far over-estimating the strength of the country's economic data. We'll cover more on this in the bottom line.

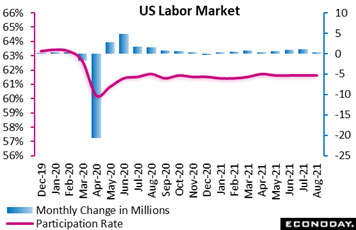

US employment provided the week's follow-up punch. Nonfarm payrolls rose just 235,000 in August, roughly 1/3 of Econoday's 740,000 consensus and well below the low estimate of 377,000. And once again there wasn't any progress on the participation front, unchanged at 61.7 percent and stuck in a tight 3-tenths range since June last year. Participation was at 63.3 percent before the pandemic broke out and however much FOMC hawks are squaking, victory for the labor market can't be declared until the millions of workers who've dropped out return in something resembling a more convincing number. US employment provided the week's follow-up punch. Nonfarm payrolls rose just 235,000 in August, roughly 1/3 of Econoday's 740,000 consensus and well below the low estimate of 377,000. And once again there wasn't any progress on the participation front, unchanged at 61.7 percent and stuck in a tight 3-tenths range since June last year. Participation was at 63.3 percent before the pandemic broke out and however much FOMC hawks are squaking, victory for the labor market can't be declared until the millions of workers who've dropped out return in something resembling a more convincing number.

The shortage of candidates to choose from now appears to be driving up wages at an accelerating rate, up 0.6 percent on the month for average hourly earnings which was twice Econoday's consensus. On a 12-month basis, wages were up 4.3 percent in August, more than the 3.9 percent expected and the 4.1 percent gain recorded in July.

Services led the payroll slowdown, rising 203,000 in the month which, though sizable, was down more than 70 percent on the month. The retail sector was mostly to blame with 28,500 jobs lost on the back of an 8,000 decrease in July. Retail trade employment is down 285,000 since February 2020. Feeling the impact of the Delta variant spread, the summer streak of gains came to a halt in the leisure and hospitality sector, which did not add any jobs in August after a solid cumulative increase of 812,000 in June and July.

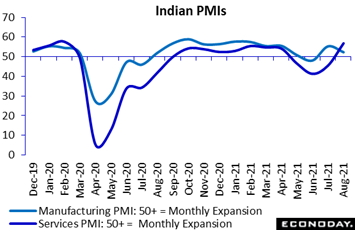

This pandemic has had long legs, swelling and easing and swelling again; but when it eases, the economic benefits are tangible. India is this week's example. The country's PMI composite surged more than 6 points in August, indicating that the economy rebounded strongly after three consecutive months of contraction as public health conditions continued to improve. Although the manufacturing PMI showed weaker growth, slowing from 55.3 in July to 52.3 in August, this was outweighed by a sharp improvement in the services sector. This index increased from 45.4 in July to 56.7 in August, indicating that the sector grew for the first time since April and at the fastest pace since the onset of the pandemic. Respondents to the services survey reported renewed growth in new orders, despite another drop in new export orders, and a smaller reduction in payrolls. The survey's measure of business sentiment improved to a five-month high. This pandemic has had long legs, swelling and easing and swelling again; but when it eases, the economic benefits are tangible. India is this week's example. The country's PMI composite surged more than 6 points in August, indicating that the economy rebounded strongly after three consecutive months of contraction as public health conditions continued to improve. Although the manufacturing PMI showed weaker growth, slowing from 55.3 in July to 52.3 in August, this was outweighed by a sharp improvement in the services sector. This index increased from 45.4 in July to 56.7 in August, indicating that the sector grew for the first time since April and at the fastest pace since the onset of the pandemic. Respondents to the services survey reported renewed growth in new orders, despite another drop in new export orders, and a smaller reduction in payrolls. The survey's measure of business sentiment improved to a five-month high.

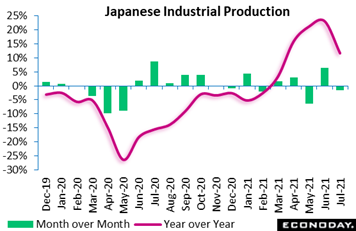

Japan's PMIs in August fell steeply with services at a deeply contractionary level of 42.9 as the country continues to struggle, at least for now, with emergency restricitons that are covering 80 percent of the population. July was also a rough month for Japan including industrial production which fell 1.5 percent compared to June to trim year-over-year growth nearly in half to 11.6 percent. The index, at 98.1, is well above its bottom of 77.2 in May last year but is 1 point short of where it was before the pandemic hit. July saw a decline in the production of passenger cars, lithium-ion batteries and chemicals, offsetting increases for chip-making equipment, pulp and paper products, and for electronics. Japan's auto industry has been hit by lingering global chip shortages and the pandemic's impact on Asian supply-chain networks. Japan's Ministry of Economy, Trade and Industry, in echos of rising vaccination hopes in the PMI reports, remains upbeat, forecasting a 3.4 percent monthly rebound in August and saying production "remains on a recovery track". Japan's PMIs in August fell steeply with services at a deeply contractionary level of 42.9 as the country continues to struggle, at least for now, with emergency restricitons that are covering 80 percent of the population. July was also a rough month for Japan including industrial production which fell 1.5 percent compared to June to trim year-over-year growth nearly in half to 11.6 percent. The index, at 98.1, is well above its bottom of 77.2 in May last year but is 1 point short of where it was before the pandemic hit. July saw a decline in the production of passenger cars, lithium-ion batteries and chemicals, offsetting increases for chip-making equipment, pulp and paper products, and for electronics. Japan's auto industry has been hit by lingering global chip shortages and the pandemic's impact on Asian supply-chain networks. Japan's Ministry of Economy, Trade and Industry, in echos of rising vaccination hopes in the PMI reports, remains upbeat, forecasting a 3.4 percent monthly rebound in August and saying production "remains on a recovery track".

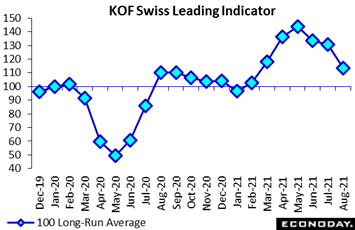

Much of Europe's data have been falling short of expectations including for Swizterland which had been beating forecasts by a wide margin earlier in the year. The KOF's leading indicator, at 113.5, fell for a third straight month in August, down 17.4 points from July for one of its steepest declines on record and more than 11 points short of expectations. While still well above its 100 long-run average, the decline since May's near-144 peak has been sharp and points to a marked slowdown in economic growth over coming months. With the exception of construction, all major sectors posted weaker performances in August. Other Swiss data in the week included a very weak retail sales for July and increasing but still limited pressure for consumer prices. Much of Europe's data have been falling short of expectations including for Swizterland which had been beating forecasts by a wide margin earlier in the year. The KOF's leading indicator, at 113.5, fell for a third straight month in August, down 17.4 points from July for one of its steepest declines on record and more than 11 points short of expectations. While still well above its 100 long-run average, the decline since May's near-144 peak has been sharp and points to a marked slowdown in economic growth over coming months. With the exception of construction, all major sectors posted weaker performances in August. Other Swiss data in the week included a very weak retail sales for July and increasing but still limited pressure for consumer prices.

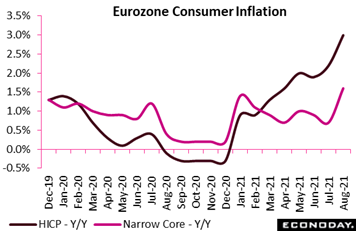

Inflation and how transitory it proves to be is one of the great dramas playing out in the global economy. Many graphs just keep on going up including harmonised consumer prices in Europe. The headline HICP index rose 0.4 percent on the month in August, pushing the annual inflation rate up from July's 2.2 percent to 3.0 percent, 2 tenths above the consensus and a level not seen in the last 10 years. This is well above the European Central Bank's two percent target and no doubt is testing the patience of the monetary hawks. Stronger price pressures were broad-based across most countries in the Eurozone and also across major categories. Prices of food, alcohol and tobacco rose 2.0 percent on the year in August, up from 1.6 percent in July, while the year-over-year increase in energy prices accelerated from 14.3 percent to 15.4 percent. Prices of non-energy industrial goods rose 2.7 percent on the year, up sharply form 0.7 percent previously, while prices of services rose 1.1 percent on the year, up from 0.9 percent. Narrower measures of HICP inflation also picked up in August including the narrow core, which excludes energy, food, alcohol and tobacco, and which rose 0.3 percent on the month, pushing this rate up from 0.7 percent in July to 1.6 percent in August, which was 3 tenths over the consensus. Inflation and how transitory it proves to be is one of the great dramas playing out in the global economy. Many graphs just keep on going up including harmonised consumer prices in Europe. The headline HICP index rose 0.4 percent on the month in August, pushing the annual inflation rate up from July's 2.2 percent to 3.0 percent, 2 tenths above the consensus and a level not seen in the last 10 years. This is well above the European Central Bank's two percent target and no doubt is testing the patience of the monetary hawks. Stronger price pressures were broad-based across most countries in the Eurozone and also across major categories. Prices of food, alcohol and tobacco rose 2.0 percent on the year in August, up from 1.6 percent in July, while the year-over-year increase in energy prices accelerated from 14.3 percent to 15.4 percent. Prices of non-energy industrial goods rose 2.7 percent on the year, up sharply form 0.7 percent previously, while prices of services rose 1.1 percent on the year, up from 0.9 percent. Narrower measures of HICP inflation also picked up in August including the narrow core, which excludes energy, food, alcohol and tobacco, and which rose 0.3 percent on the month, pushing this rate up from 0.7 percent in July to 1.6 percent in August, which was 3 tenths over the consensus.

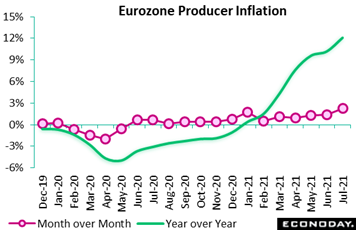

And as consumer prices aren't showing any let up, neither are pipeline inflationary pressures. Eurozone producer prices continued to rise during July. A 2.3 percent monthly advance was nearly double the consensus and large enough to raise the annual inflation rate from June's 10.2 percent to 12.1 percent. Energy, up 5.7 percent on the month, continued to lead the way but even excluding this category, prices were up a full 1.0 percent and now stand 6.7 percent higher on the year. This was 1.1 percentage points higher than the June rate. Intermediates climbed a monthly 1.9 percent, durable consumer goods 0.7 percent, and capital goods 0.5 percent. Regionally, prices were higher on the month in all the reporting member states. Among the largest four, the PPI in France advanced 1.3 percent, in Germany 1.9 percent, in Italy 2.5 percent and in Spain 1.8 percent. Taking a look at the US, producer prices have exceeded Econoday's high estimate in each of the last five reports (August data to be released in the coming week). And as consumer prices aren't showing any let up, neither are pipeline inflationary pressures. Eurozone producer prices continued to rise during July. A 2.3 percent monthly advance was nearly double the consensus and large enough to raise the annual inflation rate from June's 10.2 percent to 12.1 percent. Energy, up 5.7 percent on the month, continued to lead the way but even excluding this category, prices were up a full 1.0 percent and now stand 6.7 percent higher on the year. This was 1.1 percentage points higher than the June rate. Intermediates climbed a monthly 1.9 percent, durable consumer goods 0.7 percent, and capital goods 0.5 percent. Regionally, prices were higher on the month in all the reporting member states. Among the largest four, the PPI in France advanced 1.3 percent, in Germany 1.9 percent, in Italy 2.5 percent and in Spain 1.8 percent. Taking a look at the US, producer prices have exceeded Econoday's high estimate in each of the last five reports (August data to be released in the coming week).

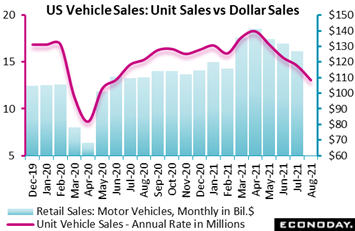

And the US is where we'll end the week's data rundown. Whether or not the next retail sales report (to be released at mid-month) beats expectations, it will probably be against subdued expectations based at least on unit vehicle sales. August sales fell an unexpected 11.5 percent in the month to an annual rate of 13.1 million. This was the fourth decline in a row (and all steep declines) and puts this measurement of sales at its lowest level since the pandemic crush of June last year. Though unit sales are an undifferentiated blend of consumer sales (the largest part) and business sales (the smaller part), these results will have forecasters marking down their estimates for the August retail sales report. What's especially curious about these results is that US manufacturing data for July showed a seasonally elevated rate of auto output and shipments at the same time that trade data for the month showed a boost in auto imports; yet none of this helped auto sales during August. And the US is where we'll end the week's data rundown. Whether or not the next retail sales report (to be released at mid-month) beats expectations, it will probably be against subdued expectations based at least on unit vehicle sales. August sales fell an unexpected 11.5 percent in the month to an annual rate of 13.1 million. This was the fourth decline in a row (and all steep declines) and puts this measurement of sales at its lowest level since the pandemic crush of June last year. Though unit sales are an undifferentiated blend of consumer sales (the largest part) and business sales (the smaller part), these results will have forecasters marking down their estimates for the August retail sales report. What's especially curious about these results is that US manufacturing data for July showed a seasonally elevated rate of auto output and shipments at the same time that trade data for the month showed a boost in auto imports; yet none of this helped auto sales during August.

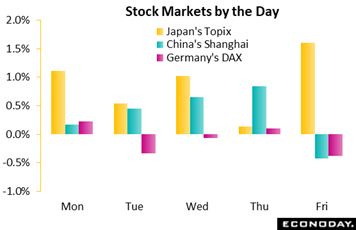

Japan started its stellar week on Monday, benefitting from Friday gains on Wall Street that helped lift the Topix 1.1 percent. And it was not so much current data that helped Japanese stocks in the week but expectations for future data, whether the official METI forecast for a coming jump in industrial production or the upbeat outlooks in the PMIs. China had a less positive week, held back by regional Covid news, negative regulatory headlines, not to mention the unexpected PMI declines. Central-bank chatter was led by Governor Robert Holzmann from Austria, a noted hawk who, ahead of the coming week's policy meeting, said the ECB should start discussing phasing out its PEPP emergency asset purchase program. Echoes were heard from ECB Vice President Luis de Guindos who said the Eurozone recovery has picked up steam and policymakers will be obliged to discuss the size of fourth-quarter asset purchases. The best news for the markets, at least for Japan, came on Friday when Prime Minister Yoshihide Suga said he would resign, raising expectations that the ruling coalition will win a general election to be held later this year. No major moves were triggered by Friday's US jobs report, as weak payroll growth was offset by strong wage growth in what is a dead heat when it comes to monetary policy. Japan started its stellar week on Monday, benefitting from Friday gains on Wall Street that helped lift the Topix 1.1 percent. And it was not so much current data that helped Japanese stocks in the week but expectations for future data, whether the official METI forecast for a coming jump in industrial production or the upbeat outlooks in the PMIs. China had a less positive week, held back by regional Covid news, negative regulatory headlines, not to mention the unexpected PMI declines. Central-bank chatter was led by Governor Robert Holzmann from Austria, a noted hawk who, ahead of the coming week's policy meeting, said the ECB should start discussing phasing out its PEPP emergency asset purchase program. Echoes were heard from ECB Vice President Luis de Guindos who said the Eurozone recovery has picked up steam and policymakers will be obliged to discuss the size of fourth-quarter asset purchases. The best news for the markets, at least for Japan, came on Friday when Prime Minister Yoshihide Suga said he would resign, raising expectations that the ruling coalition will win a general election to be held later this year. No major moves were triggered by Friday's US jobs report, as weak payroll growth was offset by strong wage growth in what is a dead heat when it comes to monetary policy.

Econoday's consensus divergence indexes measure the separation between expected results and actual results. And the indications for China are very clear, at a massively negative minus 71 that fairly raises the question whether forecasts for this economy will begin to be trimmed back. Germany, pulled down by a weak retail sales report for July, is also deeply in the negative column, at minus 36 in what, like China, is easily its weakest reading so far this year. The UK is at minus 11, the Eurozone at minus 9, and Switzerland near the spot-on zero line at minus 3. Those in the positive column include Canada at 12 and also the US at 16 in a reading that got a lift from what is a fundamental negative for monetary policy: the jump in average hourly earnings. France is at 19 with Italy, getting its own lift from consumer price pressures, once again at the top at 45.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Chinese data headlined the August 30 week and they look to headline the September 6 week as well, opening with merchandise trade on Monday followed on Thursday by updates on both consumer and producer prices. Steady readings are the expectation. Central bank announcements also headline the week: the Reserve Bank of Australia on Tuesday, the Bank of Canada on Wednesday, and the European Central Bank of Thursday. No action is expected. A run of German data will precede the ECB announcement led by manufacturers' orders on Monday and industrial production on Tuesday, both of which were disappointments in their last updates, and ZEW sentiment on Tuesday which has been mixed. Industrial production reports from France and Italy will be posted on Friday as will industrial production from UK as well as July GDP from the UK. Other reports to watch will be Swiss unemployment on Tuesday, which has been rock solid, and producer prices from the US on Friday which have been taking off.

Chinese Merchandise Trade Balance for August (Estimated for Monday local time, release time not set)

Consensus Forecast: US$ 53.30 billion

Consensus Forecast: Imports - Y/Y: 25.0%

Consensus Forecast: Exports - Y/Y: 19.5%

The trade surplus in August is seen at US$53.30 billion versus July's greater-than-expected surplus of $56.58 billion. June's surplus, at $51.53 billion, was also greater than expected.

German Manufacturers' Orders for July (Mon 06:00 GMT; Mon 08:00 CEST; Mon 02:00 EDT)

Consensus Forecast, Month over Month: -1.0%

Consensus Forecast, Year over Year: 18.9%

Manufacturers' orders swung 3.2 percent lower in May then swung 4.1 percent higher in June with July seen at a less volatile decrease of 1.0 percent.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEST; Tue 00:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

The Reserve Bank of Australia is not expected to change its policy rate of 0.10 percent. At its August meeting, the RBA continued to judge that Australia's economic recovery, though stronger than expected, had been disrupted by Covid outbreaks and tight public health restrictions.

Swiss Unemployment Rate for August (Tue 05:45 GMT; Tue 07:45 CEST; Tue 01:45 EDT)

Consensus Forecast, Adjusted: 3.0%

The adjusted unemployment rate is expected to hold steady at a favorable 3.0 percent in August.

German Industrial Production for July (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast, Month over Month: 0.7%

A 0.7 percent increase is expected for industrial production in July after falling 1.3 percent in June. This report has both contracted and missed expectations the last three reports.

Germany: ZEW Survey for August (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Current Conditions: 33.0

Consensus Forecast, Economic Sentiment: 30.0

In August's report, analysts were more positive about current conditions but less positive about the outlook. More of the same is expected for September where the consensus for the former is a nearly 4-point gain to 33.0 and a nearly 10-point fall to 30.0 for the latter.

Bank of Canada Announcement (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Bank of Canada is expected to hold rates steady at plus 0.25 percent but whether it once again extends its tapering efforts, or passes until the October meeting, is uncertain.

Chinese CPI for August (Thu 01:30 GMT; Thu 09:30 CST; Wed 21:30 EDT)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 1.0%

Consumer prices, rising at a 1.0 percent annual rate in July, have missed expectations the last four reports. August's consensus is for 1.0 percent. The monthly call is a gain of 0.5 percent versus July's 0.3 percent rise.

Chinese PPI for August (Thu 01:30 GMT; Thu 09:30 CST; Wed 21:30 EDT)

Consensus Forecast, Year over Year: 9.0%

Producer prices are expected to have climbed at a 9.0 percent annual rate in August which would match July's rate.

European Central Bank Announcement (Thu 11:45 GMT; Thu 13:45 CEST; Thu 07:45 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

The European Central Bank has been perhaps the most dovish of any central bank, underscored by its recent adoption of a flexible inflation target. No immediate changes in rates or QE are expected but adjustments to guidance on future tapering, given hawkish chatter from ECB members, is possible.

UK Industrial Production for July (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 0.4%

Falling short of expectations in each of the last four reports and after having contracted 0.7 percent in June, industrial production is expected to rebound a monthly 0.4 percent in July.

UK GDP for July (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 0.7%

GDP in the month of July is expected to rise 0.7 percent following a promising 1.0 percent rise in June.

French Industrial Production for July (Fri 06:45 GMT; Fri 08:45 CEST; Fri 02:45 EDT)

Consensus Forecast, Month over Month: 0.4%

Industrial production in July is expected to rise a monthly 0.4 percent following June's as-expected 0.5 percent increase.

Italian Industrial Production for July (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Month over Month: 0.2%

Industrial production in July is expected to ease to a 0.2 percent increase after hitting expectations in June at a strong 1.0 percent monthly gain.

Canadian Labour Force Survey for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 65,000

Though July's 94,000 rise in employment was short of expectations, it followed an outsized 230,700 surge in June. August's expectations are a rise of 65,000.

US PPI-FD for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 8.3%

US PPI-FD, Less Food & Energy

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 6.6%

Producer prices have exceeded Econoday's high estimates in each of the last five reports. Following 1.0 percent monthly increases for both the overall and ex-food and ex-energy rates in July, August's expectations are increases of 0.6 and 0.5 percent respectively. Respective annual rates are seen at 8.3 and 6.6 percent.

|