|

Consumer inflation is swelling and swelling but isn't swelling at an increasing rate, at least based on the latest update from the US. What is mushrooming in size and at an alarming rate is Fedspeak which on net indicates, well we'll let you decide for yourself. The bulk of the week's news comes from confidence surveys which we'll turn to after we look at inflation and also home values, the latter a reminder that runaway prices, provided you're safely locked inside, aren't always a bad thing.

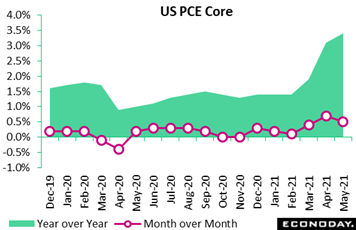

PCE price indexes in the US came in roughly as expected in May, with the overall PCE up 0.4 percent on the month after a 0.6 percent increase in April. The 12-month index rose 3.9 percent, a rate last matched in June 2008. Excluding energy and food, core prices increased 0.5 percent on the month and 3.4 percent from a year ago. The last time the 12-month core was this high was in April 1992, and the last time it was higher was in December 1991, at 3.5 percent. Yearly inflation readings are getting a boost from the comparison to 2020's depressed levels, especially at the beginning of the pandemic. On a monthly basis, price gains accelerated from 0.3 percent in January to 0.6 percent in April making May the first month of slowing since the beginning of the year. In its June policy statement, the Federal Reserve reaffirmed its view that recent pressure on inflation would prove "largely transitory"; Chair Jerome Powell added this week it is "very, very unlikely" that prices will rise at the pace experienced in the 1970s. In separate data released by the University of Michigan, year-ahead inflation expectations at the consumer level ended June at 4.2 percent which is up 2 tenths from mid-month but down 4 tenths from May. Five-year expectations were unchanged from May at a favorable 2.8 percent which, compared to the year-ahead rate, supports the Fed's view. PCE price indexes in the US came in roughly as expected in May, with the overall PCE up 0.4 percent on the month after a 0.6 percent increase in April. The 12-month index rose 3.9 percent, a rate last matched in June 2008. Excluding energy and food, core prices increased 0.5 percent on the month and 3.4 percent from a year ago. The last time the 12-month core was this high was in April 1992, and the last time it was higher was in December 1991, at 3.5 percent. Yearly inflation readings are getting a boost from the comparison to 2020's depressed levels, especially at the beginning of the pandemic. On a monthly basis, price gains accelerated from 0.3 percent in January to 0.6 percent in April making May the first month of slowing since the beginning of the year. In its June policy statement, the Federal Reserve reaffirmed its view that recent pressure on inflation would prove "largely transitory"; Chair Jerome Powell added this week it is "very, very unlikely" that prices will rise at the pace experienced in the 1970s. In separate data released by the University of Michigan, year-ahead inflation expectations at the consumer level ended June at 4.2 percent which is up 2 tenths from mid-month but down 4 tenths from May. Five-year expectations were unchanged from May at a favorable 2.8 percent which, compared to the year-ahead rate, supports the Fed's view.

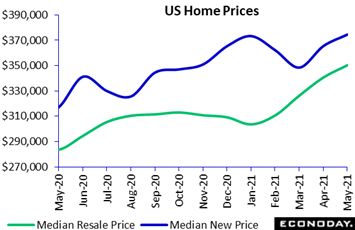

Home prices are one prominent area of inflation that is often missed in the data and which continue to rise despite significant slowing underway in home sales. Existing home sales slid back another 0.9 percent in May to a 5.8 million annualized rate for a fourth straight decline. A factor slowing sales has been exceptionally high prices with the median for a resale in May up 2.8 percent on the month to $350,300. Home prices are one prominent area of inflation that is often missed in the data and which continue to rise despite significant slowing underway in home sales. Existing home sales slid back another 0.9 percent in May to a 5.8 million annualized rate for a fourth straight decline. A factor slowing sales has been exceptionally high prices with the median for a resale in May up 2.8 percent on the month to $350,300.

And much like resales, sales of new homes fell back in May in contrast to prices which continued to rise. New home sales dropped a very steep 5.9 percent in May to 769,000 for the softest annual rate since early on in the pandemic in May last year. Yet the median selling price rose 2.5 percent in the month to $374,400 for an 18.1 percent gain from May last year in a climb that makes the 3-percent handles on the PCE price indexes look trivial. And resales are moving away even faster for first-time buyers, at an annual rise of 23.5 percent. This is arguably making the rich richer and the poor poorer as rising home prices, driven substantially by the Fed's policy of low interest rates and asset purchases, are raising the wealth of homeowners relative to renters. For those out in the cold, buying a home may never have looked so out of reach.

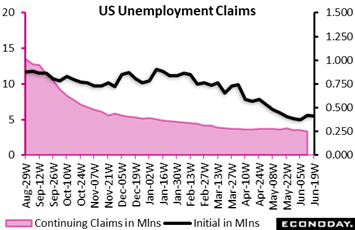

Global employment data were light in the week but did include an ominously unfavorable jobless claims report from the US. Initial claims failed to retrace much of the prior week's reversal, falling only 7,000 to a 411,000 level in the June 19 week that exceeded Econoday's consensus range and was more than 30,000 over the median. In what was a further disappointment, the prior week's gain was revised 7,000 higher to 44,000. The results for the latest week, which directly track the sample week of the monthly employment report, do not point to much acceleration for June payrolls. Econoday's consensus for nonfarm payrolls, the biggest single headline of next week's heavy global calendar, is 675,000 which would compare with 559,000 and 278,000 in May and April and respective expectations for 650,000 and 998,000. Global employment data were light in the week but did include an ominously unfavorable jobless claims report from the US. Initial claims failed to retrace much of the prior week's reversal, falling only 7,000 to a 411,000 level in the June 19 week that exceeded Econoday's consensus range and was more than 30,000 over the median. In what was a further disappointment, the prior week's gain was revised 7,000 higher to 44,000. The results for the latest week, which directly track the sample week of the monthly employment report, do not point to much acceleration for June payrolls. Econoday's consensus for nonfarm payrolls, the biggest single headline of next week's heavy global calendar, is 675,000 which would compare with 559,000 and 278,000 in May and April and respective expectations for 650,000 and 998,000.

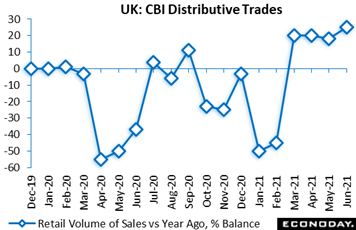

Consumer spending data were also light in the week but there was one report from the UK not to miss. June was a very buoyant month for CBI's distributive trades survey with July expectations even better. At 25 percent, the balance of respondents reporting a yearly rise in June volumes was up 7 percentage points versus May and well above the market consensus. And the forecast for July is 46 percent! Sales for the time of year (23 percent after minus 3 percent) were the strongest since November 2016 and are expected to remain similarly robust next month. Grocers reported sales above seasonal norms, as did furniture and carpets, hardware and do-it-yourself. Sales at department stores were average for the time of year and although clothing stores reported that sales were again below seasonal norms, this was to a much lesser extent than in May. Reflecting this, volumes of stocks across the distribution sector in relation to expected sales (minus 19 percent after minus 6 percent) declined to a record low. CBI's update is consistent with a sharp pick-up underway in consumers spending. Consumer spending data were also light in the week but there was one report from the UK not to miss. June was a very buoyant month for CBI's distributive trades survey with July expectations even better. At 25 percent, the balance of respondents reporting a yearly rise in June volumes was up 7 percentage points versus May and well above the market consensus. And the forecast for July is 46 percent! Sales for the time of year (23 percent after minus 3 percent) were the strongest since November 2016 and are expected to remain similarly robust next month. Grocers reported sales above seasonal norms, as did furniture and carpets, hardware and do-it-yourself. Sales at department stores were average for the time of year and although clothing stores reported that sales were again below seasonal norms, this was to a much lesser extent than in May. Reflecting this, volumes of stocks across the distribution sector in relation to expected sales (minus 19 percent after minus 6 percent) declined to a record low. CBI's update is consistent with a sharp pick-up underway in consumers spending.

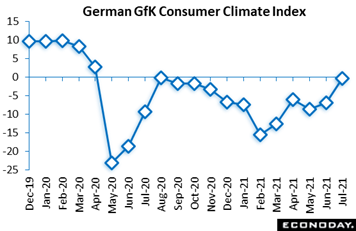

Consumer sentiment data, also used as a gauge for consumer spending, were heavy in the week and included a June GfK survey from Germany that was on the strong side of the market consensus. Following minus 6.9 in June, the provisional reading for July's consumer climate is forecast to rise a surprisingly large 6.6 points to minus 0.3 in July. This would be its strongest reading since last August. Consumer sentiment data, also used as a gauge for consumer spending, were heavy in the week and included a June GfK survey from Germany that was on the strong side of the market consensus. Following minus 6.9 in June, the provisional reading for July's consumer climate is forecast to rise a surprisingly large 6.6 points to minus 0.3 in July. This would be its strongest reading since last August.

All three components posted fresh gains, led by economic expectations. At 58.4, this sub-index was up 17.3 points versus May, its highest outturn in more than a decade and nearly 50 points above its level a year ago. Similarly, income expectations climbed 14.6 points on the month to 34.1, a 27.5 point rise from a year ago and its best print since February 2020. The propensity to buy, however, increased a more modest 3.4 points and at 13.4, was still 6 points short of its mark in June 2020. Yet this may reflect the fact that despite an ongoing easing of Covid restrictions, some areas of the German economy have yet to fully reopen. Overall, the June survey was surprisingly upbeat and bodes well for a stronger contribution from the household sector to German GDP.

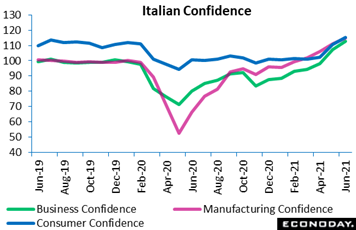

Making headlines in Italy was a suite of strong confidence readings that included marked improvement for the consumer, to 115.1 in June after 110.6 in May and, for the first time, above its pre-pandemic level of 110.8. All of the main consumer components made positive contributions. Business confidence was no less upbeat, at 112.8 from 107.3 for a seventh straight increase and now 13.8 points above its pre-pandemic level. Breaking down sectors, confidence among manufacturers advanced a surprisingly large 3.9 points to 114.8, fully 15.4 points above its reading in February last year. Outside of construction (153.6 after 153.9), morale saw solid increases in both services (106.7 after 99.1) and retail trade (106.7 after 99.9). Retail is the only sector still below its pre-pandemic level and then only by 0.2 points. Making headlines in Italy was a suite of strong confidence readings that included marked improvement for the consumer, to 115.1 in June after 110.6 in May and, for the first time, above its pre-pandemic level of 110.8. All of the main consumer components made positive contributions. Business confidence was no less upbeat, at 112.8 from 107.3 for a seventh straight increase and now 13.8 points above its pre-pandemic level. Breaking down sectors, confidence among manufacturers advanced a surprisingly large 3.9 points to 114.8, fully 15.4 points above its reading in February last year. Outside of construction (153.6 after 153.9), morale saw solid increases in both services (106.7 after 99.1) and retail trade (106.7 after 99.9). Retail is the only sector still below its pre-pandemic level and then only by 0.2 points.

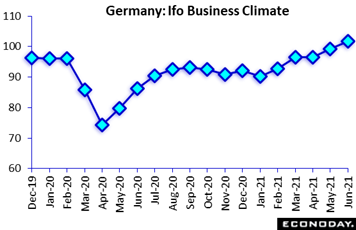

Concentrating on business confidence, June's Ifo survey found another surprisingly large improvement in German economic conditions. The headline climate indicator rose from 99.2 in May to 101.8, its fourth increase of the last five months and its highest mark since November 2018. It's now a solid 5.8 points above its pre-pandemic level. The gain once again reflected increases in both current conditions and expectations, the former up a solid 3.9 points to 99.6, its steepest rise since April 2010, its strongest reading since July 2019, and first above its pre-pandemic mark. Expectations were up 1.1 points to 104.0, a level not surpassed since way back in December 2010. At the sector level, improvements in morale were again broad-based: services at 22.4 after 13.7 saw another healthy advance as did trade, at 17.8 after 8.4; manufacturing and construction posted smaller gains. Ifo's report points to broad-based and accelerating growth approaching quarter-end as easier Covid restrictions in Germany are providing more of a boost to the recovery than forecasters had anticipated. Concentrating on business confidence, June's Ifo survey found another surprisingly large improvement in German economic conditions. The headline climate indicator rose from 99.2 in May to 101.8, its fourth increase of the last five months and its highest mark since November 2018. It's now a solid 5.8 points above its pre-pandemic level. The gain once again reflected increases in both current conditions and expectations, the former up a solid 3.9 points to 99.6, its steepest rise since April 2010, its strongest reading since July 2019, and first above its pre-pandemic mark. Expectations were up 1.1 points to 104.0, a level not surpassed since way back in December 2010. At the sector level, improvements in morale were again broad-based: services at 22.4 after 13.7 saw another healthy advance as did trade, at 17.8 after 8.4; manufacturing and construction posted smaller gains. Ifo's report points to broad-based and accelerating growth approaching quarter-end as easier Covid restrictions in Germany are providing more of a boost to the recovery than forecasters had anticipated.

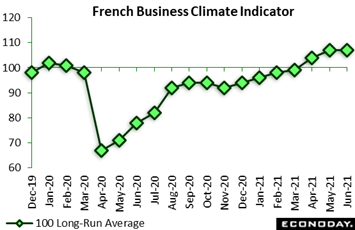

Business sentiment in France was less striking than Germany or Italy but still positive. INSEE's business climate indicator for June held steady at 107 in May, 7 points above its long-run average but on the soft side of the market consensus. This was the first time in seven months that the measure failed to signal a rise in confidence. Past output slowed to 16 percent after 20 percent though new orders were slightly stronger at minus 9 percent after minus 10 percent. The outlook was similarly mixed with personal production expectations (18 percent after 19 percent) marginally weaker but general production expectations (27 percent after 18 percent) climbing to their highest level since February 2018. Yet elsewhere business sentiment was more upbeat and there were solid gains in services (113 after 107) and retail trade (115 after 107). As a result, the economy-wide gauge jumped a further 5.0 points to 113.0, its second steepest increase since June last year and its highest level since July 2007. This was also nearly 11 points above its pre-pandemic level in February last year. In sum, June's update is consistent with the flash PMI survey in painting a generally bullish picture of French business activity at the end of the current quarter. Business sentiment in France was less striking than Germany or Italy but still positive. INSEE's business climate indicator for June held steady at 107 in May, 7 points above its long-run average but on the soft side of the market consensus. This was the first time in seven months that the measure failed to signal a rise in confidence. Past output slowed to 16 percent after 20 percent though new orders were slightly stronger at minus 9 percent after minus 10 percent. The outlook was similarly mixed with personal production expectations (18 percent after 19 percent) marginally weaker but general production expectations (27 percent after 18 percent) climbing to their highest level since February 2018. Yet elsewhere business sentiment was more upbeat and there were solid gains in services (113 after 107) and retail trade (115 after 107). As a result, the economy-wide gauge jumped a further 5.0 points to 113.0, its second steepest increase since June last year and its highest level since July 2007. This was also nearly 11 points above its pre-pandemic level in February last year. In sum, June's update is consistent with the flash PMI survey in painting a generally bullish picture of French business activity at the end of the current quarter.

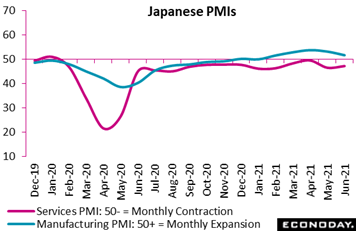

But the latest business survey from Japan, a country still struggling with public-health restrictions, was less upbeat. June's flash PMI indicate conditions in the domestic economy have weakened this month, with respondents reporting a fall in output in the manufacturing sector and another month of contraction in the services sector. The flash estimate for manufacturing, though still over breakeven 50 for a fifth straight month, slowed by 1.5 points to 51.5. The output index for manufacturing contracted in June, dropping below 50 to 49.1 versus May's 53.7. And importantly the flash estimate for services remained below 50, up only slightly to 47.2. Services and manufacturing together give a flash estimate for the composite PMI of 47.8, down from May's final estimate at 48.8. This is consistent with contraction for the overall economy. But the latest business survey from Japan, a country still struggling with public-health restrictions, was less upbeat. June's flash PMI indicate conditions in the domestic economy have weakened this month, with respondents reporting a fall in output in the manufacturing sector and another month of contraction in the services sector. The flash estimate for manufacturing, though still over breakeven 50 for a fifth straight month, slowed by 1.5 points to 51.5. The output index for manufacturing contracted in June, dropping below 50 to 49.1 versus May's 53.7. And importantly the flash estimate for services remained below 50, up only slightly to 47.2. Services and manufacturing together give a flash estimate for the composite PMI of 47.8, down from May's final estimate at 48.8. This is consistent with contraction for the overall economy.

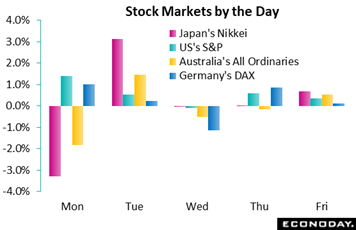

Japanese markets opened the week, plunging across the board on Fed tightening worries from the prior week with the Nikkei down 3.3 percent on Monday. Chipmakers, which provide specialized products for mining bitcoin, have been getting hit on China's efforts to rein in crypto mining and financial transactions related to crypto. Japanese markets opened the week, plunging across the board on Fed tightening worries from the prior week with the Nikkei down 3.3 percent on Monday. Chipmakers, which provide specialized products for mining bitcoin, have been getting hit on China's efforts to rein in crypto mining and financial transactions related to crypto.

Dominating the week's news was often hawkish but sometimes dovish headlines coming from Fed officials. Tuesday's news included San Francisco Fed President Mary Daly saying tapering could begin by the fall in contrast perhaps to Jerome Powell who told lawmakers in Washington that the Fed would not "preemptively" raise rates based on the "fear" of inflation alone: "We will wait for evidence of actual inflation or other imbalances." Then on Wednesday Atlanta Fed President Raphael Bostic, considered a centrist, said he had moved forward his forecast for a rate rise to 2022 and that the time is nearing for the Fed to taper. Bostic and Fed Governor Susan Bowman both said temporary inflation increases may take longer than anticipated to fade.

Australian markets slipped Wednesday on negative Covid news with the All Ordinaries index off 0.5 percent as Sydney imposed new limited restrictions in response to an uptick in Covid cases, and other states and cities imposed travel restrictions. Authorities appear to be considering additional restrictions if cases continue to climb. Commonwealth Bank of Australia said the Reserve Bank of Australia is likely to start raising interest rates late in 2022 and continue in 2023. Westpac has said it expects rate increases to start in 2023.

On Thursday the big jump in the German Ifo business confidence underpinned risk appetite and hopes for recovery. The Bank of England, as expected, left its policy settings unchanged and said there had been no tapering discussion at the day's meeting. Earlier in the week, comments from European Central Bank officials suggested the ECB is not ready to consider pulling back from its accommodative stance either. In the US, Thursday's big news was a deal between the Biden administration and a bipartisan group of 10 senators for $597 billion in infrastructure spending including roads, bridges, water infrastructure, and broadband. The deal, which is a fraction of Biden’s original proposal, must still be approved in Congress, including the Senate, where it may face a filibuster. The week wound down with financials outperforming on Friday after big banks passed the Federal Reserve's stress tests, clearing them to resume stock buybacks and dividends.

Germany's GfK and Ifo confidence readings, together with robust acceleration in the country's flash PMIs for June, drove the country's consensus divergence index sharply higher to end the week at plus 36, indicating that recent data are now running well ahead of market expectations. Switzerland is now a distant second at plus 16 with Italy, helped by its confidence readings, holding steady at 11. The Eurozone as a whole is also in the plus column at 8 with the UK straddling the no surprise zero-line at plus 3. Canadian data are only slightly below consensus at minus 5 in contrast to French data which have been coming in much weaker than expected the past month, driving down this country's index to minus 29 and approaching China's minus 31 in the disappointment category. On the bottom of the list is the US whose index has been crumbling this month to end the week at minus 33 to indicate that forecasters are sizably over-estimating the country's economic strength. Something to consider perhaps heading into next week's employment report.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

Germany leads the week's run with the first look at consumer prices in the month of June, posted on Tuesday, and also the first look at June conditions in employment, posted on Wednesday. CPI reports for June will follow on Wednesday from France then on Thursday from both Switzerland and Korea: steady to slower is the general expectation. Steep acceleration, in contrast, would be no surprise for Eurozone producer prices on Friday. The US follows Germany with the only major employment releases of the week: initial jobless claims on Thursday followed by the June employment report on Friday where a substantial gain is once again the call.

Updates on the consumer sector open the week with US consumer confidence on Tuesday in a report that has failed, reopening or not, to show much improvement at all. Retail sales data for May will be limited to Japan on Tuesday and Germany on Friday. Manufacturing updates for June will open with China's CFLP PMI on Wednesday and the Caixan PMI on Thursday capped by the ISM manufacturing index also on Thursday. Definitive data will include industrial production reports for May from Japan on Wednesday, French consumer manufactured goods consumption on Wednesday, and Japan's Tankan report for the second quarter on Thursday.

Leading indicator reports will be limited to Switzerland on Wednesday with market-moving GDP data limited to Canada on Wednesday with international trade data also limited to Canada on Friday.

Japanese Retail Sales for May (Mon 23:50 GMT; Tue 08:50 JST; Mon 19:50 EDT)

Consensus Forecast, Year over Year: 7.9%

Retail sales in May are expected to rise at an annual pace of 7.9 percent versus April's higher-than-expected pace of 12.0 percent.

German CPI, Preliminary for June (Tue 12:00 GMT; Tue 14:00 CEST; Tue 08:00 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 2.3%

June expectations are a 0.4 percent increase on the month for an annual 2.3 percent rate, which would compare with 0.5 and 2.5 percent respectively in May.

US Consumer Confidence Index for June (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 118.8

After easily beating expectations in prior results, May's index, weighed down by weakness in expectations, proved unexpectedly soft at 117.2 and still 15 points below its prepandemic level. For June, forecasters see the consumer confidence rising to 118.8.

Japanese Industrial Production for May (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Month over Month: -2.4%

Industrial production is expected to fall 2.4 percent in May after a 2.5 percent gain in April.

China: CFLP Manufacturing PMI for June (Wed 01:00 GMT; Wed 09:00 CST; Tue 21:00 EDT)

Consensus Forecast: 50.8

The government's official CFLP manufacturing PMI has been steady for the past year at roughly the 51.0 level with 50.8 the expectation for May.

French Consumer Manufactured Goods Consumption for May (Wed 06:45 GMT; Wed 08:45 CEST; Wed 02:45 EDT)

Consensus Forecast, Month over Month: 6.4%

Goods consumption is expected to rise 6.4 percent in May following an unexpected and very sharp monthly decline of 10.6 percent in April.

French CPI, Preliminary June (Wed 06:45 GMT: Wed 08:45 CEST; Wed 02:45 EDT)

Consensus Forecast, Year over Year: 1.5%

Consumer prices in June are expected to rise at a year-over-year rate of 1.5 percent. This would compare with a 1.4 percent yearly rate in May.

KOF Swiss Leading Indicator for June (Wed 07:00 GMT; Wed 09:00 CEST; Wed 03:00 EDT)

Consensus Forecast: 145.0

The Swiss leading indicator, seen at 145.0 in June versus a record 143.2 in May, has greatly exceeded expectations the last four reports.

German Unemployment Rate for June (Wed 07:55 GMT; Wed 09:55 CEST; Wed 03:55 EDT)

Consensus Forecast: 5.9%

Unemployment has held steady at a comparatively favorable 6.0 percent with forecasters calling for a 1 tenth dip in June to 5.9 percent.

Canadian GDP for April (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: -0.8%

GDP for April is expected to fall 0.8 percent on the month in what would partially reverse March's 1.1 percent gain.

Japanese Tankan for Second Quarter (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Large Manufacturers: 15

Consensus Forecast, Small Manufacturers: -5

Forecasters see the index for large manufacturers rising from plus 5 to plus 15 with the index for small manufacturers rising from minus 13 to minus 5.

China: Caixin Manufacturing PMI for June (Thu 01:45 GMT; Thu 09:45 CST; Wed 21:45 EDT)

Consensus Forecast: 51.9

March's Caixan manufacturing PMI is expected to hold steady at 51.9 in June versus 52.0 and 51.9 in the last two reports.

Swiss CPI for June (Thu 06:30 GMT; Thu 08:30 CEST; Thu 02:30 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 0.7%

Consumer prices have been climbing higher, up 0.3 percent on the month in May for an annual rate of plus 0.6 percent. June's expectations are a 0.2 percent monthly gain for a yearly 0.7 percent.

US Initial Jobless Claims for the June 26 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 387,000

Jobless claims for the June 26 week are expected to fall to 387,000 versus 411,000 in the June 19 week. Claims have exceeded expectations the past three reports.

US: ISM Manufacturing Index for June (Thu 14:00 GMT; Thu 10:00 EDT)

Consensus Forecast: 61.1

ISM manufacturing has been sky high for this index, at 61.2 in May with June expected to come in at 61.1.

Korean CPI for June (Thu 23:00 GMT; Fri 08:00 KST; Thu 19:00 EDT)

Consensus Forecast, Year over Year: 2.1%

Annual CPI is expected to slow to 2.1 percent in June versus 2.6 percent in May which was 1 tenth lower than expected.

German Retail Sales for May (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 5.1%

Lockdowns pulled retail sales down a steep 5.5 percent in April with easing restrictions expected to make for a reversal in May where the consensus is a 5.1 percent monthly gain.

Eurozone PPI for May (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT))

Consensus Forecast, Month over Month: 1.1%

Consensus Forecast, Year over Year: 9.5%

Producer prices are expected to extend their upward trend in May with a 1.1 percent monthly increase that would boost the annual inflation rate from 7.6 percent to 9.5 percent.

US Employment Situation for June (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Change in Nonfarm Payrolls: 675,000

Consensus Forecast: Unemployment Rate: 5.7%

A rise of 675,000 is Econoday's consensus for June nonfarm payrolls following lower-than-expected increases of 559,00 in May and 278,000 in April. Job growth in the US appears to be falling short of recovery in general demand.

Canada Merchandise Trade Balance for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: C$0.40 billion

Canada is expected to post a May surplus of C$0.40 billion versus an April surplus of C$0.59 billion.

|