|

The Federal Reserve will do what it "can to avoid a market reaction" when it comes time to taper, said Jerome Powell at Wednesday's press conference and, given the subdued reaction to the latest FOMC results, he and his colleagues may have already succeeded. The Fed's economic projections have suddenly penciled in 50 basis points of rate hikes in 2023, bringing forward that profound moment when paper money begins to be withdrawn from the paper economy. But Powell strongly downplayed the FOMC projection, warning it should be taken with a "big grain of salt". But if projections are only projections, shouldn't this also apply to inflation?

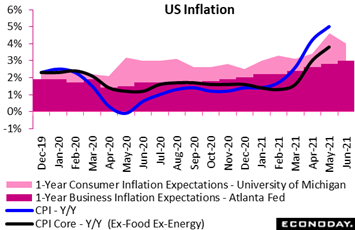

Helping to set the stage for Wednesday's FOMC events was a jump in year-ahead inflation expectations at the business level. The reading is up 2 tenths this month to 3.0 percent which doesn't sound that extreme but really is, prompting the usually taciturn Atlanta Federal Reserve, which compiles the data, to describe June's result as a "significant" increase. This in fact is the highest level in 10 years of available data with the prior month of May, at 2.8 percent, and April, at 2.6 percent, the next highest readings. Helping to set the stage for Wednesday's FOMC events was a jump in year-ahead inflation expectations at the business level. The reading is up 2 tenths this month to 3.0 percent which doesn't sound that extreme but really is, prompting the usually taciturn Atlanta Federal Reserve, which compiles the data, to describe June's result as a "significant" increase. This in fact is the highest level in 10 years of available data with the prior month of May, at 2.8 percent, and April, at 2.6 percent, the next highest readings.

At his press conference, Powell conceded that inflation readings are indeed coming in above expectations, but he said the details behind the headlines suggest that current pressures will ease. He cited lumber as an example where prices jumped on supply snags but have since come down. This he said is likely for used car prices as well where a "perfect storm" of strong demand and limited availability have created severe pressures that have yet to recede. Though the exact timing is uncertain, he said such factors "over time" should abate and that pressures tied to inadequate supply will prove "temporary".

Interestingly, Jerome Powell stressed repeatedly that forecasts among the 18 FOMC members see inflation falling back in 2022 and 2023 to within a very narrow corridor just above the Fed's 2 percent price target. This he used to support his view that inflation will ease. Yet doesn't this contrast with his "grain-of-salt" dismissal of the 2023 rate-hike projection? But who hasn't been guilty of cherry picking when it comes to economic indications.

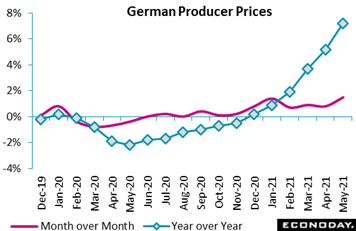

Pressures at the base of the price chain are exceeding expectations as they are at the consumer level, evident all week long whether producer prices in the US at an annual 6.6 percent, input prices in the UK at 10.7 percent, or wholesale prices in India at 12.9 percent. And let's not forget Germany which posted its producer price index on Friday and which, at an annual 7.2 percent in May, was also unexpectedly strong with monthly growth, at 1.5 percent, more than double Econoday's consensus. Energy is a special hot spot, up 2.6 percent on the month and up 14.9 percent on the year. But it's more than just energy, excluding which producer prices were still up an annual 4.9 percent on the year and reflecting wide pressure for intermediates, up 2.2 percent on the month and 10.7 percent on the year that reflects rising prices for processed metals and wood and also chemicals. The overall annual rate has now climbed 7 percentage points since the end of 2020, a rise that final product prices will find hard to resist. CPI inflation in Germany has already moved up to 2.5 percent with much more perhaps still to come. Pressures at the base of the price chain are exceeding expectations as they are at the consumer level, evident all week long whether producer prices in the US at an annual 6.6 percent, input prices in the UK at 10.7 percent, or wholesale prices in India at 12.9 percent. And let's not forget Germany which posted its producer price index on Friday and which, at an annual 7.2 percent in May, was also unexpectedly strong with monthly growth, at 1.5 percent, more than double Econoday's consensus. Energy is a special hot spot, up 2.6 percent on the month and up 14.9 percent on the year. But it's more than just energy, excluding which producer prices were still up an annual 4.9 percent on the year and reflecting wide pressure for intermediates, up 2.2 percent on the month and 10.7 percent on the year that reflects rising prices for processed metals and wood and also chemicals. The overall annual rate has now climbed 7 percentage points since the end of 2020, a rise that final product prices will find hard to resist. CPI inflation in Germany has already moved up to 2.5 percent with much more perhaps still to come.

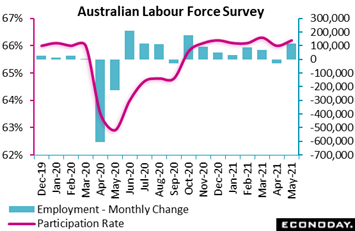

Inflation is only one of the pillars of monetary policy, another is employment where the week's data were light but did include an upbeat labour force report from Australia. Employment in May jumped 115,200 rebounding strongly from a decline of 30,600 in April and well above Econoday's consensus for a rise of 30,000. The participation rate rose 2 tenths to 66.2 percent, just below the recent high of 66.3 percent, while the unemployment rate fell 4 tenths to 5.1 percent for the lowest level since February last year. May's improvement came despite ongoing public health restrictions and the recent expiration of emergency wage subsidies. Inflation is only one of the pillars of monetary policy, another is employment where the week's data were light but did include an upbeat labour force report from Australia. Employment in May jumped 115,200 rebounding strongly from a decline of 30,600 in April and well above Econoday's consensus for a rise of 30,000. The participation rate rose 2 tenths to 66.2 percent, just below the recent high of 66.3 percent, while the unemployment rate fell 4 tenths to 5.1 percent for the lowest level since February last year. May's improvement came despite ongoing public health restrictions and the recent expiration of emergency wage subsidies.

Speaking ahead of the report, Philip Lowe, Governor of the Reserve Bank of Australia, said the jobs recovery has been surprisingly strong but he also stressed that wage pressures, reflecting a "laser-like focus" among employers to hold down costs, remain subdued. Lowe again stressed that rates will not be raised until inflation is sustainably within the RBA's target range of 2.0 percent to 3.0 percent and argued that this will not happen until wage pressures are "materially higher than they have been recently". This, he believes, "still seems some way off". Lowe also confirmed that the RBA will continue purchasing government bonds when its current program, worth A$100 billion, expires in September.

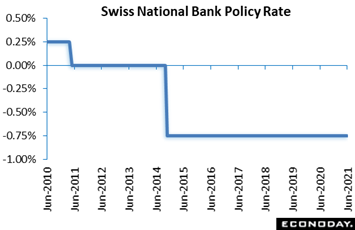

There was lots of central bank action in the week including from the Swiss National Bank where we can report one new policy wrinkle. There was no move on the policy rate which remains pegged at minus 0.75 percent, but with regard to the Swiss franc, the central bank described it as "highly valued", a term missing from the March meeting when the currency was trading a couple of percentage points lower against the euro. The language suggests the central bank isn't happy with the franc's recent gain and to this end, the SNB predictably reiterated its willingness to intervene as and when necessary to prevent any unwanted appreciation. There was lots of central bank action in the week including from the Swiss National Bank where we can report one new policy wrinkle. There was no move on the policy rate which remains pegged at minus 0.75 percent, but with regard to the Swiss franc, the central bank described it as "highly valued", a term missing from the March meeting when the currency was trading a couple of percentage points lower against the euro. The language suggests the central bank isn't happy with the franc's recent gain and to this end, the SNB predictably reiterated its willingness to intervene as and when necessary to prevent any unwanted appreciation.

Reflecting an easing of public health measures and an improved global picture, the SNB's baseline economic scenario is growing more upbeat. Real GDP is now expected to rise 3.5 percent this year, up from March's 3.0 percent call and, after an anticipated strong second quarter, total output is seen reclaiming its pre-pandemic level around the middle of next year. The near-term inflation forecast was also revised up but nothing alarming: CPI inflation is now put at 0.4 percent this year and 0.6 percent in both 2022 and 2023, these are up a couple of tenths or so from March. In other words, inflation is still seen as very low over the entire forecast horizon.

With inflation too weak and the franc too strong, any early shift in SNB policy remains unlikely. Recent FX interventions suggest that EUR/CHF1.09 is now the pain threshold for the central bank and, if needed, further aggressive sales of the local currency are to be expected in the event of any major break below this level.

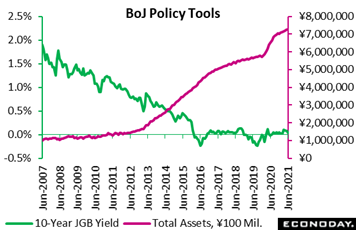

The Bank of Japan also met in the week, extending the purchase of Japanese government bonds at a pace to keep the 10-year yield close to its zero-percent target; the bank also extended a financing facility to support corporate funding for an additional six months. The BoJ said Japan's economy has "picked up" but remains severely impacted by the pandemic especially private consumption where weakness is being offset only in part by stronger business investment and government spending. Officials expect the pandemic's impact on economic activity to wane but note that the outlook remains highly uncertain. The bank noted that inflation has been close to zero, will likely remain there in the near-term, and then increase only gradually (CPI data posted Friday showed annual contraction of 0.1 percent in May). Officials once again reaffirmed their commitment that monetary policy will remain highly accommodative until inflation reaches and then stabilizes above their 2.0 percent target level. They continue to expect policy rates to stay at or below current levels for the foreseeable future but have reiterated that they will not hesitate to ease policy further if necessary. The Bank of Japan also met in the week, extending the purchase of Japanese government bonds at a pace to keep the 10-year yield close to its zero-percent target; the bank also extended a financing facility to support corporate funding for an additional six months. The BoJ said Japan's economy has "picked up" but remains severely impacted by the pandemic especially private consumption where weakness is being offset only in part by stronger business investment and government spending. Officials expect the pandemic's impact on economic activity to wane but note that the outlook remains highly uncertain. The bank noted that inflation has been close to zero, will likely remain there in the near-term, and then increase only gradually (CPI data posted Friday showed annual contraction of 0.1 percent in May). Officials once again reaffirmed their commitment that monetary policy will remain highly accommodative until inflation reaches and then stabilizes above their 2.0 percent target level. They continue to expect policy rates to stay at or below current levels for the foreseeable future but have reiterated that they will not hesitate to ease policy further if necessary.

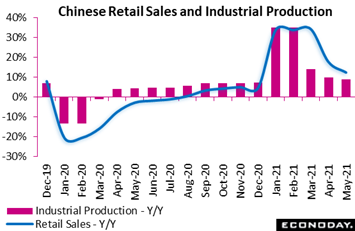

Turning back to economic data, the most market-moving came from slumping results in China. Retail sales rose 0.81 percent on the month in May versus a 0.25 percent rise in April but year-over-year growth of 12.4 percent came up short versus expectations for 14.0 percent and compared with 17.7 percent in April. The slowing was broad-based including auto sales, up 6.3 percent on the year after increasing 16.1 percent previously with sales of communication equipment, home appliances, household non-durables, and clothing also slowing appreciably. Urban and rural sales both decelerated to a similar extent. Turning back to economic data, the most market-moving came from slumping results in China. Retail sales rose 0.81 percent on the month in May versus a 0.25 percent rise in April but year-over-year growth of 12.4 percent came up short versus expectations for 14.0 percent and compared with 17.7 percent in April. The slowing was broad-based including auto sales, up 6.3 percent on the year after increasing 16.1 percent previously with sales of communication equipment, home appliances, household non-durables, and clothing also slowing appreciably. Urban and rural sales both decelerated to a similar extent.

Industrial production also couldn't meet expectations, rising 0.52 percent on the month as it did in April but the annual rate of 8.8 percent was just short of expectations and down from 9.8 percent in April. Among details, manufacturing output was up 9.0 percent on the year after increasing 10.3 percent in April, with output of autos, steel products, chemicals, textiles, steel products, and general equipment all recording slower growth. Utilities output rose 11.0 percent on the year after increasing 10.3 percent previously, while year-over-year growth in the mining sector was steady at 3.2 percent. Data on fixed asset investment rounded out the disappointing week, rising 15.4 percent in data for this indicator measured year to date versus expectations for 16.8 percent and against April's 19.9 percent. Details in this report were also broadly slower.

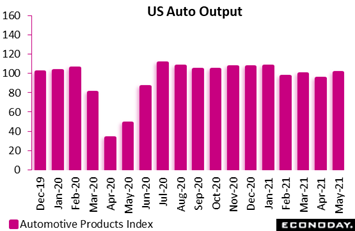

One of the major wild cards this year has been chip shortages in the auto sector which, based on May's industrial production report in the US, may be easing. Total production volumes rose 0.8 percent on the month driven by a 5.7 percent jump in automotive products to an index level, as tracked in the accompanying graph, of 100.6. Yet this level is still down 6.6 percent relative to January this year and is down 4.5 percent versus February last year. Canada, which is a US partner in auto production, has also suffered from chip shortages evident in manufacturing sales in data for the month of April that fell 2.1 percent overall and with every major auto manufacturer in the country halting or ramping down production. Yet May's data from the US do point to improvement for Canada's next manufacturing report. Also of note in the week was a massive 27.3 monthly surge in margins at US dealers in May in data from the producer price report where the headline 0.8 percent jump exceeded Econoday's high estimate. One of the major wild cards this year has been chip shortages in the auto sector which, based on May's industrial production report in the US, may be easing. Total production volumes rose 0.8 percent on the month driven by a 5.7 percent jump in automotive products to an index level, as tracked in the accompanying graph, of 100.6. Yet this level is still down 6.6 percent relative to January this year and is down 4.5 percent versus February last year. Canada, which is a US partner in auto production, has also suffered from chip shortages evident in manufacturing sales in data for the month of April that fell 2.1 percent overall and with every major auto manufacturer in the country halting or ramping down production. Yet May's data from the US do point to improvement for Canada's next manufacturing report. Also of note in the week was a massive 27.3 monthly surge in margins at US dealers in May in data from the producer price report where the headline 0.8 percent jump exceeded Econoday's high estimate.

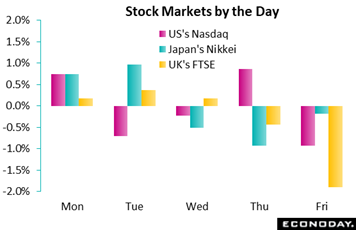

James Bullard, president of the St. Louis Federal Reserve, turned the tightening screw another notch on Friday saying a rate hike next year, not in 2023, is also possible and that tapering is in active discussion at the Fed. Bullard, who has a history of launching Fed bombs, rotates in the FOMC voting pool next year. Stocks seemed to show more reaction to Bullard than they did to the actual FOMC projections on Wednesday when declines were marginal, suggesting perhaps that investors, less and less certain of easy money, may already be getting a case of bad nerves. By week's end, the Nasdaq had lost only 0.3 percent, the Nikkei had gained 0.1 percent, though the FTSE, as Europe reacted to Bullard's comments, had lost 1.6 percent. James Bullard, president of the St. Louis Federal Reserve, turned the tightening screw another notch on Friday saying a rate hike next year, not in 2023, is also possible and that tapering is in active discussion at the Fed. Bullard, who has a history of launching Fed bombs, rotates in the FOMC voting pool next year. Stocks seemed to show more reaction to Bullard than they did to the actual FOMC projections on Wednesday when declines were marginal, suggesting perhaps that investors, less and less certain of easy money, may already be getting a case of bad nerves. By week's end, the Nasdaq had lost only 0.3 percent, the Nikkei had gained 0.1 percent, though the FTSE, as Europe reacted to Bullard's comments, had lost 1.6 percent.

The week opened on the upside led by Japan where falling infections and rising vaccinations are raising talk of an easing in restrictions in Tokyo and other cities. But Tuesday was another story as risk appetite in China suffered from a liquidity drain by the People’s Bank of China and a report of a radiation leak at a nuclear power facility near Hong Kong. The US and EU settled their long-running dispute over aircraft subsidies also on Tuesday in a plus offset in the session by UK Prime Minister Boris Johnson's decision to delay lifting anti-Covid restrictions. Wednesday was hit not only by the Fed rate-hike projection but also by the mid-month batch of Chinese economic indicators, all on the soft side of expectations, including slowing growth for both retail sales and industrial production.

China's consensus divergence index reflected the disappointment, falling nearly 30 points to end the week at minus 31 to indicate that forecasters are sizably over-estimating the strength of the country's data. The index for the US, hit by weak reports on retail sales and jobless claims, ended the week at minus 15 for the worst showing in a month. France is at minus 14 and Germany still in negative ground at minus 10 despite the hotter-than-expected PPI.

The Eurozone got a lift from a strong industrial production for a score of plus 20 that indicates forecasters are under-estimating the strength of the continent. Strong CPI and housing starts reports offset weakness in manufacturing sales to help Canada climb 8 points to plus 19; Switzerland is at plus 16 and Italy unchanged at plus 11. Only one country is near zero right now, at plus 1 to indicate that forecasters, on net, are calling UK data correctly, or at least the mix correctly as strong consumer and producer price reports were balanced against weak retail sales and mixed employment data.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

Scheduled monetary policy news is light in the coming week, opening with China's loan prime rate on Tuesday and a Bank of England announcement on Thursday. No moves for either are expected. Inflation news will be limited to Friday's PCE readings in the US personal income and outlays report where very elevated pressure, in line with the already released CPI, is the expectation. Consumer news will include the EC consumer confidence flash on Tuesday, where further improvement is expected, and will include retail sales reports from Australia on Monday and Canada on Wednesday. New home sales on Wednesday and initial jobless claims on Thursday will offer clues on household conditions in the US. Readings on business confidence will include reports from France and Germany on Wednesday and Italy on Friday. Updates on the manufacturing sector will be limited to CBI Industrial trends from the UK on Tuesday and US durable goods on Thursday, the latter expected to show strength. A focus of the week will be flash PMIs for June, all on Wednesday in a sweep that is expected to be highlighted by continued recovery for the global services sector. Trade data will be limited to advance goods data from the US on Friday.

Australian Retail Sales for May (Mon 01:30 GMT; Mon 11:30 AEST; Sun 21:30 EDT)

Consensus Forecast, Month over Month: 0.6%

Retail sales in Australia are expected to increase 0.6 percent on the month in May following a 1.1 percent rise in April.

China Loan Prime Rate (Tuesday, Release Time Not Set)

Consensus Change: 0 basis points

Consensus Level: 3.85%

The People's Bank of China is not expected to change its one-year loan prime rate at 3.85 percent.

UK: CBI Industrial Trends for June (Tue 10:00 GMT; Tue 11:00 BST; Tue 06:00 EDT)

Consensus Forecast: 25%

CBI's industrial trends have been on the climb with a headline plus 25 expected for June which would compare with plus 17 in May.

Eurozone: EC Consumer Confidence Flash for June (Tue 14:00 GMT; Tue 16:00 CEST; Tue 10:00 EDT)

Consensus Forecast: -2.9

Consumer confidence has been improving at a faster pace than forecasters have been expecting. After minus 5.1 in May, June's reading is called at minus 2.9.

Japanese PMI Flashes for June (Wed 00:30 GMT; Wed 09:30 JST; Tue 20:30 EDT)

Consensus Forecast, Manufacturing: No consensus

Consensus Forecast, Services: No consensus

Manufacturing growth has been moderate, at 53.5 in April, but services weak, at 45.7. There are no consensus forecasts for May.

French PMI Flashes for June (Wed 07:15 GMT; Wed 09:15 CEST; Wed 03:15 EDT)

Consensus Forecast, Manufacturing: 58.5

Consensus Forecast, Services: 59.4

Forecasters see the manufacturing PMI, which has held in the high 50s the last three months, coming in at 58.5; services, which jumped into the mid-50s in May, are seen at 59.4.

German PMI Flashes for June (Wed 07:30 GMT; Wed 09:30 CEST; Wed 03:30 EDT)

Consensus Forecast, Manufacturing: 63.0

Consensus Forecast, Services: 55.3

Services moved back above the breakeven 50 line in May to 52.8 and, at a consensus 55.3, are expected to further improve in June. Manufacturing, where readings have been exceptionally strong, has been holding in the mid-60s with 63.0 June's consensus.

UK PMI Flashes for June (Wed 08:30 GMT; Wed 09:30 BST; Wed 04:30 EDT)

Consensus Forecast, Manufacturing: 64.0

Consensus Forecast, Services: 63.0

Boosted by the lifting of Covid restrictions beginning in March, the UK PMIs have climbed from the mid-to-high 50s to the mid-60s for manufacturing and the low 60s for services. June's consensus is 64.0 for manufacturing and 63.0 for services.

Canadian Retail Sales for April (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: -5.0%

After a better-than-expected 2.3 percent rise in March, retail sales in April are expected to fall a monthly 5.0 percent.

US PMI Flashes for June (Wed 13:45 GMT; Wed 09:45 EDT)

Consensus Forecast, Manufacturing: 61.5

Consensus Forecast, Services: 69.8

Growth rates of the PMIs have been very strong and especially so for services which bolted to the 70 line in May. June's expectations are 69.8 for services and 61.5 for manufacturing.

US New Home Sales for May (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast, Annual Rate: 881,000

New home sales fell back sharply in April but are expected to re-accelerate in May, to a 881,000 annual rate versus April's 863,000.

French Business Climate Indicator for June (Thu 06:45 GMT; Thu 08:45 CEST; Thu 02:45 EDT)

Consensus Forecast, Manufacturing: 110

Manufacturing sentiment improved sharply in both April and May and is expected to extend the strength in June to 110 in what would be a 3 point gain.

German Ifo Business Climate Indicator for June (Thu 08:00 GMT; Thu 10:00 CEST; Thu 04:00 EDT)

Consensus Forecast: 100.3

June's business climate indicator is expected to climb to 100.3 versus May's better-than-expected 99.2.

Bank of England Announcement (Thu 11:00 GMT; Thu 12:00 BST; Thu 07:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

Consensus Forecast: Asset Purchase Level: £895 billion

The Bank of England kept policy steady at their May meeting and are expected to do the same for June's meeting, at 0.10 percent for Bank Rate and £895 billion (gilts accounting for £875 billion) for QE.

US Durable Goods Orders for May (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: Month over Month: 2.0%

Consensus Forecast: Ex-Transportation - M/M: 0.7%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.5%

Durable goods orders shrank 1.3 percent in April with May's consensus calling for a 2.0 percent bounce higher. Econoday's consensus excluding transportation equipment is a 0.7 percent increase and a 0.5 percent rise for core capital goods orders.

US Initial Jobless Claims for the June 19 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 380,000

Jobless claims for the June 19 week are expected to come in at 380,000 versus 412,000 in the June 12 week in a result that ended six straight weeks of improvement.

US International Trade in Goods (Advance) for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Balance: -$87.9 billion

The US goods deficit (Census basis) is expected to widen to $87.9 billion in May versus $85.7 billion in April

(revised from $85.2 billion).

Germany: GfK Consumer Climate for July (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast: -4.0

At minus 7.0, the GfK survey was on the soft side of expectations in June. The consensus for July is minus 4.0.

Italian Business and Consumer Confidence for June (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Business Confidence: 107.3

Consensus Forecast, Manufacturing Confidence: 112.0

Consensus Forecast, Consumer Confidence: 112.0

Business confidence in June, at 106.7, improved for a sixth straight month and sharply too. The consensus for June is 107.3 with the manufacturing and consumer confidence forecasts both at 112.0 which would be further improvement for both.

US Personal Income for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: -2.6%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.3%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 3.5%

Personal income, which has been swinging wildly on stimulus payments, is expected to fall 2.6 percent in May. Personal consumption expenditures, after April's 0.5 percent rise, are expected to rise 0.3 percent in May. PCE prices, which have turned sharply higher, are expected to rise 0.5 percent on the month and 3.9 percent on the year with the core seen at a monthly 0.6 percent for an annual 3.5 percent.

|