|

With helmets fastened, central bankers are waiting out inflation's bumpy ride which in the US is especially rough given the economic reopening now underway. But prices at the base of the supply chain continue to accelerate including in China in pressures that raise two questions: how high will input prices go and will they, and by how much, be passed through to the global consumer. Two major central banks met in the week and the results are steady as you go.

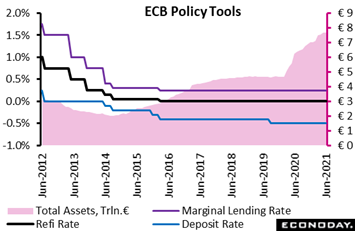

As widely anticipated, the ECB made no policy adjustments. Net purchases under the longstanding asset purchase programme (APP) remain at €20 billion a month with the ceiling on the pandemic emergency purchase programme (PEPP), its main QE tool, at €1.85 trillion. APP acquisitions will continue until just before official interest rates are hiked while the PEPP will remain in place until at least March 2022. On interest rates, the refi rate was again held at zero percent and rates on the deposit and marginal lending facilities at minus 0.50 percent and plus 0.25 percent respectively. As widely anticipated, the ECB made no policy adjustments. Net purchases under the longstanding asset purchase programme (APP) remain at €20 billion a month with the ceiling on the pandemic emergency purchase programme (PEPP), its main QE tool, at €1.85 trillion. APP acquisitions will continue until just before official interest rates are hiked while the PEPP will remain in place until at least March 2022. On interest rates, the refi rate was again held at zero percent and rates on the deposit and marginal lending facilities at minus 0.50 percent and plus 0.25 percent respectively.

Key for the meeting was that the ECB opted not to trim its PEPP purchases. These were raised from around €60 billion to €80 billion a month at the March meeting in a bid to stem rising sovereign bond yields. The move was supposed to be temporary and last only through the current quarter. Consequently, June's decision to extend the current pace of purchases for another quarter suggests that the central bank remains cautious about the near-term economic outlook and sees any tapering now as carrying the risk of boosting both yields and an uncomfortably strong euro.

The results reaffirm the ECB's outlook that the recent rise in inflation will be only temporary and not a reason for a shift in policy. In particular, the decision not to taper PEPP purchases should prove moderately positive for fixed income markets and may also dent the euro, both highlighting the central bank's determination to maintain favorable financing conditions.

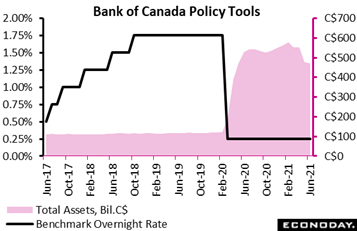

The Bank of Canada, which has been out in front of other central banks having first tapered in October and then again in April, held pat as expected at its June meeting. The BoC left its benchmark overnight rate at 0.25 percent and what is currently viewed as the effective lower bound. The central bank similarly reaffirmed its forward guidance which sees the policy interest rate pegged at the ELB "until enough economic slack has been absorbed to ensure that the 2 percent inflation target is sustainably achieved". The Bank of Canada, which has been out in front of other central banks having first tapered in October and then again in April, held pat as expected at its June meeting. The BoC left its benchmark overnight rate at 0.25 percent and what is currently viewed as the effective lower bound. The central bank similarly reaffirmed its forward guidance which sees the policy interest rate pegged at the ELB "until enough economic slack has been absorbed to ensure that the 2 percent inflation target is sustainably achieved".

Crucially too, there was no adjustment to QE. Back in April, weekly asset purchases were trimmed by C$1 billion a week to C$3 billion and while a further cut was a possibility at June's meeting, it was always unlikely. Tighter Covid restrictions saw employment contract by more than anticipated in both April and May so the second quarter has not started well. Even so, with vaccinations proceeding at a faster pace and provincial containment restrictions now on an easing path, growth should begin to rebound soon.

Although inflation (3.4 percent in April) is already well above its 2 percent target mid-point, the BoC still expects the rise to be only temporary and to fade as base-year effects diminish and excess capacity continues to exert downward pressure. The bank continues to see considerable spare capacity and believes and that the recovery continues to require extraordinary monetary policy support. For now at least, the BoC clearly remains more focused on supporting the economy than reducing inflation.

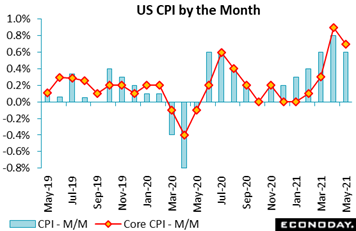

But it wasn't central banks that made the biggest headlines in the week, it was inflation data and specifically a May CPI report out of the US that was more heated than expected but nevertheless showed less heat than April. Consumer prices advanced a further 0.6 percent following a 0.8 percent gain in April, while the ex-energy ex-food core added another 0.7 percent to April's 0.9 percent surge. But food, up 0.4 percent on the month, and energy, unchanged, were not major factors in the report, rather it was once again used vehicle prices, rising another 7.3 percent following a 10 percent leap in April. Fully one-third of the total gain for the CPI was tied to this component, a surge reflecting stimulus-fed demand for vehicles together with supply constraints for new vehicles. Prices for new vehicles also rose in the month as did household furnishings and operations, airline fares, and apparel all extending their April march higher into May. But it wasn't central banks that made the biggest headlines in the week, it was inflation data and specifically a May CPI report out of the US that was more heated than expected but nevertheless showed less heat than April. Consumer prices advanced a further 0.6 percent following a 0.8 percent gain in April, while the ex-energy ex-food core added another 0.7 percent to April's 0.9 percent surge. But food, up 0.4 percent on the month, and energy, unchanged, were not major factors in the report, rather it was once again used vehicle prices, rising another 7.3 percent following a 10 percent leap in April. Fully one-third of the total gain for the CPI was tied to this component, a surge reflecting stimulus-fed demand for vehicles together with supply constraints for new vehicles. Prices for new vehicles also rose in the month as did household furnishings and operations, airline fares, and apparel all extending their April march higher into May.

The Federal Reserve believes US price pressures will ease as the reopening fades, a conviction that got a little confirmation at week's end from the University of Michigan's year-ahead reading on consumer inflation expectations which are down 6 tenths so far this month though they remain, nevertheless, at a substantially elevated 4.0 percent.

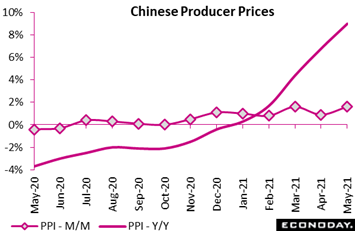

The biggest news for the markets probably came from Chinese producer prices which, as they are across the global economy, are rising much faster than consumer prices. China's producer price index jumped 1.6 percent on the month in May with the year-over-year rate, inflated by easy comparisons during the initial phases of the pandemic last year, climbing to 9.0 percent. This is the annual rate's most heated reading since 2008. Pressure was broad-based across major categories: fuel and power, raw material procurement, and mining and exploration all rising. Unlike the PPI, China's CPI looked tame, down 0.2 percent on the month in May and up only 1.3 percent on the year; how long the separation between producer and consumer prices will last, and whether it will last, are questions for the calm exteriors of central bankers. The biggest news for the markets probably came from Chinese producer prices which, as they are across the global economy, are rising much faster than consumer prices. China's producer price index jumped 1.6 percent on the month in May with the year-over-year rate, inflated by easy comparisons during the initial phases of the pandemic last year, climbing to 9.0 percent. This is the annual rate's most heated reading since 2008. Pressure was broad-based across major categories: fuel and power, raw material procurement, and mining and exploration all rising. Unlike the PPI, China's CPI looked tame, down 0.2 percent on the month in May and up only 1.3 percent on the year; how long the separation between producer and consumer prices will last, and whether it will last, are questions for the calm exteriors of central bankers.

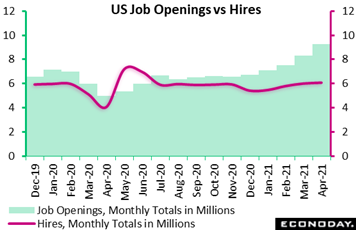

One inflationary factor playing out in the US, where pandemic job losses last year were monstrous, is the slow re-entry of the labor force. For the last five reports, job openings in the US have exceeded, not only Econoday's consensus median, but the entire consensus range, and spectacularly so in April at a record 9.3 million. Econoday's top estimate was only 8.2 million. On a monthly basis, openings jumped 12.0 percent in April compared to only a 1.1 percent rise for hirings, at 6.075 million. Yes, it takes time to add new workers but the extended build in openings raises questions whether generous emergency payments from the government including fattened jobless benefits are stunting the sense of urgency among the unemployed. Much of the jobless benefits will begin to be phased out in July after which it will be interesting to see how fast hirings pick up. One inflationary factor playing out in the US, where pandemic job losses last year were monstrous, is the slow re-entry of the labor force. For the last five reports, job openings in the US have exceeded, not only Econoday's consensus median, but the entire consensus range, and spectacularly so in April at a record 9.3 million. Econoday's top estimate was only 8.2 million. On a monthly basis, openings jumped 12.0 percent in April compared to only a 1.1 percent rise for hirings, at 6.075 million. Yes, it takes time to add new workers but the extended build in openings raises questions whether generous emergency payments from the government including fattened jobless benefits are stunting the sense of urgency among the unemployed. Much of the jobless benefits will begin to be phased out in July after which it will be interesting to see how fast hirings pick up.

Emergency benefits have greatly inflated retail sales data in the US, a pattern less evident in Europe where pandemic job losses, and the need for emergency benefits, have been comparatively limited. Retail sales in Italy were surprisingly soft in April: a 0.4 percent monthly drop followed no change in March and made for the first two-month period in which sales have not risen since May and June last year. Annual growth, distorted by last year's lockdown, jumped to 30.4 percent. More significantly, purchases were still 3.5 percent below their pre-pandemic level in February last year. Despite April's disappointing results, volume sales in April were still 1.5 percent above their first-quarter mean and the accelerating vaccine rollout and easing Covid restrictions should widen this gap over coming months. Emergency benefits have greatly inflated retail sales data in the US, a pattern less evident in Europe where pandemic job losses, and the need for emergency benefits, have been comparatively limited. Retail sales in Italy were surprisingly soft in April: a 0.4 percent monthly drop followed no change in March and made for the first two-month period in which sales have not risen since May and June last year. Annual growth, distorted by last year's lockdown, jumped to 30.4 percent. More significantly, purchases were still 3.5 percent below their pre-pandemic level in February last year. Despite April's disappointing results, volume sales in April were still 1.5 percent above their first-quarter mean and the accelerating vaccine rollout and easing Covid restrictions should widen this gap over coming months.

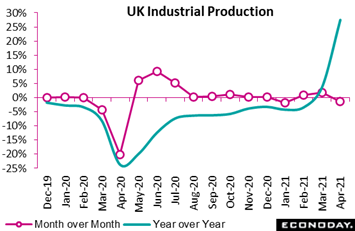

The UK posted a run of data on Friday that, for an economy that had been smashing expectations, were no better than mixed. The goods producing sector, in fact, had a surprisingly poor April. Industrial production declined 1.3 percent on the month, its first setback since January and only its second decline since April last year. Boosted by very positive base effects annual growth still jumped from 3.6 percent to 27.5 percent but production was 3.1 percent below February's pre-pandemic level. The UK posted a run of data on Friday that, for an economy that had been smashing expectations, were no better than mixed. The goods producing sector, in fact, had a surprisingly poor April. Industrial production declined 1.3 percent on the month, its first setback since January and only its second decline since April last year. Boosted by very positive base effects annual growth still jumped from 3.6 percent to 27.5 percent but production was 3.1 percent below February's pre-pandemic level.

Manufacturing held up rather better but output here again unexpectedly dropped a monthly 0.3 percent, also its first negative print since the start of the year. Five of the 13 subsectors posted declines led by a 16.0 percent nosedive in pharmaceuticals. Transport equipment, textiles, clothing and footwear were the other main losers. Components outside of manufacturing showed a gain for utilities but a slump for energy extraction.

In a pattern evident in other economies, the UK's definitive production data were a good deal weaker than suggested by business surveys, whether the CBI's industrial trends survey or, in particular, the manufacturing PMI survey. This may mean (always optimistic) that positive revisions are in store for the next industrial production report.

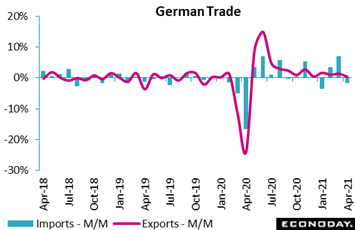

How Brexit effects are unfolding is of course of special interest. UK merchandise trade for April, also released Friday, showed a deepening in the shortfall with the EU, from £5.16 billion to £5.41 billion, a 3-month high as a 2.3 percent monthly gain in exports was eclipsed by a 3.0 percent increase in imports. Yet what's important is less the relative balance of exports versus imports and more the fact that exports and imports are both climbing, not contracting as they had earlier in the year. Merchandise trade data from Germany, also released in the week, showed exports to the UK climbing 64.1 percent on the year in April with imports no worse than flat, down 0.6 percent. Germany's total trade balance in April posted a €15.9 billion surplus, lower than expected but still nearly €2 billion better than March and reflecting a 1.7 percent drop in imports relative to a small 0.3 percent rise in exports. German trade has been less than exhilarating this year though an extended gain in exports to the UK wouldn't hurt. How Brexit effects are unfolding is of course of special interest. UK merchandise trade for April, also released Friday, showed a deepening in the shortfall with the EU, from £5.16 billion to £5.41 billion, a 3-month high as a 2.3 percent monthly gain in exports was eclipsed by a 3.0 percent increase in imports. Yet what's important is less the relative balance of exports versus imports and more the fact that exports and imports are both climbing, not contracting as they had earlier in the year. Merchandise trade data from Germany, also released in the week, showed exports to the UK climbing 64.1 percent on the year in April with imports no worse than flat, down 0.6 percent. Germany's total trade balance in April posted a €15.9 billion surplus, lower than expected but still nearly €2 billion better than March and reflecting a 1.7 percent drop in imports relative to a small 0.3 percent rise in exports. German trade has been less than exhilarating this year though an extended gain in exports to the UK wouldn't hurt.

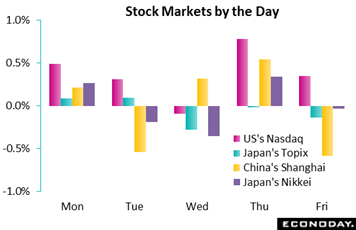

The US Justice Department opened the week's action late on Monday announcing it had recovered the majority of the 63.7 bitcoin ransom paid by Colonial last month to reopen the company's pipeline. Crypto-currencies fell about 1 percent in initial reaction and nearly 10 percent on Tuesday before, however, recovering by week's end. Meme stocks were again in focus during the week and showed big swings for brick-and-mortar retailers Bed Bath & Beyond, GameStop and AMC. The US Justice Department opened the week's action late on Monday announcing it had recovered the majority of the 63.7 bitcoin ransom paid by Colonial last month to reopen the company's pipeline. Crypto-currencies fell about 1 percent in initial reaction and nearly 10 percent on Tuesday before, however, recovering by week's end. Meme stocks were again in focus during the week and showed big swings for brick-and-mortar retailers Bed Bath & Beyond, GameStop and AMC.

Japanese sentiment has improved as vaccine rollouts continue and many anti-Covid restrictions are scheduled to ease in late June. Still, the market is seeing profit-taking whenever the Topix makes a run at recent highs around 2,000. The Topix ended the week at 1,954.

Chinese mining shares lagged on Wednesday after a bigger-than-expected rise in Chinese producer prices, results that were followed by additional Chinese measures to control prices for certain commodities. Rising US-Chinese friction was also a negative: the US signaled a resumption of trade talks with Taiwan which China warned against; and the Biden administration cited China for unfair trade practices that it said are damaging US supply chains. Yet the week ended with a report that Chinese and US commerce ministers had spoken by phone and agreed to promote cooperation on trade and investment.

US shares rallied on Thursday despite sharp gains in the country's consumer price report which, however, showed less severity on a monthly basis. Talk that US inflation – and growth – may be peaking spurred rotation out of cyclical/value stocks into growth; some analysts are noting that institutions are shifting out of stocks and into fixed income.

The week's run of data was, on net, on the soft side of expectations, reflected in Econoday's consensus divergence indexes which shifted from widely positive to mostly positive. The UK index, however, flew in the southernly direction, falling from 36 in the prior week to minus 3 for the first negative indication since late April, though only barely so. Leading the way is the Eurozone at 19 which indicates that data from the continent continue to exceed forecaster expectations by a tangible degree, though breakdowns of the major economies within the EU are mostly negative: Germany at minus 17, France at minus 7 with Italy holding in the plus column at 11. Canada is also at 11 with the US steady at plus 6 and China easing to minus 3. Switzerland is at plus 13 in a reading that points to greater-than-expected economic strength heading into next week's Swiss National Bank meeting.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

Barring surprises, the week ahead looks tame. Markets could slow ahead of Wednesday's Federal Reserve meeting or Thursday's Swiss National Bank announcement but no policy moves are expected for either. Swiss inflation data will open on Monday with the May producer and import price report followed by the May CPI from India and whether, if it all, Covid troubles are having an impact on the country's prices. May CPIs will follow from Canada and the UK on Wednesday and Japan on Friday with German producer prices also set for Friday. Employment data in the week will be limited to the UK labour market report on Tuesday followed by Australia's report on Thursday. The UK will also release its May retail sales on Friday but the most sensitive consumer news will come from US retail sales on Tuesday and Chinese retail sales on Wednesday, the latter part of a run May updates that will include industrial production also on Wednesday. The Eurozone will update its industrial production report on Monday while Canada, also on Monday, will release monthly manufacturing sales. Japanese machinery orders are set for Tuesday as are Japan's merchandise trade report which, Covid issues or not, has been very strong in recent months. Another report to watch will be US housing starts on Wednesday and whether residential construction continues to slow.

Swiss Producer and Import Price Index for May (Mon 06:30 GMT; Mon 08:30 CEST: Mon 02:30 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 2.8%

A monthly 0.2 percent gain is expected for May versus April's strong rise of 0.7 percent. The yearly rate for May is expected at plus 2.8 percent versus April's plus 1.8 percent rise.

Eurozone Industrial Production for April (Mon 09:00 GMT; Mon 11:00 CEST; Mon 05:00 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 37.2%

Eurozone industrial production is expected to rise 0.3 percent on the month in April. Growth in annual production is seen at 37.2 percent.

Indian CPI for May (Mon 12:00 GMT; Mon 17:30 IST; Mon 08:00 EDT)

Consensus Forecast, Year over Year: 5.30%

Consumer inflation has been above the 4 percent midpoint of the Reserve Bank of India's target 2-to-6 percent range all through last year and so far this year. After a 4.29 percent annual rate in April, the consensus for May is a jump to 5.30 percent.

Canadian Manufacturing Sales for April (Mon 12:30 GMT; Mon 08:30 EDT)

Consensus Forecast, Month over Month: -1.0%

Manufacturing sales are expected to decrease a monthly 1.0 percent in April after rebounding 3.5 percent in March.

UK Labour Market Report (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, ILO Unemployment Rate for April: 4.7%

Consensus Forecast, Average Hourly Earnings for May: 4.9%

The ILO unemployment rate is expected to edge 1 tenth lower to 4.7 percent in data for the three months to April after edging 1 tenth lower to 4.8 percent in the three months to March. Average hourly earnings in data for May are expected to jump nearly a point to an annual 4.9 percent.

US Retail Sales for May (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month over Month: -0.4%

Following the great stimulus distortions of March and April, retail sales are expected to settle down in May especially for autos. Econoday's consensus is a 0.4 percent fall overall with ex-autos, however, seen rising 0.5 percent and ex-auto ex-gas at an expected 0.2 percent gain.

US Industrial Production for May (Tue 13:15 GMT; Tue 09:15 EDT)

Consensus Forecast, Month over Month: 0.6%

US Manufacturing Output

Consensus Forecast, Month over Month: 0.4%

A 0.6 percent rise in industrial production is the consensus for May following April's 0.7 percent monthly gain. Manufacturing output for May, which in April was held back by weakness in vehicle production, is seen up 0.4 percent.

Japanese Machinery Orders for April (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Month over Month: 2.5%

Consensus Forecast, Year over Year: 8.0%

Machinery orders are expected to rise 2.5 percent on the month in April for year-over-year expansion of 8.0 percent.

Japanese Merchandise Trade for May (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast: -¥90.0 billion

Consensus Forecast, Imports Y/Y: 27.0%

Consensus Forecast, Exports Y/Y: 51.0%

Forecasters see Japan's merchandise trade balance coming in at a ¥90.0 billion deficit in May following a larger-than-expected surplus of ¥255.3 billion in April.

Chinese Fixed Asset Investment for May (Wed 02:00 GMT; Wed 10:00 CST; Tue 22:00 EDT)

Consensus Forecast, Year-to-Date on Y/Y Basis: 16.8%

A 16.8 percent gain is May's estimate for Chinese fixed asset investment which, on the year-to-date year-over-year basis used for this indicator, was up 19.9 percent in April.

Chinese Industrial Production for May (Wed 02:00 GMT; Wed 10:00 CST; Tue 22:00 EDT)

Consensus Forecast, Year over Year: 8.9%

Industrial production in May is expected to continue slow, to 8.9 percent annual growth from 9.8 percent in April.

Chinese Retail Sales for May (Wed 02:00 GMT; Wed 10:00 CST; Tue 22:00 EDT)

Consensus Forecast, Year over Year: 14.0%

Growth in retail sales slowed more than expected in April, to 17.7 percent on a year-over-year basis versus expectations for 25.0 percent. Annual growth in May is expected to slow to 14.0 percent.

UK CPI for May (Wed 06:00 GMT; Wed 07:00 BST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 1.8%

Consumer prices were slightly stronger than expected in April, up 0.6 percent on the month and 1.5 percent on the year. The consensus for May is a monthly increase of 0.3 percent for an annual rate of 1.8 percent.

UK PPI for May (Wed 06:00 GMT; Wed 07:00 BST; Wed 02:00 EDT)

Consensus Forecast, Input Prices - M/M: 1.1%

Consensus Forecast, Output Prices - M/M: 0.4%

Input costs are seen rising a further 1.1 percent on the month in May with output prices expected to climb 0.4 percent.

US Housing Starts for May (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Annual Rate: 1.630 million

US Building Permits

Consensus Forecast: 1.750 million

A 1.630 million annual rate is expected for May starts versus April's 1.569 million rate; permits are seen at 1.750 million versus 1.760 million. Permits and especially starts were lower than expected in April.

Canadian CPI for May (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 3.5%

After rising more sharply than expected in April, growth in consumer prices is expected to hold steady in May: forecasters are calling for a 0.5 percent increase on the month, matching April's 0.5 percent gain, and 3.5 percent on the year which would compare with 3.4 percent.

US Federal Reserve Announcement (Wed 18:00 GMT; Wed 14:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Policy Range: 0.0% to 0.25%

With inflation now spiking but, presumably, on a one-time basis, there are no expectations for a change in the funds target centered at 0.125 percent between a zero and 0.25 percent corridor and there are no expectations for any tapering in QE ($120 billion per month).

Australian Labour Force Survey for May (Thu 01:30 GMT; Thu 11:30 AEST; Wed 21:30 EDT)

Consensus Forecast, Unemployment Rate: 5.5%

Consensus Forecast, Employment: 30,000

May’s consensus forecasts are 5.5 percent for the unemployment rate, unchanged from April, and an increase of 30,000 in employment following a decline of 30,600 in April.

Swiss National Bank Monetary Policy Assessment (Thu 07:30 GMT; Thu 09:30 CEST; Thu 03:30 EDT)

Consensus Forecast, Change: 0.0 basis points

Consensus Forecast, Level: -0.75%

The Swiss National Bank is expected to keep its key deposit rate at minus 0.75 percent. At its last meeting in March, the bank made no change in its policy rate but moderated its stance on FX intervention to hold down the Swiss franc.

Japanese Consumer Price Index for May (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast, Month over Month: -0.2

Consensus Forecast, Year over Year: -0.3%

Consensus Forecast Ex-Food, Month over Month: 0.1%

Consensus Forecast Ex-Food, Year over Year: 0.0%

Forecasters expect price weakness to persist in May, calling for a 0.2 percent monthly decline overall for a minus 0.3 percent annual rate. The ex-food reading is seen at plus 0.1 percent on the month for no change on the year.

Bank of Japan Announcement (Anytime Friday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

The Bank of Japan is committed to aggressive stimulus and since early 2016 has kept its policy rate unchanged at minus 0.1 percent. Officials in their last statement in April reaffirmed their commitment that monetary policy will remain highly accommodative until inflation reaches and then stabilizes above their 2.0 percent target level.

German PPI for May (Fri 6:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 6.2%

Producer prices are expected to rise 0.6 percent in May after posting an as-expected 0.8 percent monthly increase in April. Consensus for annual growth is 6.2 percent in May versus April's 5.2 percent.

UK Retail Sales for May (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 2.0%

After a very robust 9.2 percent monthly gain in April, retail sales in May are expected to rise 2.0 percent.

|