|

The US and Canada may be going on two separate paths when it comes to reopenings but they're both going the same way when it comes to employment, and that's not good news. Even if a jump in consumer inflation proves sustained, a shallow recovery for the labor markets would likely force central bankers to keep any asset tapering in the great distance. Not all of the week's news was bad, but unfortunately that's where we'll start.

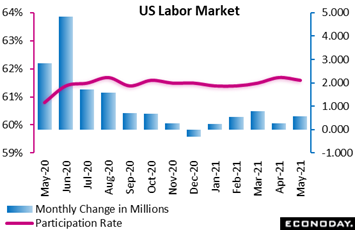

Job growth in the US is not meeting expectations, raising uncomfortable questions whether emergency stimulus from the federal government is numbing incentives among the unemployed. Nonfarm payrolls rose 559,000 in May, nearly 100,000 below the consensus and toward the low end of Econoday's consensus range. The participation rate actually fell in the month by 1 tenth to 61.6 percent in a revealing indication that incentives not to work may be proving too great. Job growth in the US is not meeting expectations, raising uncomfortable questions whether emergency stimulus from the federal government is numbing incentives among the unemployed. Nonfarm payrolls rose 559,000 in May, nearly 100,000 below the consensus and toward the low end of Econoday's consensus range. The participation rate actually fell in the month by 1 tenth to 61.6 percent in a revealing indication that incentives not to work may be proving too great.

Yet there is definitely recovery underway in the labor market led by leisure and hospitality where payrolls rose 292,000 versus an even greater rise of 328,000 in April. Health care and social assistance also added payroll jobs, up 45,800 in May though other sectors were mixed: manufacturing up 23,000 which was 14,000 shy of Econoday's consensus; construction, despite strong demand in the sector, was down 20,000, and retail trade fell 5,800.

The inevitable takeaway from May's report is that recovery in the labor market is not matching recovery underway in general demand, a situation that may further strain capacity and may well lead to relative shortages and related inflationary pressures. The results also raise the question whether federal stimulus is excessive and may need to be scaled back. For monetary policy, the results point to the need for an extended period of low interest rates and untapered asset purchases.

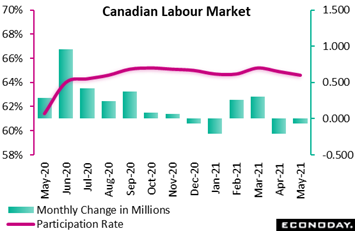

Emergency stimulus has also been heavy in Canada whose employment reports have largely shadowed those of the US during the pandemic. The country's labour market was once again weaker than expected in May as employment contracted a further 68,000 on the month, deeper than Econoday's consensus for a 20,000 decline. The cumulative drop for the past two months totals 275,100, partially erasing February/March gain of 562,300. The participation rate fell to 64.6 percent from 64.9 percent, with the number of discouraged job seekers remaining high. And details don't offer any offset, with deterioration across the different measures of the labour market state: part-time, full-time, private sector, public sector, goods and services industries, all recorded lower employment in the month. May's report is a reminder of the bumpy road to full recovery, and could lead the Bank of Canada to pause longer before further tapering its quantitative easing especially as the country, in contrast to the US, is still under lockdown. Emergency stimulus has also been heavy in Canada whose employment reports have largely shadowed those of the US during the pandemic. The country's labour market was once again weaker than expected in May as employment contracted a further 68,000 on the month, deeper than Econoday's consensus for a 20,000 decline. The cumulative drop for the past two months totals 275,100, partially erasing February/March gain of 562,300. The participation rate fell to 64.6 percent from 64.9 percent, with the number of discouraged job seekers remaining high. And details don't offer any offset, with deterioration across the different measures of the labour market state: part-time, full-time, private sector, public sector, goods and services industries, all recorded lower employment in the month. May's report is a reminder of the bumpy road to full recovery, and could lead the Bank of Canada to pause longer before further tapering its quantitative easing especially as the country, in contrast to the US, is still under lockdown.

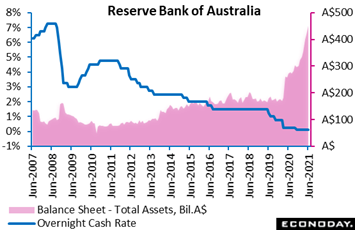

The week's results mostly contrast with the prior week's upbeat news that included a shift higher in the Reserve Bank of New Zealand's forecasts. But new optimism was missing in the Reserve Bank of Australia's announcement in the latest week, as the RBA held its policy rate steady at 0.10 percent and reiterated that, at its meeting next month, it will consider whether to introduce a new round of bond purchases once they complete the current round worth A$100 billion in September. Officials will also decide at their July meeting whether to keep using the government bond that matures in April 2024 for their 3-year target yield or whether to change to the next bond that matures in November 2024. Making such a change could signal that officials do not expect policy rates to rise until late 2024, whereas making no change would indicate that they expect policy rates to start to rise earlier in 2024. The week's results mostly contrast with the prior week's upbeat news that included a shift higher in the Reserve Bank of New Zealand's forecasts. But new optimism was missing in the Reserve Bank of Australia's announcement in the latest week, as the RBA held its policy rate steady at 0.10 percent and reiterated that, at its meeting next month, it will consider whether to introduce a new round of bond purchases once they complete the current round worth A$100 billion in September. Officials will also decide at their July meeting whether to keep using the government bond that matures in April 2024 for their 3-year target yield or whether to change to the next bond that matures in November 2024. Making such a change could signal that officials do not expect policy rates to rise until late 2024, whereas making no change would indicate that they expect policy rates to start to rise earlier in 2024.

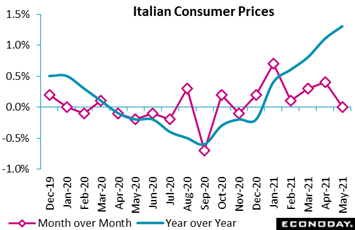

Outside the US, where reopenings are contributing to a sudden jump in month-over-month inflation readings, inflation in other major economies is looking surprisingly tame. Yes, annual readings are climbing but this is a comparison effect against the beginning of last year's lockdown. Monthly readings aren't showing much lift at all including Italy whose CPI for May, in an unexpected result, was unchanged. Outside of energy, components were mixed reflected in the core which posted a second straight and decidedly moderate 0.3 percent gain. The overall annual rate did rise 2 tenths but the 1.3 percent rate was also below expectations. Consumer prices in Italy remain soft - in line with the pattern seen across the Eurozone as a whole. Outside the US, where reopenings are contributing to a sudden jump in month-over-month inflation readings, inflation in other major economies is looking surprisingly tame. Yes, annual readings are climbing but this is a comparison effect against the beginning of last year's lockdown. Monthly readings aren't showing much lift at all including Italy whose CPI for May, in an unexpected result, was unchanged. Outside of energy, components were mixed reflected in the core which posted a second straight and decidedly moderate 0.3 percent gain. The overall annual rate did rise 2 tenths but the 1.3 percent rate was also below expectations. Consumer prices in Italy remain soft - in line with the pattern seen across the Eurozone as a whole.

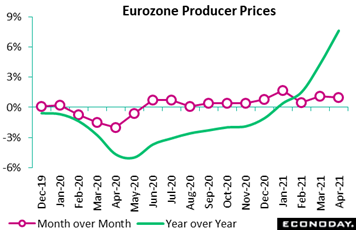

Yet producer prices, in contrast to consumer prices, are rising sharply. Excluding construction, the Eurozone's PPI rose a monthly 1.0 percent monthly which was slightly steeper than expected. With year-ago base effects very soft, the annual inflation rate surged from 4.3 percent to 7.6 percent, its highest mark in 13 years. Energy again provided a sizeable boost to the overall monthly change but even excluding this category, prices were still up a sizeable 0.9 percent, matching their March advance and raising the annual underlying rate from 2.3 percent to 3.5 percent. Regionally, national PPIs recorded monthly increases in most member states especially Spain where the annual rate is 12.8 percent; France, at minus 0.3 percent, was a notable exception. Growing dislocations in supply chains and lengthening vendor delivery times are combining with high activity rates to pose a genuine threat to the near-term inflation outlook, at least at the producer level. How much this is passed through to the consumer has yet to play out. Yet producer prices, in contrast to consumer prices, are rising sharply. Excluding construction, the Eurozone's PPI rose a monthly 1.0 percent monthly which was slightly steeper than expected. With year-ago base effects very soft, the annual inflation rate surged from 4.3 percent to 7.6 percent, its highest mark in 13 years. Energy again provided a sizeable boost to the overall monthly change but even excluding this category, prices were still up a sizeable 0.9 percent, matching their March advance and raising the annual underlying rate from 2.3 percent to 3.5 percent. Regionally, national PPIs recorded monthly increases in most member states especially Spain where the annual rate is 12.8 percent; France, at minus 0.3 percent, was a notable exception. Growing dislocations in supply chains and lengthening vendor delivery times are combining with high activity rates to pose a genuine threat to the near-term inflation outlook, at least at the producer level. How much this is passed through to the consumer has yet to play out.

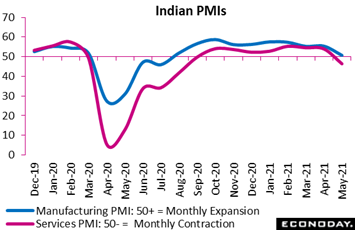

PMIs were some of the week's most important reports including the first look at May conditions in India and China. India, of course, is of special interest and the damage from the ongoing Covid spike, on the whole, looks indeed significant, especially at least for the services sector where the PMI dropped more than 7 points to a sub-50 level of 46.4 that indicates sizable contraction relative to April. Respondents reported the first drop in new orders in eight months, the sharpest decline in new export orders in six months, and the sixth consecutive decline in payrolls. The survey's measure of business confidence indicates sentiment remained positive but fell to its lowest level since August 2020. The survey indicates that profit margins for the services sample tightened in May, with input costs rising at a strong pace and selling prices only increased marginally. The country's manufacturing PMI slowed sharply, that is holding over the 50 line at 50.8 to indicate only modest monthly growth but well down from April's 55.5 pace. The results confirm that the escalation in infections and the associated tightening of public health restrictions are having a material impact on economic conditions. PMIs were some of the week's most important reports including the first look at May conditions in India and China. India, of course, is of special interest and the damage from the ongoing Covid spike, on the whole, looks indeed significant, especially at least for the services sector where the PMI dropped more than 7 points to a sub-50 level of 46.4 that indicates sizable contraction relative to April. Respondents reported the first drop in new orders in eight months, the sharpest decline in new export orders in six months, and the sixth consecutive decline in payrolls. The survey's measure of business confidence indicates sentiment remained positive but fell to its lowest level since August 2020. The survey indicates that profit margins for the services sample tightened in May, with input costs rising at a strong pace and selling prices only increased marginally. The country's manufacturing PMI slowed sharply, that is holding over the 50 line at 50.8 to indicate only modest monthly growth but well down from April's 55.5 pace. The results confirm that the escalation in infections and the associated tightening of public health restrictions are having a material impact on economic conditions.

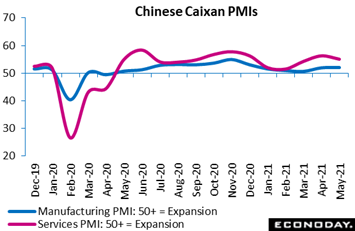

Two full sets of PMIs were released in China and show the same results, that is an extension of modest-to-moderate growth. We'll look at Caixan's set of data where the services PMI slowed by 1.2 points to what is nevertheless a still healthy 55.1. Service sector respondents reported slower but still solid growth for both new orders and employment but a decline in new export orders and a drop in the survey's measure of business confidence. Input costs were reported to have risen at a faster pace in May while respondents here reported a bigger increase in selling prices. Caixan's manufacturing PMI held nearly unchanged in May, at a subdued 52.0. New orders picked up only a bit but did include a six-month best for export sales. Production, though rising in the month, slowed relative to the prior month. Supplier delays, shortages, and sharp increases in input costs were the common complaints from the sample which, however, isn't complaining about pass through to customers as selling prices rose at the quickest rate in just more than a decade. Like other manufacturing surveys, Caixan's sample is drawing down current inventories to keep production going: employment was flat on the month despite a third straight build in backlogs. Optimism in the sample, due to the rising costs and what the report describes as pandemic uncertainty, dipped to a four-month low. Two full sets of PMIs were released in China and show the same results, that is an extension of modest-to-moderate growth. We'll look at Caixan's set of data where the services PMI slowed by 1.2 points to what is nevertheless a still healthy 55.1. Service sector respondents reported slower but still solid growth for both new orders and employment but a decline in new export orders and a drop in the survey's measure of business confidence. Input costs were reported to have risen at a faster pace in May while respondents here reported a bigger increase in selling prices. Caixan's manufacturing PMI held nearly unchanged in May, at a subdued 52.0. New orders picked up only a bit but did include a six-month best for export sales. Production, though rising in the month, slowed relative to the prior month. Supplier delays, shortages, and sharp increases in input costs were the common complaints from the sample which, however, isn't complaining about pass through to customers as selling prices rose at the quickest rate in just more than a decade. Like other manufacturing surveys, Caixan's sample is drawing down current inventories to keep production going: employment was flat on the month despite a third straight build in backlogs. Optimism in the sample, due to the rising costs and what the report describes as pandemic uncertainty, dipped to a four-month low.

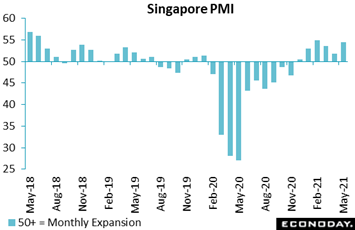

May's PMI was also posted for Singapore which for this country rolls all the sectors into one. Conditions accelerated noticeably in May, rising 2.6 points to 54.4 despite the re-imposition of public heath restrictions around the middle of the month. Survey respondents reported solid increases in output and new orders, while new export orders also rose after falling the previous month. The survey indicates, however, that payrolls fell in May while its measure of business confidence dropped to a nine-month low. Respondents also reported stronger price pressures, with input costs showing the fastest growth since June 2018 and selling prices were reported to have risen for the fourth month in a row. May's PMI was also posted for Singapore which for this country rolls all the sectors into one. Conditions accelerated noticeably in May, rising 2.6 points to 54.4 despite the re-imposition of public heath restrictions around the middle of the month. Survey respondents reported solid increases in output and new orders, while new export orders also rose after falling the previous month. The survey indicates, however, that payrolls fell in May while its measure of business confidence dropped to a nine-month low. Respondents also reported stronger price pressures, with input costs showing the fastest growth since June 2018 and selling prices were reported to have risen for the fourth month in a row.

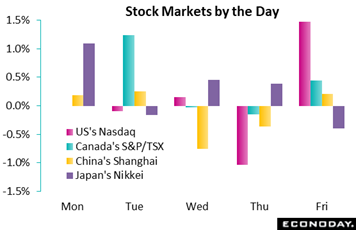

The weak job reports on Friday didn't hold back either US or Canadian stocks, both rising on the diminished risk of asset tapering. News early in the week included gains for Chinese health care stocks, boosted by the government's announcement that couples will now be allowed to have three children, up from two. Japanese equities had a positive week as vaccinations in the country gather steam; here the reopening trade gave a lift to railways, food, and beer makers. In the US, meme stocks were back in focus as retail traders teamed up again to push video-game maker Gamestop and cinema chain AMC Entertainment sharply higher. In US fiscal news, the market keyed on reports Thursday that President Biden would accept a 15 percent floor on corporate taxes rather than raising the tax rate to 28 percent from 21 percent; reports also said Biden is pushing a downsized $1 trillion infrastructure plan that would be in line with Republican proposals. Chinese shares lost momentum on Thursday following the weaker-than-expected service sector PMI that included rising prices. The weak job reports on Friday didn't hold back either US or Canadian stocks, both rising on the diminished risk of asset tapering. News early in the week included gains for Chinese health care stocks, boosted by the government's announcement that couples will now be allowed to have three children, up from two. Japanese equities had a positive week as vaccinations in the country gather steam; here the reopening trade gave a lift to railways, food, and beer makers. In the US, meme stocks were back in focus as retail traders teamed up again to push video-game maker Gamestop and cinema chain AMC Entertainment sharply higher. In US fiscal news, the market keyed on reports Thursday that President Biden would accept a 15 percent floor on corporate taxes rather than raising the tax rate to 28 percent from 21 percent; reports also said Biden is pushing a downsized $1 trillion infrastructure plan that would be in line with Republican proposals. Chinese shares lost momentum on Thursday following the weaker-than-expected service sector PMI that included rising prices.

Despite the downbeat jobs results, Econoday's consensus divergence for the US is nevertheless in the plus column at 10 to indicate that forecasters have, by and large, been slightly overestimating the strength of the country's economic data. In fact, none of the indexes are currently in the negative column, suggesting that global projections from central banks and international institutions may well need to be upgraded. That certainly appears to be the case for the UK where the index, currently at 36, has been well into plus column for the last six weeks. And Germany, long steady near zero, is beginning to move noticeably higher at plus 21, as is France, also long steady and now at plus 11 as is Canada. And Italy, which had been sliding lower, is on the rebound at plus 14. China heads into next week's data, which will include inflation updates, at plus 7 while Switzerland is also in the plus column at 4. The Eurozone as whole is similarly in the plus column at 8.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

Unless the Bank of Canada on Wednesday or the European Central Bank on Thursday surprise everyone by tapering asset purchases, the most market-moving news of the week looks to be Chinese and US consumer prices both on Thursday, the former not expected to show much pressure but the latter perhaps so. Switzerland opens the CPI data on Monday and though pressures here are expected to pick up, forecasters don't see much chance of any shocking results. Chinese merchandise trade opens the week on Monday and the only question will be how much the country's imports and exports are surging. Jobs data won't dominate events as they did in the prior week but will include unemployment updates from Switzerland on Monday and US jobless claims on Thursday. German data will open with manufacturers' orders on Monday and both industrial production and the ZEW survey on Tuesday. France will post industrial production on Thursday and the UK both industrial production and monthly GDP on Friday.

Chinese Merchandise Trade Balance for May (Estimated for Monday local time, release time not set)

Consensus Forecast: US$50.5 billion

Consensus Forecast: Imports - Y/Y: 50.0%

Consensus Forecast: Exports - Y/Y: 32.0%

Imports and exports have been surging, up 43.1 percent and 32.3 percent on the year in April with gains of 50.0 and 32.0 percent expected in May. The trade surplus in May is seen at US$50.5 billion.

Swiss Unemployment Rate for May (Mon 05:45 GMT; Mon 07:45 CEST; Mon 01:45 EDT)

Consensus Forecast, Adjusted: 3.1%

The unemployment rate has been much lower than expected the past two reports. May's adjusted rate is expected to hold unchanged at 3.1 percent.

German Manufacturers' Orders for April (Mon 06:00 GMT; Mon 08:00 CEST; Mon 02:00 EDT)

Consensus Forecast, Month over Month: 1.0%

Orders rose solidly each month of the first quarter and a good start is expected for the second quarter as well; forecasters are looking for a 1.0 percent increase for April.

Swiss CPI for May (Mon 06:30 GMT; Mon 08:30 CEST; Mon 02:30 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 0.6%

Consumer prices, at an annual plus 0.3 percent, emerged from annual contraction in April and are expected to move further above the zero line in May as well, to a consensus 0.6 percent. Month-over-month the consensus is plus 0.3 percent versus April's 0.2 percent.

German Industrial Production for April (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast, Month over Month: 0.7%

Industrial production is expected to rise 0.7 percent on the month in April. This report beat expectations in March with a 2.5 percent rise but missed expectations in both February and January with sharp declines.

Germany: ZEW Survey for June (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Current Conditions: 85.3

Consensus Forecast, Economic Sentiment: -28.0

May's results exceeded expectations, at 84.4 for economic sentiment and minus 40.1 for current conditions. Forecasters see further improvement for June, at a consensus 85.3 for sentiment and minus 28.0 for current conditions.

Bank of Canada Announcement (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Bank of Canada is expected to hold rates steady at plus 0.25 percent. Whether, however, it tapers asset purchases once again, as it did at its last meeting in April and it first did in October last year, or signals that it may at its next meeting in July, is probably unlikely given weakness in the labour market.

Chinese CPI for May (Thu 01:30 GMT; Thu 09:30 CST; Wed 21:30 EDT)

Consensus Forecast, Month over Month: -0.2%

Consensus Forecast, Year over Year: 1.5%

Chinese consumer prices in May are expected to decrease 0.2 percent on the month for 1.5 percent growth on the year. The month-over-month rate in April fell 0.3 percent for a year-over-year increase of 0.9 percent, both slightly below expectations.

Chinese PPI for May (Thu 01:30 GMT; Thu 09:30 CST; Wed 21:30 EDT)

Consensus Forecast, Year over Year: 8.3%

Producer prices have exceeded expectations the past two reports, the last for April when the month-over-month rate rose 0.9 percent and the year-over-year rate 6.8 percent. Expectations for May are an annual rate of 8.3 percent.

French Industrial Production for April (Thu 06:45 GMT; Thu 08:45 CEST; Thu 02:45 EDT)

Consensus Forecast, Month over Month: 0.5%

Industrial production in April is expected to rise a monthly 0.5 percent following March's unexpectedly soft gain of 0.8 percent.

European Central Bank Announcement (Thu 11:45 GMT; Thu 13:45 CEST; Thu 07:45 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

Covid restrictions may be lifting and vaccinations picking up, but the European Central Bank is not expected to make any policy moves at all.

US CPI for May (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 4.6%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 3.4%

Forecasters see moderation in May following April's enormous acceleration headlined by a 0.8 percent monthly rise overall that was topped by a giant 0.9 percent spike for the core. Econoday's consensus estimates for May are monthly 0.4 percent increases overall and also for the core, the latter would still be significantly elevated.

US Initial Jobless Claims for the June 5 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 369,000

Jobless claims for the June 5 week are expected to come in at 369,000 versus 385,000 in the May 29 week. Initial filings have been moving steadily lower.

US Treasury Statement for May (Thu 18:00 GMT; Thu 14:00 EDT)

Consensus Forecast: -$230.0 billion

Econoday's consensus for the Treasury's monthly deficit in May is $230.0 billion which would compare with a stimulus-swollen deficit of $225.6 billion in April and against a similarly stimulus-swollen deficit of $398.8 billion in May last year. Seven months into the government's fiscal year in April, the deficit, at $1.932 trillion, was 30 percent deeper than the same period a year ago.

UK Industrial Production for April (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 1.2%

Consensus Forecast, Year over Year: 29.6%

UK industrial production in April, which beat expectations significantly in March with a 1.8 percent gain, is expected to rise a monthly 1.2 percent for annual comparison-skewed growth of 29.6 percent.

UK GDP for April (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 2.4%

The April estimate for GDP is month-over-month growth of 2.4 percent which would exceed surprisingly strong growth of 2.1 percent in March.

US Consumer Sentiment Index, Preliminary June (Fri 14:00 GMT; Fri 10:00 EDT)

Consensus Forecast: 84.0

Pulled down by surging inflation expectations, consumer sentiment fell more than 5 points in May to 82.9. And forecasters don't expect June's preliminary reading to show much improvement, at a consensus 84.0.

|