|

There will be an awakening which may prove more sudden than gradual, that emergency stimulus, no matter how incrementally, will have to be withdrawn. This inevitability, to say the least, will arguably put at risk continued gains for global stocks where many indexes have rallied freely, as much as 50 percent during the Great Pandemic. When will the rug be pulled out from under the market? A key factor to watch will be inflation and whether expectations for higher prices continue to build and whether these expectations begin to fulfill themselves. For now, inflation data are a scrambled hash of everything, but there's one central bank which isn't taking any chances.

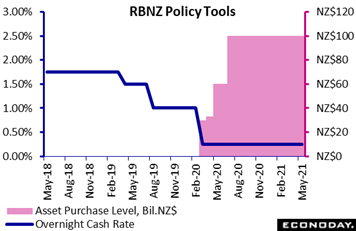

The Reserve Bank of New Zealand left its official cash rate unchanged as expected at 0.25 percent and kept the upper limit for asset purchases at NZ$100 billion. What was not expected was the bank's rate projection, starting its ascent in September 2022 and rising to 1.5 percent by the end of 2023. RBNZ officials suspended projections last year as they cut their policy rate toward zero, citing at the time "operational constraints" that would preclude a negative rate. The bank's actual assessment of current conditions was little changed: global and domestic economic conditions have continued to improve in recent months though uncertainty over the near-term outlook remains. The Reserve Bank of New Zealand left its official cash rate unchanged as expected at 0.25 percent and kept the upper limit for asset purchases at NZ$100 billion. What was not expected was the bank's rate projection, starting its ascent in September 2022 and rising to 1.5 percent by the end of 2023. RBNZ officials suspended projections last year as they cut their policy rate toward zero, citing at the time "operational constraints" that would preclude a negative rate. The bank's actual assessment of current conditions was little changed: global and domestic economic conditions have continued to improve in recent months though uncertainty over the near-term outlook remains.

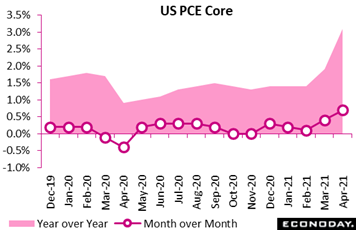

The RBNZ said it would hold policy steady until officials are confident that inflation will hold at their 2 percent target. Like other central banks, the US Federal Reserve remains confident that the spike underway, which is lifting prices over their target, will prove "transitory", the result of a one-time burst of activity ignited by the easing of restrictions and fed by emergency stimulus. As expected, the PCE price index, the Fed's central price gauge, rose 0.6 percent on the month in April, lifting the 12-month rate to 3.6 percent from 2.4 percent in March, the largest increase since September 2008. The core index, excluding food and energy, also accelerated sharply, rising 0.7 percent after 0.4 percent in March. This 12-month rate rose to 3.1 percent from 1.9 percent, a level not seen since all the way back in July 1992. Though the Fed expects one-time factors to fade, there's always the risk that rising prices could begin to feed a self-fulfilling spike in inflation expectations which by the University of Michigan's measure surged 1.2 percentage points in May to 4.6 percent. The next US inflation indication will be average hourly earnings in the coming week's employment report for May; yet this reading has been unrecognizably distorted by the loss of low wage service jobs. The next actionable reading will be the week after with May's CPI on June 10. The RBNZ said it would hold policy steady until officials are confident that inflation will hold at their 2 percent target. Like other central banks, the US Federal Reserve remains confident that the spike underway, which is lifting prices over their target, will prove "transitory", the result of a one-time burst of activity ignited by the easing of restrictions and fed by emergency stimulus. As expected, the PCE price index, the Fed's central price gauge, rose 0.6 percent on the month in April, lifting the 12-month rate to 3.6 percent from 2.4 percent in March, the largest increase since September 2008. The core index, excluding food and energy, also accelerated sharply, rising 0.7 percent after 0.4 percent in March. This 12-month rate rose to 3.1 percent from 1.9 percent, a level not seen since all the way back in July 1992. Though the Fed expects one-time factors to fade, there's always the risk that rising prices could begin to feed a self-fulfilling spike in inflation expectations which by the University of Michigan's measure surged 1.2 percentage points in May to 4.6 percent. The next US inflation indication will be average hourly earnings in the coming week's employment report for May; yet this reading has been unrecognizably distorted by the loss of low wage service jobs. The next actionable reading will be the week after with May's CPI on June 10.

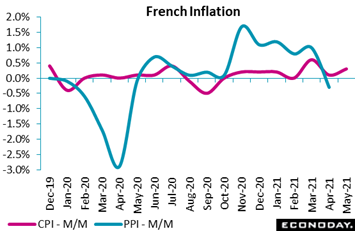

Annual readings are being uselessly skewed by the easy comparisons with the vast shutdowns this time last year. This distortion turns our focus to month-over-month comparisons which, of course, exclude last year's results, and in France, in contrast to the US, the readings aren't terrifying at all. Consumer prices rose in line with market expectations in very timely data for the month of May, at 0.3 percent on the month from only 0.1 percent in April. Producer prices, in an update for April, actually fell 0.3 percent on the month in France, though base effects with last year put the annual rate at a 7.3 percent level which we'll ignore. Restrictions in France, in contrast to the US, continue to hold down activity including inflation where pressures remain limited, at least for now. Annual readings are being uselessly skewed by the easy comparisons with the vast shutdowns this time last year. This distortion turns our focus to month-over-month comparisons which, of course, exclude last year's results, and in France, in contrast to the US, the readings aren't terrifying at all. Consumer prices rose in line with market expectations in very timely data for the month of May, at 0.3 percent on the month from only 0.1 percent in April. Producer prices, in an update for April, actually fell 0.3 percent on the month in France, though base effects with last year put the annual rate at a 7.3 percent level which we'll ignore. Restrictions in France, in contrast to the US, continue to hold down activity including inflation where pressures remain limited, at least for now.

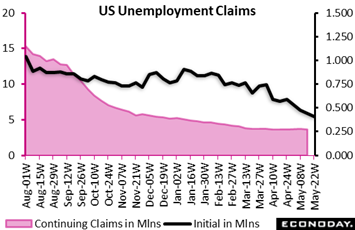

Perhaps the biggest surprise in recent data was April's stagnant results for the US labor market which, however, may turn around significantly in the approaching report for May. This was signaled in the latest week by exceptionally strong job-market assessments in the US consumer confidence report as well as extending declines for jobless claims. Initial claims fell 38,000 to 406,000 in the May 22 week to come in below Econoday's consensus range. Initial claims are at new pandemic lows as are continuing claims, down 96,000 in lagging data for the May 15 week to 3.642 million which pulled down the unemployment rate for insured workers by another tick to 2.6 percent. This rate stood at 1.2 percent going into the pandemic early last year. May's employment report will be posted on Friday, June 4. Perhaps the biggest surprise in recent data was April's stagnant results for the US labor market which, however, may turn around significantly in the approaching report for May. This was signaled in the latest week by exceptionally strong job-market assessments in the US consumer confidence report as well as extending declines for jobless claims. Initial claims fell 38,000 to 406,000 in the May 22 week to come in below Econoday's consensus range. Initial claims are at new pandemic lows as are continuing claims, down 96,000 in lagging data for the May 15 week to 3.642 million which pulled down the unemployment rate for insured workers by another tick to 2.6 percent. This rate stood at 1.2 percent going into the pandemic early last year. May's employment report will be posted on Friday, June 4.

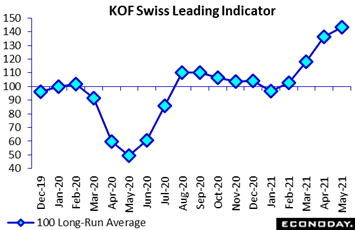

One of the biggest surprises in the global data has been how well Switzerland is doing as the country gradually reopens. Following impressive surges in March and April, KOF's leading indicator continued to climb sharply in May, jumping a further 6.8 points to a new record high of 143.2 and some 43.2 points above its long-run average. The ongoing advance has largely been due to improving conditions in manufacturing, notably in textile and clothing and chemicals, pharmaceuticals and plastics. Foreign orders have been particularly strong. Yet services are also on the rise, especially accommodation and food. In fact, the only area of weakness has been private consumption which lost a little ground. One of the biggest surprises in the global data has been how well Switzerland is doing as the country gradually reopens. Following impressive surges in March and April, KOF's leading indicator continued to climb sharply in May, jumping a further 6.8 points to a new record high of 143.2 and some 43.2 points above its long-run average. The ongoing advance has largely been due to improving conditions in manufacturing, notably in textile and clothing and chemicals, pharmaceuticals and plastics. Foreign orders have been particularly strong. Yet services are also on the rise, especially accommodation and food. In fact, the only area of weakness has been private consumption which lost a little ground.

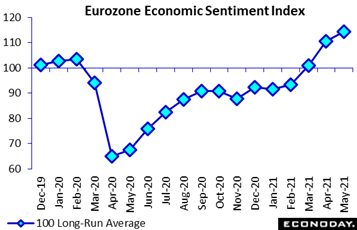

Lack of strength in private consumption raises the separation underway between consumer confidence, which is struggling, and business confidence which is taking off. The EU Commission's economic sentiment index rose another 4 points in May to a much higher than expected 114.5. This index has advanced more than 21 points in the last three months. It also leaves the gauge even further above its 100 long-run average and 10.5 points higher than its pre-pandemic level in February 2020. May's strength was broad-based across sectors including services, construction and retail trade. The national indexes are led by Italy at 115.8 with Germany at 111.2, France at 110.8, and Spain at 108.3. Inflation developments were similarly firm and, most notably, expected selling prices in manufacturing surged to a new record high. Services rose for a third straight month while household inflation expectations increased for a fifth straight month. The update further boosts the likelihood of a sharp rebound in Eurozone GDP growth this quarter and may also add a few decibels to calls among the ECB hawks to begin QE tapering sooner than later. Lack of strength in private consumption raises the separation underway between consumer confidence, which is struggling, and business confidence which is taking off. The EU Commission's economic sentiment index rose another 4 points in May to a much higher than expected 114.5. This index has advanced more than 21 points in the last three months. It also leaves the gauge even further above its 100 long-run average and 10.5 points higher than its pre-pandemic level in February 2020. May's strength was broad-based across sectors including services, construction and retail trade. The national indexes are led by Italy at 115.8 with Germany at 111.2, France at 110.8, and Spain at 108.3. Inflation developments were similarly firm and, most notably, expected selling prices in manufacturing surged to a new record high. Services rose for a third straight month while household inflation expectations increased for a fifth straight month. The update further boosts the likelihood of a sharp rebound in Eurozone GDP growth this quarter and may also add a few decibels to calls among the ECB hawks to begin QE tapering sooner than later.

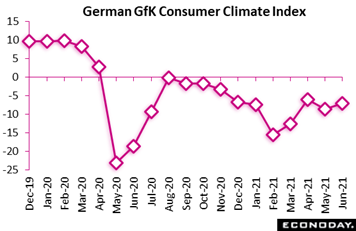

The rise underway in inflation expectations, and its implications for purchasing power, is no doubt a factor holding down consumer sentiment. June's outlook in Germany's GfK survey posted only a small advance to minus 7.0. Yet not all the news was bad as economic expectations moved to a 2-year high with income expectations in turn also improving. Nevertheless the propensity to buy, in a downbeat indication for consumer spending, surprisingly fell for the first time in four months in a reminder that Germany's economy has yet to fully reopen. And turning to the US, where reopenings are in full swing, readings are doing no better, with both the consumer confidence and consumer sentiment indexes still substantially below where they were in February last year. The rise underway in inflation expectations, and its implications for purchasing power, is no doubt a factor holding down consumer sentiment. June's outlook in Germany's GfK survey posted only a small advance to minus 7.0. Yet not all the news was bad as economic expectations moved to a 2-year high with income expectations in turn also improving. Nevertheless the propensity to buy, in a downbeat indication for consumer spending, surprisingly fell for the first time in four months in a reminder that Germany's economy has yet to fully reopen. And turning to the US, where reopenings are in full swing, readings are doing no better, with both the consumer confidence and consumer sentiment indexes still substantially below where they were in February last year.

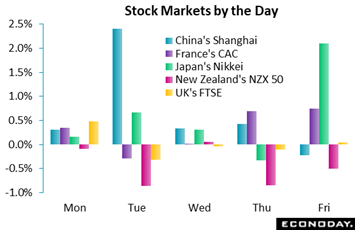

China opened the week in strong fashion, cracking down on speculators in commodities and cryptocurrencies, including bitcoin mining. The government warned companies against commodity hoarding and other speculative behavior as well. Also early in the week, ECB President Christine Lagarde appeared to downplay prospects for near-term tapering in asset purchases, raising the prospect of an extended period of low interest rates in comments that capped bank stocks in the process. Japanese markets posted solid gains despite the extension of Covid restrictions that are not only threatening the Olympics but also the country's economic recovery. Restrictions in the US are increasingly a thing of the past in contrast to emergency stimulus which just keeps building; cyclicals in the US got a boost on Thursday from reports that the Biden administration will propose an upsized $6 trillion budget for the coming fiscal year at the same time that congressional Republicans are offering their own $1 trillion infrastructure spending plan. Stimulus in New Zealand, however, may be fading based on the country's central bank whose forecasts for higher rates pushed the NZX 50 down 1.9 percent in what was the only weekly decline for any of the major global indexes. And stimulus withdrawal in the UK may also be in play after Gertjan Vlieghe, a member of the Bank of England’s Monetary Policy Committee, said on Friday that a rate hike could come late next year if the economy continues to recover as expected. China opened the week in strong fashion, cracking down on speculators in commodities and cryptocurrencies, including bitcoin mining. The government warned companies against commodity hoarding and other speculative behavior as well. Also early in the week, ECB President Christine Lagarde appeared to downplay prospects for near-term tapering in asset purchases, raising the prospect of an extended period of low interest rates in comments that capped bank stocks in the process. Japanese markets posted solid gains despite the extension of Covid restrictions that are not only threatening the Olympics but also the country's economic recovery. Restrictions in the US are increasingly a thing of the past in contrast to emergency stimulus which just keeps building; cyclicals in the US got a boost on Thursday from reports that the Biden administration will propose an upsized $6 trillion budget for the coming fiscal year at the same time that congressional Republicans are offering their own $1 trillion infrastructure spending plan. Stimulus in New Zealand, however, may be fading based on the country's central bank whose forecasts for higher rates pushed the NZX 50 down 1.9 percent in what was the only weekly decline for any of the major global indexes. And stimulus withdrawal in the UK may also be in play after Gertjan Vlieghe, a member of the Bank of England’s Monetary Policy Committee, said on Friday that a rate hike could come late next year if the economy continues to recover as expected.

After several weeks of trending lower, Econoday's consensus divergence indexes are moving higher to indicate that forecasters are once again significantly underestimating the strength of global economic data. UK data, which are consistently beating estimates, continue to baffle them the most at a score of 46; Eurozone data, likewise strong at 30, are also frustrating forecasters as increasingly are Swiss data where the score is 25. China at 14 and Italy at 11 are also in the plus column. Negative scores are very limited: Canada at minus 4, the US at minus 6, and France at minus 7 to indicate that forecasters are only marginally over-estimating these results. The one country that forecasters are absolutely nailing, as they have all through the month of May, is Germany at a perfect consensus divergence score of zero.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

In one of the busiest weeks of the year, the status of five economies will get key updates: Korea, Japan, Switzerland, Canada, and the US. The status of a very key economic force will also get key updates: a look at consumer inflation during the month of May from Italy and Germany on Monday followed by the Eurozone on Tuesday and Korea on Wednesday. Korean data will open the week with industrial production on Monday followed on Tuesday by the country's manufacturing PMI; Japan data will open Monday with industrial production and retail sales; Switzerland will follow on Tuesday with three data releases in a row each 30 minutes apart: retail sales, GDP, and then the SVME PMI. Canada and the US will post the most market-moving data of all on Friday: May employment reports that will follow major disappointments for both in the month of April. German data, aside from the CPI, will include retail sales and unemployment data both on Tuesday, and China can't be forgotten with the first look at the country's manufacturing PMIs for May beginning on Monday with the official CFLP report followed on Tuesday with the Caixan. India will also be in the mix, posting GDP data on Monday and also May's PMI on Tuesday in what will be an early look at how the Covid wave is affecting the country's manufacturing base. India's central bank will make a policy announcement on Friday preceded on Tuesday by the Reserve Bank of Australia which will follow the prior week's announcement from the Reserve Bank of New Zealand where its own projections for rate hikes betrayed an otherwise accommodative stance. The mountain of data will be concentrated early in the week and will mostly ease on Wednesday and Thursday before winding up with the North American employment reports on Friday.

Korean Industrial Production for April (Sun 23:00 GMT; Mon 08:00 KST; Sun 19:00 EDT)

Consensus Forecast, Year over Year: 11.2%

An 11.2 percent annual increase is expected for industrial production in April versus 4.7 percent in March.

Japanese Industrial Production for April (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Year over Year: 12.0%

Industrial production beat expectations in March at an annual growth rate of 4.0 percent. Growth of 12.0 percent is expected for April.

Japanese Retail Sales for April (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Year over Year: 8.1%

After a 5.2 percent annual rise in March, retail sales in April are expected to rise 8.1 percent.

China: CFLP Manufacturing PMI for May (Mon 01:00 GMT; Mon 09:00 CST; Sun 21:00 EDT)

Consensus Forecast: 51.1

The government's official CFLP manufacturing PMI, after 51.1 in April, is expected to hold steady at the same modest rate of plus-50 growth in May.

Italian CPI, Preliminary for May (Mon 09:00 GMT; Mon 11:00 CEST; Mon 05:00 EDT)

Consensus Forecast, Year over Year: 1.0%

Italian consumer prices have mostly beaten expectations so far this year. For May the consensus is a year-over-year rate of 1.0 percent versus 1.1 percent in April.

Indian First-Quarter GDP (Mon 12:00 GMT; Mon 17:30 IST; Mon 08:00 EDT)

Consensus Forecast, Year over Year: 1.0%

Forecasters see first-quarter GDP coming in at year-over-year growth 1.0 percent versus growth of 0.4 percent in the fourth quarter.

German CPI, Preliminary for May (Mon 12:00 GMT; Mon 14:00 CEST; Mon 08:00 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 2.3%

May expectations are a 0.3 percent increase on the month for annual inflation of 2.3 percent, which would compare with 0.7 and 2.0 percent respectively in April.

Canadian Industrial Product Price Index for April (Mon 12:30 GMT; Mon 08:30 EDT)

Consensus Forecast, Month over Month: 1.7%

The government's flash estimate put the IPPI up 1.7 percent on the month in April, boosting annual inflation to 14.2 percent, its highest mark since February 1980.

Korean Manufacturing PMI Flash for May (Tue 00:30 GMT; Tue 09:30 KST; Mon 20:30 EDT)

Consensus Forecast, Manufacturing: 54.0

Korea's manufacturing PMI, which has been posting steady, strong growth, is seen slowing only slightly to 54.0 versus 54.6 in April.

China: Caixin Manufacturing PMI for May (Tue 01:45 GMT; Tue 09:45 CST; Mon 21:45 EDT)

Consensus Forecast: 51.7

March's Caixan manufacturing PMI is expected to hold mostly steady at 51.7 in May after rising 1.3 points in April to 51.9.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEST; Tue 00:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

The Reserve Bank of Australia is expected to keep its policy rate unchanged at 0.10 percent. At its meeting last month, the bank lifted its inflation forecast but repeated the economy will require policy support for the foreseeable future.

Indian Manufacturing PMI for May (Tue 05:00 GMT; Tue 10:30 IST; Tue 01:00 EDT)

Consensus Forecast: 51.9

The manufacturing PMI for April, at 55.5, didn't show any ill effects from the month's spike in Covid cases. But May is a different story: economists see the index slowing noticeably but still holding over breakeven 50 at 51.9.

German Retail Sales for April (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast, Month over Month: -2.6%

Lockdowns didn't hold down retail sales in March which jumped 7.7 percent on the month. But greater lockdowns in April are expected to pull sales into a consensus decline of 2.6 percent.

Swiss Retail Sales for April (Tue 06:30 GMT; Tue 08:30 CEST; Tue 02:30 EDT)

Consensus Forecast, Year over Year: 30.6%

March's partial easing of Covid restrictions fed a giant and unexpected 22.6 percent year-over-year surge in retail sales. Forecasters see annual sales accelerating further in April to a 30.6 percent annual gain.

Swiss First-Quarter GDP (Tue 07:00 GMT; Tue 09:00 CEST; Tue 03:00 EDT)

Consensus Forecast, Year over Year: -1.1%

First-quarter GDP is expected to fall 1.1 percent on the year versus the fourth quarter's minus 1.6 percent.

Switzerland: SVME PMI for May (Tue 07:30 GMT; Tue 09:30 CEST: Tue 3:30 EDT)

Consensus Forecast: 68.0

The SVME PMI has exceeded expectations the last five reports, and easily so in April at a record 69.5. The consensus for May is 68.0.

German Unemployment Rate for May (Tue 07:55 GMT; Tue 09:55 CEST; Tue 03:55 EDT)

Consensus Forecast: 6.0%

A sixth straight and comparatively favorable 6.0 percent unemployment rate is expected for May.

Eurozone HICP Flash for May (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Year over Year: 1.9%

Forecasters see prices in May accelerating some, to a 1.9 percent annual rate versus 1.6 percent in April.

Canadian First-Quarter GDP (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Quarter over Quarter: 3.8%

Consensus Forecast, Annualized: 7.3%

A 7.3 percent annualized growth rate is the consensus for Canadian first-quarter GDP versus a 9.6 percent growth rate in the fourth quarter.

US: ISM Manufacturing Index for April (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 60.9

April's unexpected slowing to 60.7 ended a run of stronger-than-expected ISM manufacturing reports. A tick or two back up to 60.9 for May is Econoday's consensus.

Korean CPI for April (Tue 23:00 GMT; Wed 08:00 KST; Tue 19:00 EDT)

Consensus Forecast, Year over Year: 2.7%

Annual CPI is expected to accelerate to 2.7 percent in May versus April's 8 tenth rise to a 2.3 percent growth rate.

Australian First-Quarter GDP (Wed 01:30 GMT; Wed 11:30 AEST; Tue 21:30 EDT)

Consensus Forecast, Quarter over Quarter: 1.5%

Consensus Forecast, Year over Year: 0.7%

First-quarter GDP is expected to rise a quarterly 1.5 percent versus a 3.1 percent rise in the fourth quarter. Year-over-year GDP is expected to slow to 0.7 percent versus fourth-quarter contraction of 1.1 percent.

Reserve Bank of India Policy Announcement (Anytime Friday, Release Time Not Set)

Consensus Change: 0.0 basis points

Consensus Level: 4.00%

At its April meeting, the Reserve Bank of India held its benchmark repurchase rate unchanged at 4.0 percent but did complete the phased reversal of its cash reserve ratio which was raised 50 basis points back to 4.0 percent where it was before the pandemic. Consensus for the year's second meeting, against the backdrop of severe Covid troubles, is no change for the benchmark rate.

Eurozone Retail Sales for April (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast, Month over Month: -0.5%

Retail sales, which easily beat expectations in February and March with 4.2 percent and 2.7 percent monthly gains, are expected to fall 0.5 percent in April.

Canadian Labour Force Survey for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: -50,000

Consensus Forecast: Unemployment Rate: 8.0%

A further decline of 50,000 is May's consensus following April's 207,100 loss that followed sizable employment gains in both March and February.

US Employment Situation for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Change in Nonfarm Payrolls: 645,000

Consensus Forecast: Unemployment Rate: 5.9%

A rise of 645,000 is Econoday's consensus for May nonfarm payrolls following April's increase of 266,000. After exceeding expectations significantly in February and March, this report missed expectations badly in April.

|